Reported comments by an unnamed central bank official that there may be a pause in rate hikes after Friday’s monetary policy review triggered a rally in the Government Securities (G-Secs) market, but had a negative impact on the rupee, which weakened further.

A wire agency on Thursday reported about the possibility of the rate-setting monetary policy committee hitting the pause button after the forthcoming policy review as retail inflation appears to have more or less peaked.

Price of the 10-year benchmark G-Sec (coupon rate: 6.54 per cent) jumped 56 paise to close at ₹95.8125 (₹95.2525). Yield of this paper tumbled about 9 basis points to close at 7.1566 per cent (7.2416 per cent).

Bond prices and yields are inversely co-related and move in opposite directions.

Related Stories

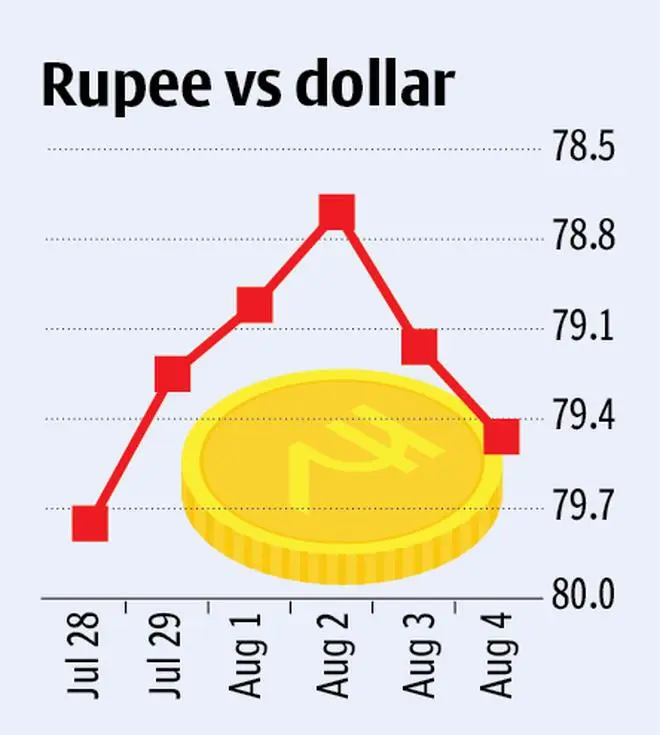

Rupee falls 17 paise to close at 79.32 against US dollar

On Wednesday, the rupee had slumped by 62 paise, marking its worst single-day fall in FY23Marzban Irani, CIO-Fixed Income, LIC Mutual Fund, observed that a news report, quoting central bank sources, indicated that there may be a pause after Friday’s expected repo rate hike.

“The market rallied immediately after this news report. But central bank officials are believed to have denied this. However, the market did not correct even after this clarification,” he said.

Price of the 14-year G-Sec (coupon rate: 7.54 per cent), which is the second most liquid paper after the 10-year paper, surged 67 paise to close at ₹101.42 (₹100.75). Yield of this paper fell about 8 basis points to close at 7.3724 per cent (7.4502 per cent).

Forex market dealers, however, were not amused by the comments attributed to central bank sources.

They feared that a pause in rate hikes could widen the interest rate differential between India and overseas (advanced economy) markets, leading to dollar outflows from the country. This can weaken the rupee and have ramifications on the inflation front.

Rupee weakens

The rupee opened about 7 paise weaker at 79.23 per dollar. The intraday high and low for the rupee was 79.23 and 79.85, respectively. It closed at 79.4650, down 30 paise as compared to the previous close of 79.1650.

The rupee weakened as foreign banks reportedly bought dollars on behalf of Uber for repatriating the sale proceeds ($390 million) of its divestment in Zomato. Demand from oil marketing companies too weighed down the Indian unit.

RBI is believed to have sold dollars in the non-deliverable forward and futures market to stem the depreciation in the rupee, a private sector bank dealer said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.