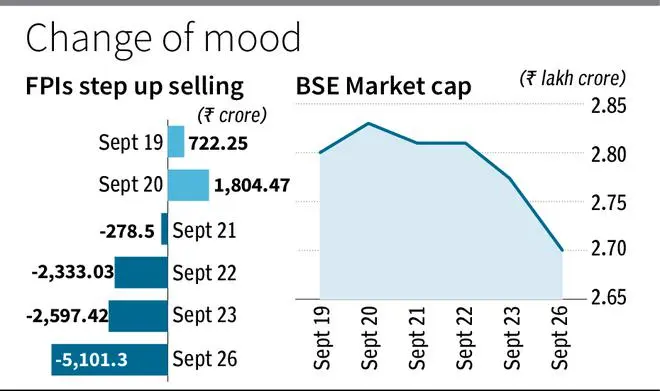

Foreign portfolio investors (FPIs) pushed the panic button on Monday as stock markets were hit by the storm brewing in the global currency markets. FPIs sold stocks worth ₹5,101 crore in the cash segment, which was the highest single day selling in nearly couple of months.

Sensex and Nifty could not remain decoupled from the turmoil. Sensex plunged 953 points or 1.64 per cent to close at 57,145. Nifty index fell by 311 points or 1.8 per cent at 17,016. The UK was staring at a potential balance of payments crisis, which could exacerbate the pain in the markets, analysts said. Monday’s fall was an extension of last week’s rout, which saw stocks being hammered around the world. In the week from September 19-23, FPIs have made more selling than buying in India’s market, mainly following the US Federal Reserve’s intense interest rate hike roadmap. FPIs have sold stocks worth ₹7,547 crore in cash segment. Domestic institutional investors tried to salvage the situation on Monday by making net purchases of ₹3,532 crore in the cash segment. “The speed with which central banks across the globe are hiking interest rates, investors are worried that slackening growth would push key economies into recession. With the monetary policy decisions on the anvil, rate-sensitive stocks like banking, realty and auto crumbled badly as rate hikes could dent demand going ahead. However, due to markets being in oversold territory, we could witness a quick pullback rally. On the flip-side, 17,150 and 17,200 could be the immediate hurdle for the bulls,” said Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.