With the country’s largest mortgage financier HDFC Ltd merging with HDFC Bank, banks that are already the dominant players in the home loan segment are likely to gain more market share. A few years ago, housing finance companies (HFCs) had been gaining market share from banks in individual housing loans but it reduced after the IL&FS crisis.

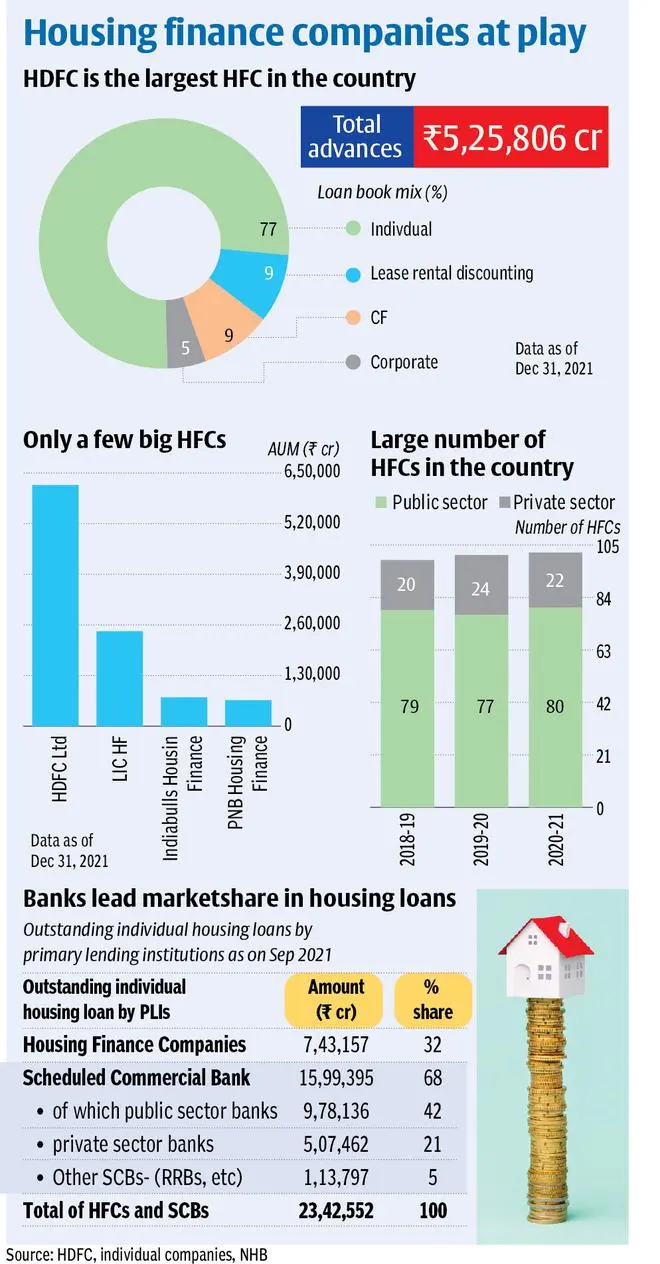

According to a recent report from CRISIL, the assets under management of HFCs were ₹13.2-lakh crore as of March 31, 2021. Since HDFC’s AUM of ₹5.69-lakh crore, accounting for 43 per cent of the segment is now getting transferred to HDFC Bank, the proportion of housing loans held by banks will increase further.

Over three-fourths of the loan book of HFCs is made up of individual housing loans. Outstanding individual housing loans of HFCs as of September 2021 were ₹7.43-lakh crore. But this amounted to a market share of just 32 per cent, as per the National Housing Bank’s (NHB) report of ‘Trend and Progress of Housing in India 2021’.

Scheduled commercial banks had the lion’s share in individual housing loans with a market share of 68 per cent. The market share of banks in individual housing loans has been increasing over the year, rising from 62 per cent in 2017-18 to 67 per cent in 2019-20. Meanwhile, the market share of HFCs reduced from 38 per cent to 33 per cent in this period.

“The merger of HDFC with HDFC Bank will lead to more of the market share of housing finance going to banks. The market share of HFCs in the segment had been increasing but it will reduce to about 25 per cent post the merger,” said an industry source.

Uncertain times

Experts also note that the merger of HDFC Ltd with HDFC Bank, though it will be completed in a period of about 18 months, comes at a time when there is uncertainty over strategies by other large housing finance companies.

The erstwhile Dewan Housing Finance Corporation Ltd is now with Piramal Capital and Housing Finance Company Ltd while there are also questions over the future of LIC Housing Finance. Life Insurance Corporation of India, in its DRHP, has said that either IDBI Bank or LIC Housing Finance will have to exit the home loan business by November 2023. Other large players include IndiaBulls Housing Finance and PNB Housing Finance.

“Almost all the top HFCs are going through interesting times. The segment will eventually see more medium to small size players come into focus,” the source noted, adding that there are only 12 HFCs that have assets under management (AUM) of over ₹15,000 crore and five with AUM between ₹10,000 crore to ₹15,000 crore.

Home loan growth outlook

In all, there are about 102 HFCs in the country. The outlook for home loan growth is also positive with robust demand for home loans, and both banks and HFCs are working to increase their market share. The co-origination model is seeing good participation from both banks and HFCs.

Experts, however, noted that customers will remain insulated from these developments and will, in fact, benefit from the merger of HDFC and HDFC Bank. “Customers will benefit from the lower cost of funds available through HDFC Bank once the merger takes place,” said Deo Shankar Tripathi, Managing Director and CEO, Aadhar Housing Finance.

The merger will also give a big boost to HDFC Bank, which has just an 11 per cent contribution from mortgages in its loan book. HDFC Ltd has total advances of ₹5.25-lakh crore as of December 3, 2021, with individual loans making up 77 per cent of its book. It has 651 offices inclusive of 206 outlets of HDFC Sales.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.