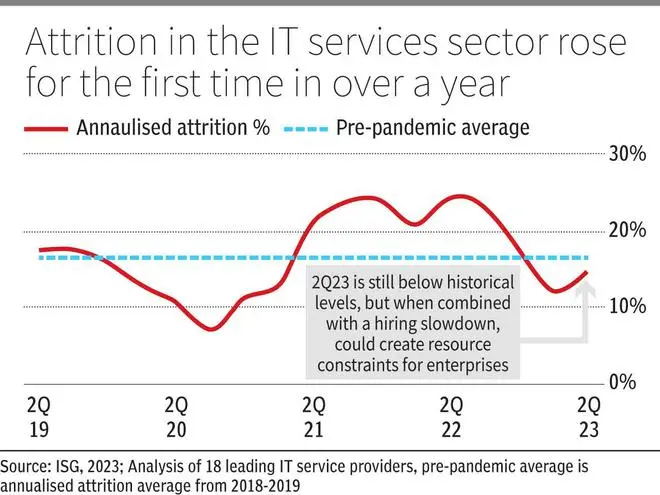

Attrition in the global information technology (IT) sector rose in the June quarter for the first time in over a year. This, combined with the industry-wide slowdown in hiring, means that companies can expect some challenges in finding in-demand skills for their engagements, according to global IT research firm, ISG.

The issue of hiring and attrition continues to hog the limelight in the IT industry. Over the course of 2021 and 2022, global IT service providers added over 2.2 million employees. This hiring explosion was in response to the unprecedented demand for managed services in late 2021 and most of 2022. However, the sector finds itself in a different place in the June quarter of 2023.

Managed services growth remains strong and companies have turned their focus to optimising delivery pyramids to improve margins. They are doing this by slowing down hiring. This approach has been working well over the past couple of quarters, primarily because attrition has been declining from the 2022 peaks.

- Also read: Indian IT services revenue growth to slow on weaker growth in U.S., Europe: Fitch Ratings

However, after three-quarters of quarter-over-quarter decline in annualised attrition (which represents the attrition in the quarter), attrition increased in June quarter, ISG.

Annualised attrition is at 14.5 per cent, the first increase for the sector since the June quarter of 2022. Due to industry-wide hiring slowdown, for every 10 people that left a provider in the second quarter, only six were hired.

It is important to keep in mind that attrition is still well below the unprecedented highs of 2021 and 2022. And the slowdown in hiring is expected as well, especially given the pressure on discretionary work driven by macroeconomic uncertainty.

“It’s the combination of these two factors that ISG clients should be aware of. Given that it will likely take a quarter or two for hiring to ramp back up — and if attrition continues to go up — it will mean that there is very little spare capacity in the system. Combine this with high utilisation levels (which are now near all-time highs), and enterprises will likely face some challenges in finding in-demand skills for their engagements,” the research firm said.

Pricing perspective

Yugal Joshi, Partner, Everest Group, says that talent and attrition issue is not hidden from anyone. Providers can still offer the right skills if given the right price. Therefore, this has to be seen from a pricing perspective as well. Overall attrition numbers matter less for individual clients and they should be concerned about their account.

The providers will take more time to onboard critical skills especially as most of them want to reduce dependence on contractors to enhance their margin. This can see a reversal of pattern where staffing companies may be a lot more in demand and their strategy of turning into a managed service provider may get delayed.

Kamal Karanth, co-founder, Xpheno, a specialist staffing company, says the top four IT service companies announced total contract value of $36 billion, bagged over the last two quarters. Amidst rising net utilisation rates across IT services, servicing fresh order books require the addition of incremental capacity. With unprecedented negative headcount growths in the quarter ending June 2023, the sector cannot stay away from adding headcounts any longer if they have to service these new clients signed.

The average attrition of 17 per cent of the top IT Services companies plugged with higher bench utilisation suggests companies cannot optimise their talent any further. This quarter may see net additions amongst the IT services companies, he said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.