The benchmark indices logged gains on the last trading session of the financial year aided by positive global cues.

The Sensex rallied nearly 1,200 points, intra-day before closing at 73,651, up 0.9 per cent. The Nifty rose 0.9 per cent to 22,326.

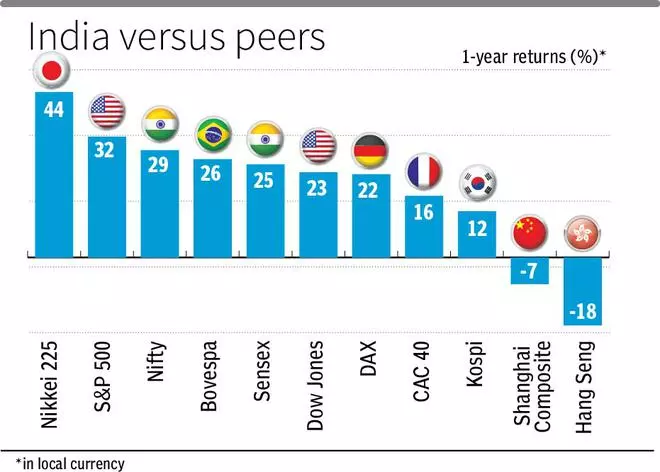

The indices have gained 28.6 per cent and 24.8 per cent, respectively, this fiscal, beating most other major market indices. The Nifty Midcap and Nifty Smallcap indices have surged 60 per cent and 70 per cent, respectively, with the latter marking its best performance in the last three financial years. The realty, CPSE and infra indices gained over 100 per cent during the year.

“The Nifty is trading in the fair zone in terms of valuations. FY25 is expected to be a year of mega events, with elections to be held in India as well as in key developed economies, clarity emerging on interest rates and India’s inclusion in global bond indices,” said Sanjay Bembalkar, Co-Head Equities at Union Mutual Fund.

Bembalkar prefers large-caps over mid- and small-caps due to better risk-reward to investors, attractive valuations and strong earnings potential. Key risks to watch out for are protectionist trade policies and economic implications from geopolitical conflicts.

Cash market volumes on the NSE on Thursday remained above ₹1-lakh crore. About 52 per cent, or 2,042 stocks, declined on the BSE compared to 1,793 that advanced. Bajaj Finserv, Grasim, Hero Motocorp and Bajaj Finance were the top Nifty gainers, advancing over 3 per cent each.

Key metrics positive

S&P Global on Tuesday had raised India’s FY25 growth forecast to 6.8 per cent on the back of strong domestic demand and a pick-up in exports. India’s CAD/GDP remained steady at 1.2 per cent in Q3FY24.

With valuations a concern, the market will look to the upcoming earnings season for assigning earnings multiples, said Joseph Thomas, Head - Research, Emkay Wealth Management.

Other markets

Most Asian indices ended in the red on Thursday, with Nikkei 225 losing the most at 1.46 per cent. European indices were trading marginally in the green. The US indices ended higher on Wednesday, with the S&P 500 hitting a fresh high. The UK fell into a shallow recession last year as its gross domestic product fell by 0.3 per cent in the last quarter of CY23, after a decrease of 0.1 per cent in the previous quarter.

In the US, data on jobless claims, gross domestic product, consumer sentiment, personal income, consumer spending and personal consumption expenditure will be released on Thursday and Friday.

The market will also look to the US Fed Chair’s speech on Friday for interest rate cues. In India, RBI’s monetary policy committee meeting is scheduled next week.

All major markets will remain closed on Friday.