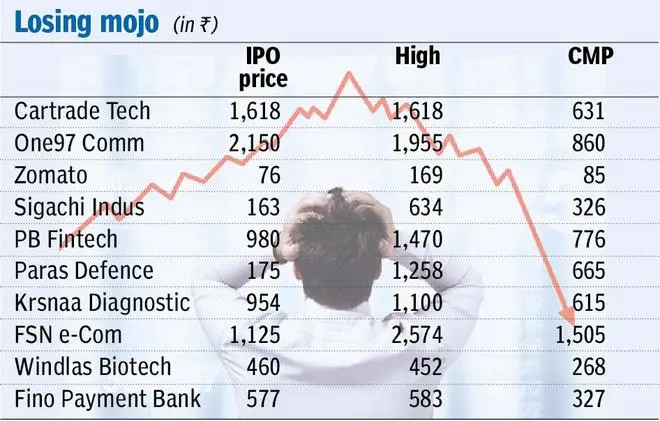

The sharp fall in valuation of recently listed stocks in the market meltdown has put to test the risk appetite of investors who backed these companies during their initial public offering.

Institutions exit

Interestingly, most of the institutional investors sold their investments partially when these stocks where trading at a high and cut down losses while retail investors are still hoping that the tide will change one day.

Latent View Analytics and Chemplast Sanmar dipped to ₹487 and ₹517 on Wednesday from their recent high of ₹755 and ₹826 while Ami Organics and Tega Industries plunged to ₹936 and ₹489 from their high of ₹1,434 and ₹768.

Similarly, Barbeque-Nation Hospitality and Go Fashion slipped to ₹1,410 and ₹965 from ₹1,946 and ₹1,340.

Facing dilemma

Sorbh Gupta, Fund Manager (equity), Quantum AMC, said most of these newly listed companies face the difficult choice of growing their business by burning cash or focusing on being cash flow positive.

In either case, they will face challenges while trying to regain the premium valuation that they have been sold at in the primary market and the increasing global interest rates will impact their valuations further, he added.

Vinod Nair, Head of Research, Geojit Financial Services, said excess valuation and loss-making companies will continue to be under pressure as the market becomes risk-averse. The focus going ahead will be on value-buying, steady business and fair valuation, he added.

Too early to write off

Piyush Nagda, Head of Investment Products at Prabhudas Lilladher, said it is too early to write off the new age business as they are on an evolutionary phase and they have already disrupted the markets to create an unmatched scale. India has the third largest start-up ecosystem in the world after the US and China and there will be more IPOs in the future with more sanity in IPO valuations.

Mohit Nigam, Head - PMS, Hem Securities, said despite profitability being sort of a daydream, most of the start-ups sought comparatively higher valuations than their traditional listed competitors.

As venture capitalist been holding stake in these companies for long, he said investors can start investing small chunks in these new age start-ups with a bit of caution as India is also modernising and actively using innovative technology to solve its problem.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.