The mutual funds that have subscribed to Mamaearth’s initial public offering are facing criticism on social media.

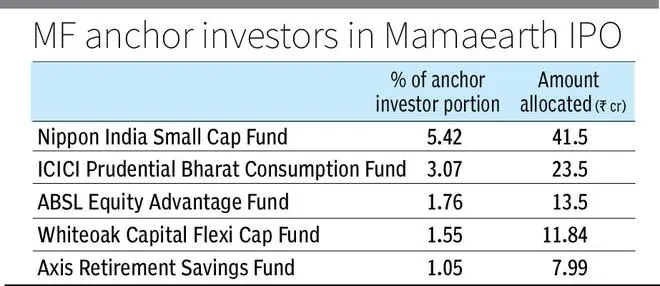

About a third of the total allocation reserved for anchor investors were allocated to seven domestic mutual funds through 19 schemes. A few more funds may have invested in the main book. The issue has been subscribed 70 per cent on day 2, with the QIB or institutional portion seeing full subscription.

There are concerns on rich valuations and wild swings post-listing.

“Would love to see the investment thesis. Trustees will never ask. Investors don’t know,” said R Balakrishnan, an independent consultant who has held senior positions at a couple of mutual funds, on X (formerly Twitter).

“Lessons are still not learnt. Unit holders should ask tough questions on rationale for making such investments where IPO is extremely over valued,” said a user on platform X, who goes by the handle @lalitinvestor.

He said that fund managers should not defend their investment decisions by saying that the investment is a minuscule portion of their assets under management. “To me, it’s about process and principles followed. Every single rupee spent on such ideas is like breaking the trust of unit holders,” he said.

“When even a layman can see through the motives, what makes fund managers invest? What’s the rationale? Unitholders in these schemes should ask fund managers. May be they see an angle we don’t,” said Rishabh Jain, a content creator on LinkedIn.

Certain categories of MF schemes were similarly criticised for their investment in Zomato’s IPO in 2021. The stock did well on listing but fell below the issue price in the subsequent weeks.

Historically, fund managers have spoken about investing in companies with positive cash flows, robust profit margins, revenue growth, a decent return on equity or return on capital employed and a favourable debt to equity ratio. The entry of new-age companies on the bourses, however, have called these metrics into question.

“We did not invest because we found the valuations to be on the higher side,” said a senior fund manager. “There was a dearth of new-age companies that were listed earlier, which is why those that came to the market got a scarcity premium. That’s no longer the case and fund managers will need to differentiate between new-age companies that come to the market now.”

New age companies such as Paytm, Nykaa and PB Fintech have fared poorly on the bourses post listing. Paytm, for instance, is still trading at 57 per cent below its issue price.

“Every fund house is entitled to make its choice of investment based on its own evaluation of company fundamentals, valuations and investment mandate of the scheme. There might be funds investing for listing gains or from a long term perspective. Eventually, every investment decision will show up in the performance of the scheme and the fund can be held accountable by investors,” said Vicky Mehta, an independent MF research analyst.

On a price band of ₹308-324 per share, Mamaearth could command a market cap of ₹99-104 billion. According to Emkay Global Financial Services, the stock’s valuation could be deemed to be attractive at the upper-end of the price band if the company doubles its revenues in three years and improves operating margins to ~12 per cent; fair if company sees revenue CAGR of 20 per cent with OPM of 10 per cent; and expensive if the company registers revenue CAGR of about 10 per cent and maintains margin at about 6 per cent.

Prashanth Tapse, Senior VP (Research), Mehta Equities, says the Mamaearth offering may be suitable only for high-risk investors as the IPO includes a larger offer for sale, the company will have low promoter holding and faces high competition. He said the IPO appeared to be overvalued in the current market conditions, which does not augur well for how a stock may fare post-listing.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.