Mutual funds have increased their holding in top three Adani group companies by 12 per cent last month to ₹3,454 crore against ₹3,073 crore in May.

Large cap funds holding in Adani Enterprises have jumped 12 per cent to ₹3,169 crore against ₹2,835 crore, said an ICICI Direct research report.

Shares of the company, which was hovering around ₹2,500 a piece, had dipped to ₹1,887 in May after reports emerged that showed the US’ Securities and Exchange Commission is conducting investigation into the allegation made by the Hindenburg Research on Adani Group.

How the market reacted

The stock price of the company dipped to ₹1,920 from ₹2,560 but bounced back after it clarified that it is providing the information sought by SEC.

In June, it jumped nine per cent to ₹2,492 from a low of ₹2,281 with strong demand from MFs and other investors. Similarly, Adani Green Energy and Adani Transmission shares also plunged and bounced back providing an opportunity for mutual funds to rise their stake.

Mutual funds also increased stake in HDFC and Coal India to ₹76,767 crore and ₹14,116 crore, from ₹67,233 crore and ₹12,653 crore respectively.

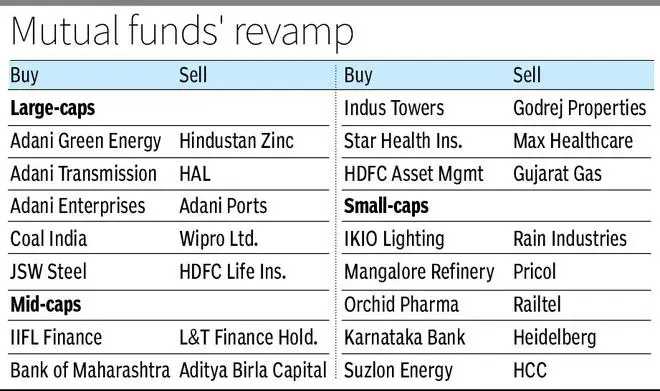

Large cap funds trimmed their holdings in Hindustan Zinc, Hindustan Aeronautics, Adani Ports, Wipro and HDFC Life Insurance.

Among mid-cap stocks, mutual funds increased their stake in HDFC AMC to ₹5,886 crore (₹3,020 crore), Timken India to ₹4303 crore (₹2,887 crore) and NMDC to ₹2,107 crore (₹1,798 crore).

The mid-cap funds sold holdings in Indian Hotels, L&T Finance, Aditya Birla Capital, Godrej Properties, Max Healtchcare Institute and Gujarat Gas.

The top pick of small cap funds were IKIO Lighting, Orchid Pharma, TD Power Systems and Kalyan Jewellers. It sold holdings in Global Health, Aditya Birla Sun Life AMC and Rain Industries.

SBI Mutual Fund increased its holding in Krishna Institute of Medical Science to ₹920 crore from ₹94 crore, Indian Energy Exchange to ₹130 crore (₹26 crore) and Fusion Micro Finance to ₹82 crore (₹25 crore).

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.