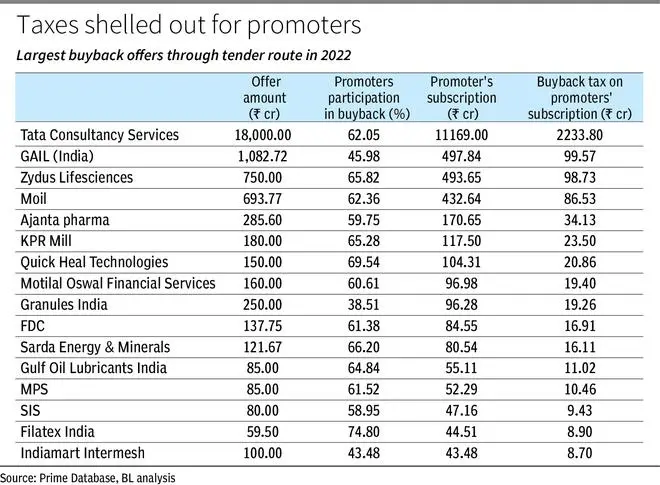

In the press conference after the recent SEBI Board Meeting, Chairperson, Madhabi Puri Buch remarked that Peter is paying taxes on behalf of Paul. She was alluding to the taxation rules on share buybacks under which companies are paying the tax on behalf of promoters from funds which belong to shareholders. Some of the larger companies such as TCS, GAIL and Zydus Life Sciences, which made large buyback offers in 2022 have paid significant amounts as tax for shares purchased by promoters.

This anomaly in taxation came into effect from July 2019, when the section 115QA of the Income Tax Act was changed to introduce a buyback tax at the rate of 20 per cent to be paid by listed companies on amount distributed by them during share buybacks. Prior to this amendment, the onus of paying tax on such income laid on the shareholder.

Promoters gain from this change

Of the two main routes for share repurchase in India, the tender offer has been quite popular among companies.

The largest tender offer made in 2022 was TCS’ ₹18,000 crore offer to buyback about 4 crore shares at ₹4,500 per share. This offer accounted for more than 70 per cent of the value of shares bought back through the tender offer route this year. While the entire offer was taken up by shareholders, the proportion of shares tendered by promoters, predominantly Tata Sons, accounted for 62 per cent of the offer or ₹11,169 crore. The company would have had to pay buyback tax of ₹2,234 crore on the shares purchased from the promoter of TCS.

Some of the other large buyback offers through the tender route made in 2022 were from GAIL (India), Zydus Lifesciences and MOIL Limited. Sums paid by companies as tax for shares tendered by promoters in these offers amounted to ₹100 cr, ₹99 cr and ₹87 cr respectively.

Keki Mistry Committee Report

The Keki Mistry committee on share buybacks had pointed out the manner in which small shareholders are being short-changed due to these rules. “The current mechanism of buyback tax appears to be tilted in favour of those shareholders who tender their shares and take exit (partially or fully) from the company adversely impacting the interest of shareholders who do not wish to tender their shares under buyback. As a result, all the continuing shareholders have to share the burden of tax payable by the listed company on the buyback proceeds of the shares tendered by exiting/tendering shareholders,” notes the report of the committee.

Further, the committee had evaluated the buyback offers made in FY20 and found that in 19 companies promoters had tendered more shares than they should have based on the pre-buyback shareholding, since other shareholders had not taken up the offer. Of the buyback tax of ₹2,988 crore paid by these companies, ₹2,734 crore was on shares tendered by promoters.

Dividend distribution tax

While tax on share buybacks have to be paid by companies, shareholders are responsible for paying tax on dividends received, following the abolishment of the dividend distribution tax in the Finance Act 2020.

“Given that the incidence of tax in case of distribution of dividends is now shifted to the hands of recipients, accordingly, a realignment of tax incidence in case of distribution of surplus through buyback with that of distribution of dividend is desirable,” notes the report.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.