Notwithstanding the record-breaking inflows through systematic investment plan, most equity SIPs have failed to beat their respective benchmark index.

Nearly 73 per cent of the flexi-cap, the most popular category among investors, have failed to beat their benchmark both over two- and 10-year as of April-end, according to data sourced from Fisdom, a leading online financial services provider.

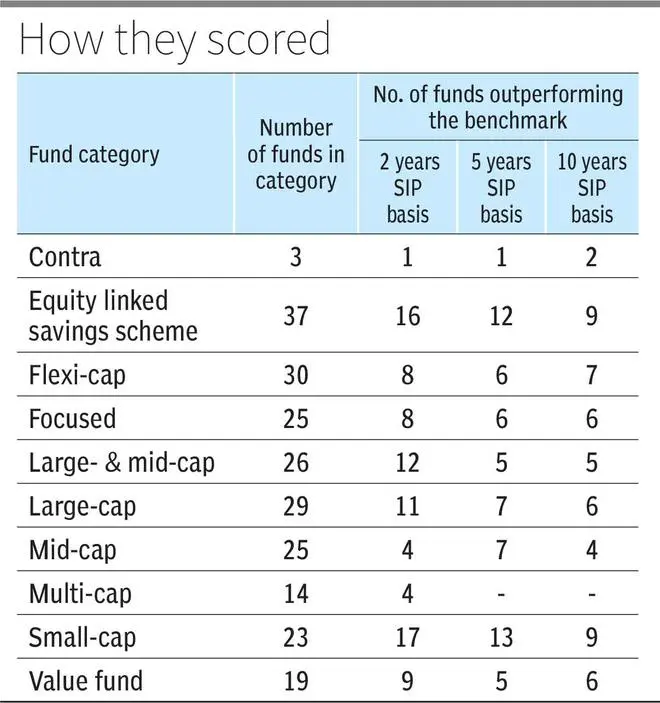

Of the 30 flexi-cap funds, only eight and seven funds have beaten benchmark over two- and 10-year period. This category of fund has an asset under management of ₹2.41-lakh crore.

Similarly, SIP in 62 per cent of the large-cap funds have lagged behind the benchmark indices over two-year and the underperformance is about 80 per cent over 10-year.

In the large-cap category, only 11 out of 29 funds over two years and six over 10 years have managed to beat the benchmark, raising question on the fund managers’ performance and hefty fees being charged by mutual funds.

ELSS, small cap fare better

Interestingly, the SIP in small cap and equity linked savings schemes have registered a marginally better performance. Over two years, SIP in 17 of 23 small cap funds and 16 of 37 ELSS schemes have managed to beat their benchmark indices. However, over 10-year period 60 per cent of small cap SIPs and 75 per cent of ELSS have trailed behind the benchmark.

The performance of most market segments has remained lacklustre and relatively narrow with only a few select stocks holding the indices in good stead. A similar trend was seen in the multi-cap category, where a minimum investment in large-, mid- and small market-cap categories have to be made.

Small-cap funds, which operate with a larger universe and mostly through bottom-up security selection practices, have fared better against the benchmark. Funds in style-based categories like value and contra also differ significantly from one another compared to peer fund sets in most other categories, said the Fisdom research.

In a bid to overcome concentration risk, market regulator SEBI has mandated cap on investment that mutual funds can make in individual stock and this has led to SIP underperformance, said a CEO of leading fund house.

The gross SIP inflow into mutual fund industry touched a new high of ₹14,276 crore in March. The overall SIP inflow increased 25 per cent to record ₹1.56-lakh crore in year ended March against ₹1.25-lakh crore logged in the previous fiscal, according to the Association of Mutual Funds in India data.

The overall SIP asset under management was up 19 per cent at ₹6.83-lakh crore as of March-end against ₹5.76-lakh crore in March 2022.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.