The fear that Adani Group companies are facing an acid test from global index providers, and most likely will be pushed out of some influential indices is the primary reason for the mad rush to exit from the shares in India. According to industry experts, foreign funds will not touch Adani Group companies for a long time if they are thrown out of the MSCI indices. As a result, the average delivery volumes in the Group’s shares have declined to below 10 per cent of the total daily volumes.

The inclusion or exclusion of stocks in global indices is the most important catalyst in equity markets, since fund flows worth trillions of dollars are simply linked to this one event.

Ever since the Hindenburg episode, global index providers have put the Group companies on watch. One big US based index provider, S&P Dow Jones, removed Adani stocks from its global sustainability indices with effect from February 7. The S&P Dow Jones Sustainability World Index represents the top 10 per cent of the largest 2,500 companies in the S&P Global Broad Market Index (BMI) based on long-term economic, environmental and social criteria.

UK’s FTSE Russell, too, said it was reviewing the stocks. But analysts said most global investors are keenly watching what MSCI (Morgan Stanley Capital International), world’s largest index company with nearly $14 trillion linked to its indices, will do with the Adani Group. MSCI recently cut the free-float of Adani companies in its indices and said it will decide on any further action in May, keeping investors and traders on the edge.

2015 China episode

The 2015 Chinese market crash, which wiped out over 50 per cent of the country’s listed market-cap in weeks, was a demonstration of the sway that MSCI indices hold over global equity markets. At the start of 2015, MSCI had declared that it was reviewing China A shares for inclusion in its global indices, which resulted in a stupendous rally in the Chinese markets. But near the end of that year, MSCI said the inclusion would be delayed and did not give any deadline. This sparked an exodus of funds from Shangahai. Similar is the scenario currently in Adani Group stocks, where global and local investors have already started anticipating MSCI’s move.

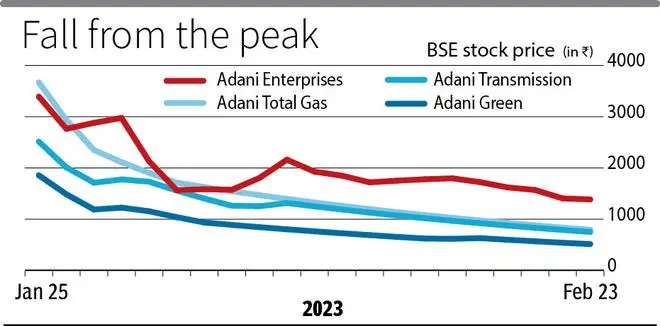

In 2020, the share price of Adani Enterprises, the Group’s flagship company, was hovering around ₹500. The shares got an impetus mainly after its inclusion in the MSCI India Index in June 2020. Similarly, most Group companies were also included in MSCI’s equity benchmarks covering India, Asia, emerging markets and all-country world stock indices. In just two years of its inclusion, Adani Enterprises rose to a peak of ₹4,200 as funds pegged to the global index service provider chased the stock. The other Group companies (which were included in the MSCI indices), too, saw similar meteoric rise.

Fall from the peak

Additionally, a letter written by Mahua Moitra, Member of Parliament, to the National Stock Exchange (NSE) seeking removal of Adani Enterprises and Adani Ports & SEZ from the Nifty-50 index also had an effect of rubbing salt into the wound, said analysts. Adani Enterprises had surged 113 per cent in a year after being included in the Nifty index. Though NSE follows its own criteria for inclusion and exclusion of stocks in the main indices, that has not stopped the street from speculating.

In Thursday’s trade, Adani Enterprises touched a low of ₹1,350, nearly 0.5 per cent lower. The previous day’s, the share was locked in a 10 per cent lower circuit. Nearly 60 per cent of the company’s market-cap has been erased from the peak during the rout.

Among other stocks, Adani Total Gas, Adani Power, Adani Green and Adani Transmission were locked in the 5 per cent lower circuit on Thursday — this after losing more than 65 per cent value from the peak. Adani Ports & SEZ, Ambuja Cement and ACC are witnessing some buying but not enough to signal a resurgence yet.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.