IIFL Finance’s gold business is expected to undergo some massive changes in the coming months. As a start, the company will replace its internal assayers with certified external personnel to assess the value and quality of the underlying asset before loans can be extended.

The company also plans to revamp and beef up its compliance team and the search is on to bring in a new compliance officer. “Like most NBFCs, IIFL was also assessing the value of gold using internal resources because it reduced the turnaround time on loan disbursements and was cost effective. Now that practice must be discontinued and the lender is in the process of appointing external assayers like how it is done in most banks,” said a person familiar with the development. The person also added that the search for a new compliance officer with deep expertise in the financial services industry is underway and the appointment of should be made a few months.

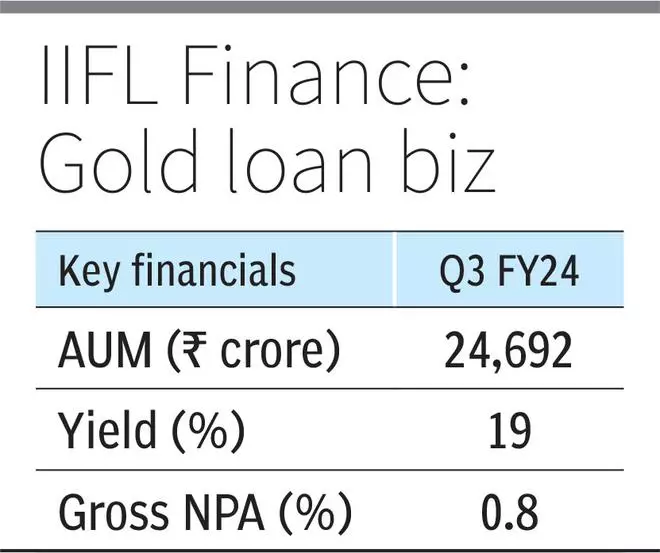

MUMBAI IIFL Finance did not respond to the email sent to seeking confirmation on the above developments. Gold loans account for 32 per cent of IIFL Finance’s total loan book and stood at ₹24,692 crore in December FY24 quarter.

On Monday, the Reserve Bank of India noted certain material supervisory concerns in the gold loan portfolio of IIFL Finance which included serious deviations in assaying and certifying purity and net weight of the gold at the time of sanction of loans and at the time of auction upon default; breaches in loan-to-value ratio; significant disbursal and collection of loan amount in cash far in excess of the statutory limit; non-adherence to the standard auction process; and lack of transparency in charges being levied to customer accounts.

Critical issues

According to sources, IIFL may have overvalued the underlying asset (gold) at the time of extending the loan in its branches and this discrepancy has come to the fore during the time of audit and/or auctioning the asset.

“There are instances where 18-carat gold may have been recorded as 22-carat gold at the branch,” said a senior official aware of the matter. “Likewise, once sanctioned the loan amount should be withdrawn by the borrower through a bank account. It cannot be handed out in case. Only up to ₹20,000 can be availed as cash whereas this limit was far breached”.

Stock takes a beating

Following the RBI curbs, IIFL Finance stock was locked in the lower circuit (down 20 per cent) at ₹478.5 a share on Tuesday.

In a call with investors, Nirmal Jain, MD, IIFL Finance said, “while the directory of RBI appears to be a bit hard, I take a moment to express our profound gratitude and admiration for the RBI. I want to make it unequivocally clear that there are no governance or ethical issues at play. These are operational and procedural issues which we will address.”

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.