Producers’ inflation, technically known as wholesale inflation based on Wholesale Price Index (WPI) remained in negative zone for fifth consecutive month at negative 0.52 per cent, government data released on Thursday showed. However, there is an increase on sequential basis i.e., from July to August.

Retail inflation based on Consumer Price Index (CPI) for the month of August was 6.8 per cent. Taking cognizance of both indicators, Monetary Policy Committee (MPC) under the Chairmanship of RBI Governor is likely to maintain status quo in its meeting next month.

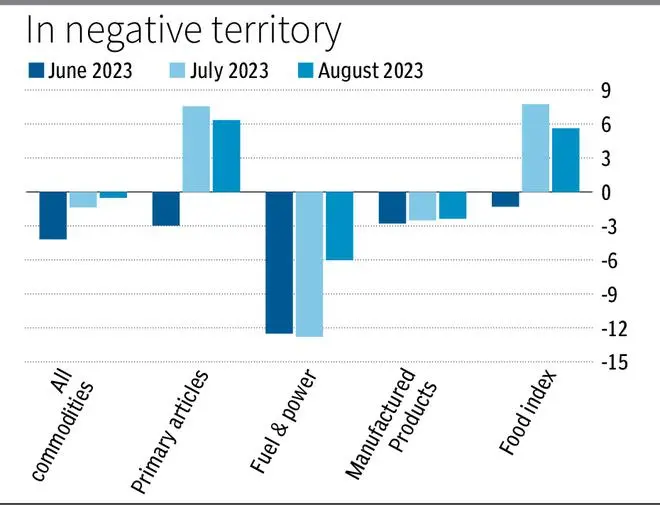

Data from Commerce & Industry Ministry showed the annual rate of inflation based on all India WPI number is (-) 0.52 per cent for the month of August against (-) 1.36 per cent recorded in July, 2023. “The negative rate of inflation in August 2023 is primarily due to fall in prices of mineral oils, basic metals, chemical & chemical products, textiles and food products as compared to the corresponding month of previous year,” the Ministry said in the statement.

Inflation in food articles remained in double digit at 10.60 per cent in August, lower than 14.25 per cent in July. Fuel and power basket inflation was at (-)6.03 per cent in August, against (-) 12.79 per cent in July. In manufactured products, inflation rate was (-) 2.37 per cent, as against (-)2.51 per cent in July.

The RBI last month kept key interest rate unchanged at 6.5 per cent for the third straight meeting but signalled tighter policy if food prices drive inflation higher The central bank takes into account retail or consumer price index-based inflation for formulating monetary policy.

Mohit Ralhan, CEO with TIW CAPITAL noted that though WPI remained in deflationary territory for the fifth straight month, but the pace of deflation declined as a decline in fuel prices moderated to - 6 per cent in August from - 12.8 per cent in July. Food inflation continued to remain in double digits although declining on a sequential basis. It was primarily due to a 8.3 per cent fall in vegetable prices, which came as a relief.

“While it’s important to control food and fuel inflation as a high food and fuel inflation dampens sentiment, the sequential increase in manufactured goods prices should be taken as a positive sign. It shows that demand is picking up and manufacturers are able to take on price hikes, although it still remains small,” he said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.