A higher price-to-earnings (P/E) ratio vis-à-vis global markets indicates overvaluation in the Indian equity market, even as robust earnings growth in the next 12 months is being priced in, the RBI’s Financial Stability Report for December said.

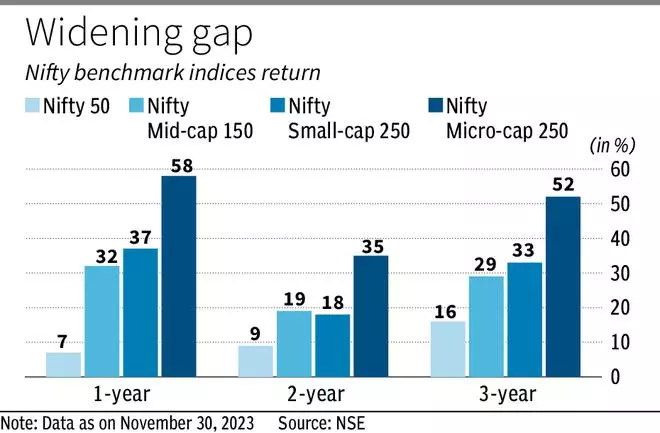

The apex bank has said there are three areas that require closer monitoring. First, the rallies in the mid-cap, small-cap and micro-cap indices were significantly larger than that in the benchmark Nifty 50 index that represents the largest firms. During April-October this year, the return on Nifty Microcap Index was more than five times that on Nifty 50. Over a three-year horizon, the performance divergence between Nifty 50 and other indices is even sharper.

In addition to the higher valuation among scrips in the mid-cap and small-cap segments relative to the large-cap firms, a substantial share of them (69 per cent in mid-cap and 70 per cent in small-cap) were trading with P/E ratios higher than those of their corresponding benchmark indices, the regulator noted.

Second, in recent years there is a sharp rise in individual investors’ participation in the equity market, primarily in shares of smaller firms. In contrast to institutional investors, individuals’ investments in listed companies excluding Nifty 500 is steadily increasing — at September-end they owned 48 per cent of the floating stock of these firms.

Increasing appetite

Individual investors’ appetite for investments in smaller firms is also augmented by mutual funds (MFs), according to the report. Mid-cap and small-cap schemes of MFs have seen rapid increase in net inflows. Between June 2020 and September 2023, MFs’ share in free float market capitalisation of micro-cap stocks went up from 10.7 per cent to 15.9 per cent, which is the highest among all categories of shareholders.

Third, equity derivatives trading volumes are increasing, with a sharp rise in individual investors’ participation in that segment. The attractiveness of options as derivatives lies in the embedded leverage, which allows traders to take exposure with little upfront cash, the RBI said.

The number of active derivatives traders went up nearly six times from 2018-19 levels to 6.9 million by the end of October 2023. Moreover, like derivatives market in other countries, there is a growing interest in shorter-duration options, which enables manifold increase in traders’ leverage, as option premiums are relatively low.

Nevertheless, the required margins have not shown any significant variation. These margins are levied and collected at the client level, which helps in mitigating over-leveraged speculation in the securities market. In addition, margins charged by Indian stock exchanges are higher than those charged by global peers: the initial margin charged by NSE on Nifty option contracts is 11 per cent (even on the last day of expiry) as against 5 per cent on NIFTY at SGX.

Empirical evidence shows that nine out of 10 traders in the derivatives segment incurred losses and the average loss per active trader was ₹50,000 in 2021-22. In this context, the SEBI has introduced

“Risk Disclosures” with respect to trading in the equity derivatives segment with a view to empowering the investors with detailed information about the risks associated with trading in equity derivatives segment and, thereby, facilitating informed decision.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.