BSE and the National Stock Exchange (NSE) will roll out same-day settlement of securities for the cash equity market starting Thursday. The bourses have put out a list of 25 common scrips that will be settled on the same day on an optional basis. These are all large-cap names and include Ambuja Cements, Ashok Leyland, Bajaj Auto, Bank of Baroda, Cipla, Divi’s Laboratories, Hindalco Industries, JSW Steel, LIC Housing Finance, LTIMindtree, MRF, Nestle India, SBI, and Vedanta.

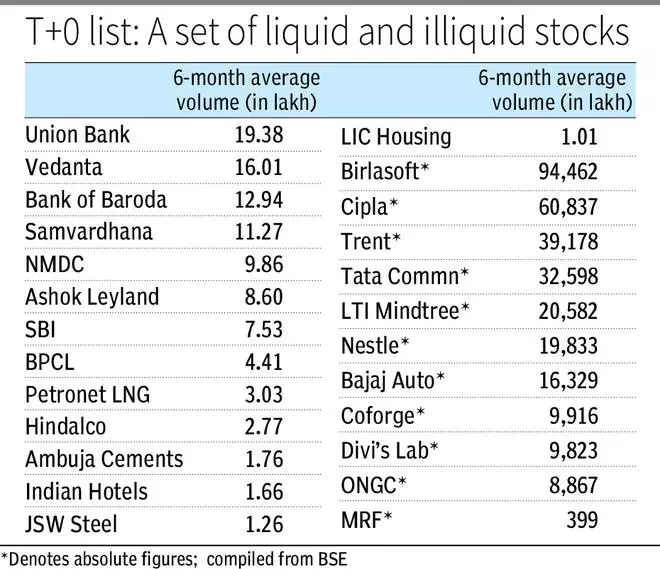

However, it puzzled market participants, as Reliance Industries, Infosys, and TCS did not figure on the list. Besides, the list also featured low liquid counters such as MRF (6-month average volume is 399 shares on BSE) and actively traded ones such as Union Bank (six-month average: 19.4 lakh shares).

The exchanges haven’t spelt out a criteria for selecting these scrips or the names of brokers who will facilitate T+0 settlement. The transition to T+1 settlement from T+2 was also done in phases but with the stocks with the least market capitalisation being included first.

Same-day settlement will be in addition to the existing T+1 settlement cycle currently in play and will be a precursor to instant settlement that may be rolled out on an optional basis at a later date.

A shortened settlement cycle will bring cost and time efficiency, transparency in charges to investors, and strengthen risk management at clearing corporations and the overall securities market ecosystem.

In the current T+1 system, sellers can only access 80 per cent of their funds on the sell day while waiting until the next day to receive the remaining 20 per cent. However, with the new T+0 settlement system, sellers will have access to 100 per cent of their funds on the same day of trade, according to Samir Shah, Head of Online Business at Axis Securities.

“This will increase liquidity for investors, allowing them to quickly enter into other trades without losing out on investment opportunities due to waiting periods. Additionally, the new system will reduce counterparty default risks,” said Shah.

Same-day settlement will substantially mitigate transactional risks, offering immediate and tangible value to both traders and investors alike, added Vamsi Krishna, CEO of StoxBox.

A shorter trading window from 9:15 AM to 1:30 pm will be available for these 25 scrips. All investors are eligible to participate. T+1 surveillance measures will apply to scrips in the T+0 settlement cycle as well. The price in the T+0 segment will operate with a price band of +/-100 basis points from the price in the regular T+1 market. This band will be recalibrated after every 50 basis points movement in the underlying T+1 market.

T+0 prices will not be considered in index calculation and settlement price computation. There will be no separate close price for securities based on trading in the T+0 segment. There shall be no netting in pay-in and pay-out obligations between the T+1 and T+0 settlement cycles.

“The significant evolution of technology, architecture, and capacity of MIIs, presents opportunities for further advancing clearing and settlement timelines. Further, India’s depository ecosystem has visibility of individual client-level holdings in digital form, and so has the ability to effect immediate transfer of securities, and India’s payments and settlements ecosystem has long allowed for real time transfer of funds,” SEBI had said in a circular last week.

SEBI had introduced rolling settlement in July 2001 for certain scrips on a T+5 basis (in 5 days from the date of trade) and then expanded to all scrips in a phased manner. T+5 gave way to T+3 in April 2002, and from April 2003, it was T+2. The cycle was shortened further to T+1 from January 2023.