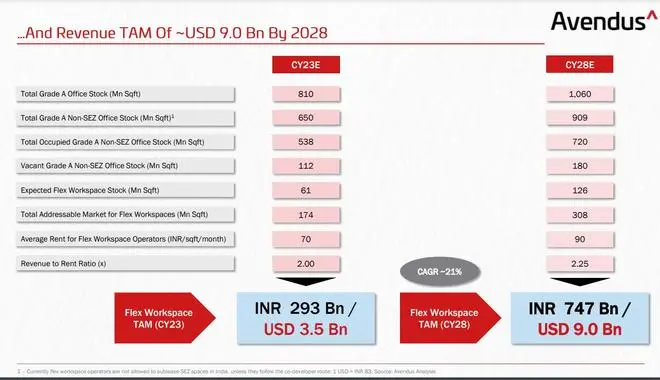

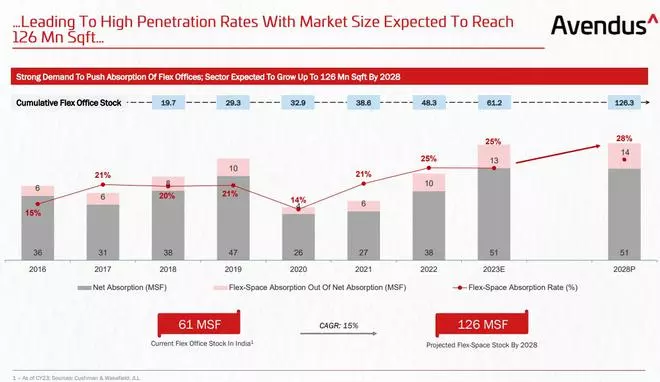

India’s commercial real estate market is expected to see strong adoption of flex workspaces in the coming years as the flex workspace segment is projected to grow up to about 126 million square feet by 2028 and address a market size of about $9 billion by the same period, according to a report by Avendus Capital.

A flex or flexible workspace is a fully furnished, serviced and managed office space offering, provided by an operator to an end user. Flex workspace can widely be classified as either a coworking or managed office or both.

The flex workspace segment is expected to grow at a CAGR of about 15 per cent over the next 5 years from about 61 million sq ft in CY23, up from 48 million sq ft in 2022 and 29 million sq ft in pre-Covid year 2019. In terms of value, the segment would grow from $3.5 billion. This growth is expected to garner the attention of all categories of investors—growth capital, private equity, real estate, HNIs and family offices, venture debt and structured credit.

The Indian office market has remained largely immune to global macro and sectoral headwinds. As more enterprises are experimenting with the remote workplace mechanism, we are seeing a broad shift towards flexible and modern office solutions, Prateek Jhawar, Managing Director and Head of infrastructure and Real Assets Investment Banking, Avendus Capital, said.

Flex workspaces have become a significant part of overall commercial real estate in India in recent years. Customisation flexibilities and efficiencies help differentiate flex workspaces from traditional offices.

The flex workspace market in India is dominated by product-led operators offering flexible office solutions across the spectrum. Sectors like IT and ITeS, BFSI, consulting, e-commerce, manufacturing, and new-age start-ups, along with the continuous influx of global captive centres (GCCs) are driving demand.

The report also claims that taking up space from a flex workspace operator can lead to 15-20 per cent cost savings for the occupier, as compared to traditional leasing.

Enterprises moving to a location-agnostic, asset-light real estate strategy and work-from-anywhere policies will drive the growth of flex workspaces in India, it added.

Large enterprises are looking for satellite offices. MSMEs, unicorns and start-ups are looking for cost-effective office solutions and are opting for flex workspaces in PBDs (peripheral business districts) of Tier-I cities owing to their affordable prices and some Tier-II cities as well.

Average per desk cost in prominent micro-markets of Tier-I metro cities like Mumbai, Bengaluru and Delhi-NCR are more than 50 per cent higher than the prominent micro-markets of other cities.

For instance, during Q4 of 2023, the average rent per square feet per month in micro markets was ₹143, while it was ₹97 in Delhi-NCR, ₹95 in Bengaluru. However, it was lower at ₹75 in Chennai and Hyderabad.

While the demand outlook seems robust, the biggest challenge for flex workspace operators could turn out to be locking in quality real estate supply in the central business districts of the top 7 cities at favourable rents.

“We expect at least 4 mature players to list in the next 2-3 years,” said Jhawar.