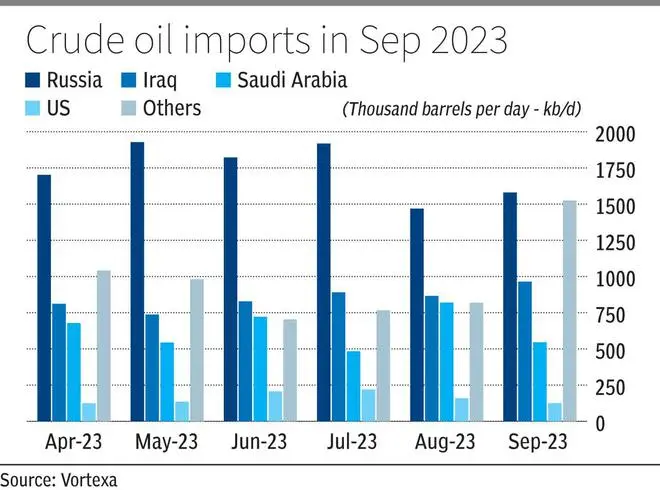

India’s crude oil imports fell for the second consecutive month in September 2023 impacted by rising prices of medium sour grades Urals and Arab Light as well as lower requirements due to autumn refinery maintenance and low consumption during monsoons

The world’s third largest crude oil importer bought around 4.2 million barrels per day (mb/d), which is the lowest in FY24. The decline was partly compensated by lifting more cargoes of Iraq’s Basrah, which is also a medium sour grade similar to Urals and preferred by Indian refiners.

According to energy intelligence firm Vortexa, India imported 1.58 mb/d of crude oil from Russia last month accounting for 38 per cent of India’s total exports. Imports were higher by 7.5 per cent m-o-m.

Also read: Crude Check: Stay above key levels

Voluntary production cuts by Saudi Arabia and Russia, the world’s top two crude oil exporters, led to prices hitting $97 per barrel last week, the highest in 2023. The scenario led India to procure more cargoes from Iraq.

Refiners turn to Iraq

Indian refiners purchased higher supplies of Basrah as the prices of Urals and Arab Light went further north. Imports from Iraq rose more than 11 per cent to 965,080 barrels per day (b/d). In line, shipments from Saudi Arabia fell over 33 per cent m-o-m to 520,000 b/d.

“In light of lower Saudi crude supplies, Iraq is the next largest sour crude supplier for India, so it comes as no surprise that Iraqi imports into India picked up in September,” Vortexa’s chief analyst for Asia Pacific, Serena Huang told businessline.

Higher crude shipments to India in September helped Iraq clock its highest export earnings in 2023 calendar year so far.

Also read: Oil prices and strong dollar to keep FPIs on edge

Ural shipments during September were largely flat at 1.12 mb/d against 1.08 mb/d in August. Trade sources said that as discounts are lower at around $5 per barrel, coupled with higher prices of the grade discouraged Indian refiners.

“Discount lower than $5 makes Ural unviable due to logistics. It was trading at over $85 a barrel last week (Primorsk and Novorossiysk ports). Similarly Arab Light prices were also raised for September. In contrast, Iraq offered some discount on Basrah coupled with lower transport costs, it was the preferred choice. However, Russia will remain the largest supplier,” an official from a leading Indian refiner said.

India procures Russian crude oil from spot markets, whereas Middle Eastern crude is largely through term contracts.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.