Investors who have watched the pre-muhurrat day chat shows on CNBC TV18, where market experts decked in festive finery give rosy predictions about the market, will recall late Rakesh Jhunjhunwala’s words. Every year, irrespective of the prevalent trend or the mood in the market, he would say, with high degree of conviction that the ‘mother of all bull markets’ is going to come in Indian stock market soon, rewarding all investors.

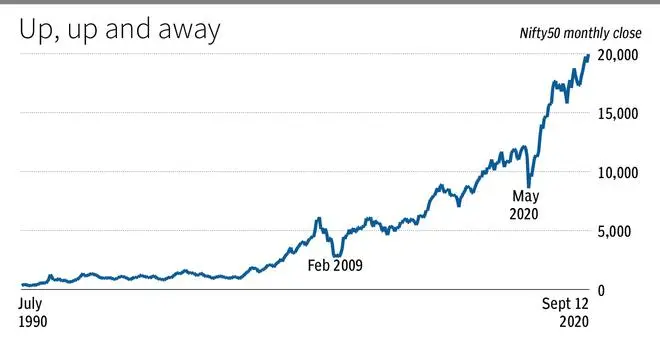

A look at the long-term chart of the Nifty50 (see accompanying chart) as the Indian benchmark crossed the 20,000 milestone this week, shows that the sage investor knew what he was talking about. The Indian market has been on a stellar run over the last two decades.

This structural bull market has been in place since 2002, when the Nifty50 was at 920. As the economy opened to foreign investments and reforms lifted growth rate, Indian stock market has been among the best performers this century. The race from 920 to 20,000 in the Nifty50 was marred by just two steep corrections, one in 2008 when the index declined 65 per cent and then in 2020, when the fall was around 40 per cent. In both these corrections, the rebound has been extremely fast, taking most investors unawares.

In fact, long-term investors, who would have continued to hold their positions, would not even have noticed the fall.

Needless to add that investors who held on to their stocks since early 2000 would be sitting on a tidy pile of money. But has this long-term rally run its course? Most indicators point towards the rally extending further, promising some exciting times ahead. Market regulator, SEBI, will however need to be on its toes to ensure that excessive froth does not build in the market and that the onward journey is smooth.

Is the rally over-extended?

The 20,000 milestone in the Nifty50 was accompanied by some jitters with a fund house withdrawing its recommendations on small-cap stocks. There was also a widespread selling in PSU and small-cap stocks, which had witnessed speculative rallies over the past month.

But this scepticism is a good sign as it implies that the market has not peaked yet. Bull market peaks are formed amidst excessive optimism with most analysts giving lofty targets for the market. This time around, the general mood appears rather circumspect.

Besides, the 20,000 level in the Nifty50 is just a number and does not signify anything. In fact, the gains in the Nifty50 so far this year at around 10 per cent is lesser compared to other benchmarks such as Japan’s Nikkei (25.6 per cent), S&P 500 (16.8 per cent) and South Korea’s Kospi (13.4 per cent).

The Nifty50 has, in fact, been trudging sideways since October 2021, allowing valuations to moderate as earnings growth picked up. The break-out this week, if it sustains, could herald a fresh leg of the structural uptrend in the market. Fundamentals too support this prognosis with India Inc reporting strong earnings, not just among large cap companies, but among mid- and small-cap companies too. The return of the FPIs this year, coupled with the demand from the growing number of domestic investors will ensure than corrections are not too deep.

Valuations and earning

In the column “Return of FPI flows to roil market valuation” published in May this year, we had pointed out that Indian market is rightly priced and continued FPI flows will make stocks overvalued.

But India Inc has performed extremely well in the first quarter of 2023-24, with net profit growth exceeding 30 per cent for the entire listed universe. Though revenue growth was lower due to fall in inflation, operating profit has improved with manufacturing companies benefiting from falling input prices. The country’s investment led growth is likely to help cyclical industries such as banking, infrastructure and real estate. Though consumption could take a hit due to higher interest rates and inflation, demand for premium products will protect margins of FMCG companies.

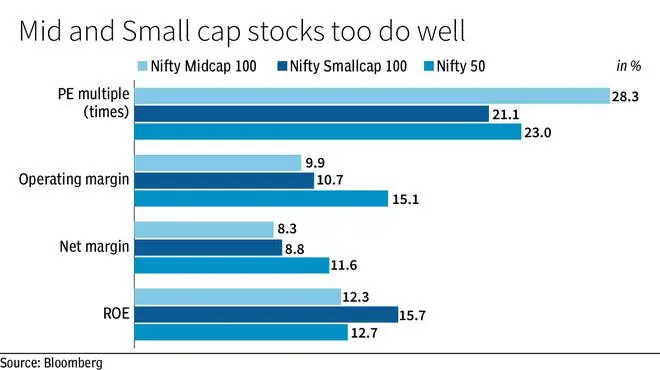

At current trailing 12-month price earning multiple of 23 times, the Nifty50 is close to its 10-year average of 22.3 times and well below the peak of 32 times recorded in October 2021. It’s true that the Nifty50 is pricier than its emerging market benchmarks and enjoys a valuation premium like S&P 500 (PE of 22) and Nasdaq Composite Index (PE of 39 times), but the premium can be justified by the stellar earnings growth of the Indian companies. Foreign investors appear to be ready to pay a higher price for Indian companies, which are likely to record better growth compared to their peers in other emerging or advanced economies.

Pockets of speculative activity

The strong earnings performance is not limited to just the top 50 companies. According to Bloomberg, companies in the Nifty Midcap100 and Nifty Small cap 100 indices too reported robust operating and net profit margins in recent quarters. With price earning multiple at 28.3 times and 21.1 times, the mid- and small-cap indices do not appear too overvalued either. The Covid-19 pandemic, which benefited the larger companies, helping them garner business from the unorganised sector, appears to have tilted the scales in favour of listed companies overall.

That said, it can not be denied that some counters in the market have been witnessing heightened speculative activity in the last couple of months. Retail investor activity too appears to have picked up in recent times, going by the growth in demat accounts last month and the jump in cash market volumes in August.

This is not surprising as participation tends to get more broad-based as rallies mature and the action also spreads to more counters. The regulator and the exchanges will however have their work cut out in trying to check fraudulent practices while allowing trading to continue in a non-disruptive manner. Care should also be taken to not change regulatory policies too often so that foreign portfolio investors are not disincentivised from operating in India.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.