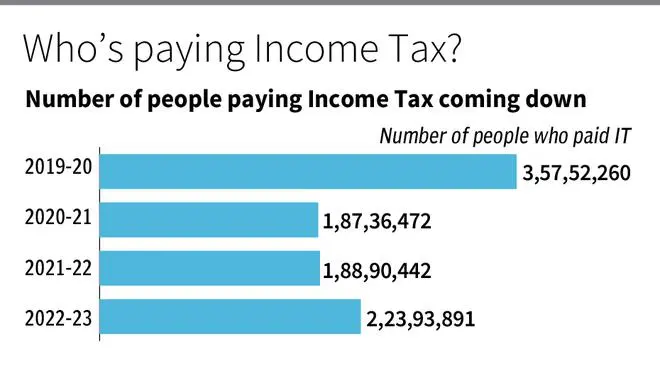

The fact that the absolute number of Income Tax returns filers is increasing in India is worth cheering. However, a closer look at the data reveals that the number of people who have actually paid I-T returns in FY23 is quite low, when compared to the FY20 numbers.

This is based on the analysis of the data shared by the Ministry of Finance in Lok Sabha. It is true that there was a whopping 7.4 crore people who filed I-T returns in FY23. But 70 per cent of those were zero tax returns, bringing the number of people who paid any money towards I-T at 2.23 crore.

Three financial years ago, 6.47 crore people filed I-T returns. But just 45 per cent of these were zero tax returns. This means 3.57 crore people paid in FY20. This number is 60 per cent higher than the taxpayer number in FY23.

“The pandemic significantly reduced people’s incomes and businesses saw a slowdown. This could be majorly why there have been a lot of zero tax filings since FY21. There were also a few additional exemptions announced during the pandemic,” says Vikram R, a tax expert from Chennai, adding that more people are filing ITR since the linking of PAN to bank accounts and the ease in the system.

first-time payers

At the same time, Akhil Chandna, Partner, Grant Thornton Bharat, notes that this could also be because of an increase in the number of first-time taxpayers, who may not fall into the tax bracket. He adds: “The copy of tax return is requested for various purposes like application for loans, processing of visa, and filing of tax returns is important to meet such requirements. Hence, more and more individual taxpayers are filing tax returns even if there is nil tax liability.”

Adding to this, Sudhakar Sethuraman, Partner, Deloitte Touche Tohmatsu India LLP, said: “The Indian government has been focussing on increasing list of the tax filers. Conditions other than having taxable income beyond the threshold for exempt income have been introduced which mandate filing tax returns, even without taxable income.”

Experts also feel that the number of zero tax returns will only increase over the years. “In the coming year, this could further increase since under the new tax regime income up to almost 7 lakh would be with zero tax liability and the new tax regime would be a default regime that would be applicable,” says Divakar Vijayasarathy, Founder & CEO, DVS Advisors.

in the lead

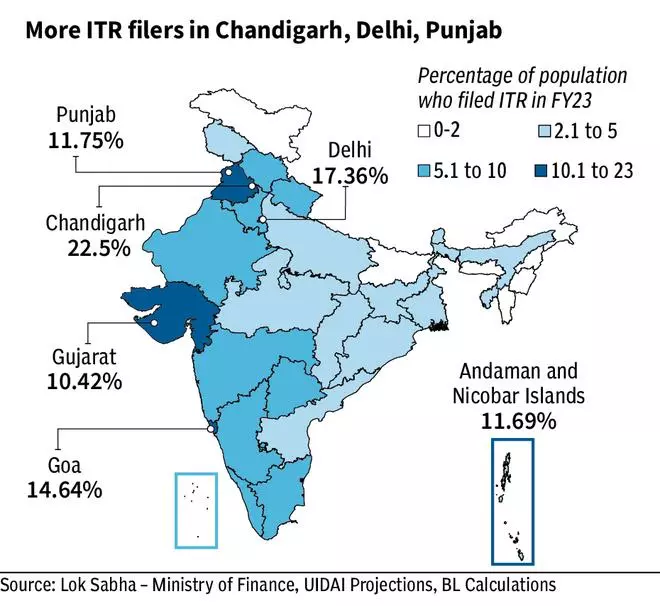

A State-wide analysis of ITRs revealed that Chandigarh, Delhi, and Goa had the most proportion of population filing ITRs — 23 per cent, 17 per cent and 15 per cent, respectively. Among the larger States, Punjab tops, with 12 per cent of its population filing ITR. Gujarat comes next with 10.4 per cent of the population filing ITR in FY23.

Commenting on the high taxpayer base in Punjab, Chadna says: “Punjab is known for its agricultural, manufacturing and trading activities and has an emerging service sector as well. While agricultural income is generally exempt from income tax, individuals with agricultural income above a certain threshold are required to file their tax returns. Further, Punjab has a large number of government employees (active and retired) whose salary may be subject to tax deductions at the source which increases the number of people eligible to file tax returns.”

Vikram adds that this could also be linked to the high number of people going abroad from Punjab and Gujarat as visa processing also requires ITR filing.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.