The recent audit conduced by RBI has found gold loan-to-value ratio deviation in 67 per cent of the gold loan account at IIFL Finance, which has been directed to stop extending fresh gold loan by the banking regulator on Monday.

Of the 18.9 lakh gold loan extended by IIFL in FY’23, 82,000 accounts have gone for auction due to default by the borrowers. Of these 82,000 accounts, RBI inspection has found deviation in 55,000 accounts at the time of auctions.

IIFL claimed that most of its co-lending partners open each and every gold loan packet and make their own assessment of gold purity and weight. Going forward, IIFL said it will ensure that the quality assessment of gold jewellery will be more stringent.

To get best realisation of the gold jewellery being auction, IIFL used e-auction platform of Auction Tiger like most financial institutions and large banks. IIFL said it will start doing all auctions at the taluka level as directed by RBI.

Lack of transparency

On lack of transparency in charges being levied to customer accounts, IIFL said it will give the split on ₹200 being charged at the time of sending a notice to customers for auction and an additional ₹1,300 when gold loans are auctioned to make the process more transparent.

RBI has also asked IIFL to cap its cash disbursements at ₹20,000 against the earlier practice of disbursing up to ₹2 lakh. IIFL said it will comply with the statutory limit once the freeze on gold loan business is removed.

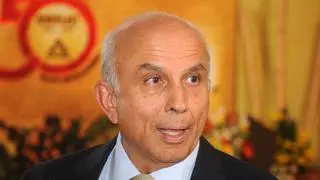

Nirmal Jain, Managing Director, IIFL Finance said with the exception of the ₹20,000 cap on cash disbursements, which will be implemented upon resuming disbursals, IIFL has implemented and rectified all other RBI observations and plans to contact the RBI with a request to conduct special audit soon.

Abhijit Tibrewal, Research Analyst, Motilal Oswal Research said in light of some recent episodes where the RBI banned certain activities and products of financial institutions, it could take about six months to get the regulator conduct a special audit and rectify its observations.

Despite the ban on new gold loan disbursements, there will be no impact on recoveries or collections and the existing gold loan portfolio will continue to accrue interest income. The impact on profitability will be contingent to how long the ban remains in force, he added.