Carbon Border Tax (CBT) is a reality. Developed countries will soon tax imports to prevent local industries from shifting to countries with less stringent environmental laws.

The EU will start collecting firm-wise data from October 1 this year, and begin collecting the tax from January 1, 2026. The UK, Canada, Japan, the US and others are also bracing up to levy CBT on imports.

CBT will affect lakhs of small and big firms. Indian exporters must factor in CBT into their costing and prepare to minimise its impact. Here’s a six-step plan for industry to prepare for future tax liability.

Check if your product is affected: The EU’s initial list covers steel, aluminium, cement, fertiliser, hydrogen and electricity. The UK proposes levying CBT on cement, chemicals, glass, iron and steel, non-ferrous metals, non-metallic minerals, paper and pulp, fertiliser, and power generation. The list will gradually expand to cover all products by 2034. Check if you export these products to the EU or the UK, respectively. Watch out for coverage of more products.

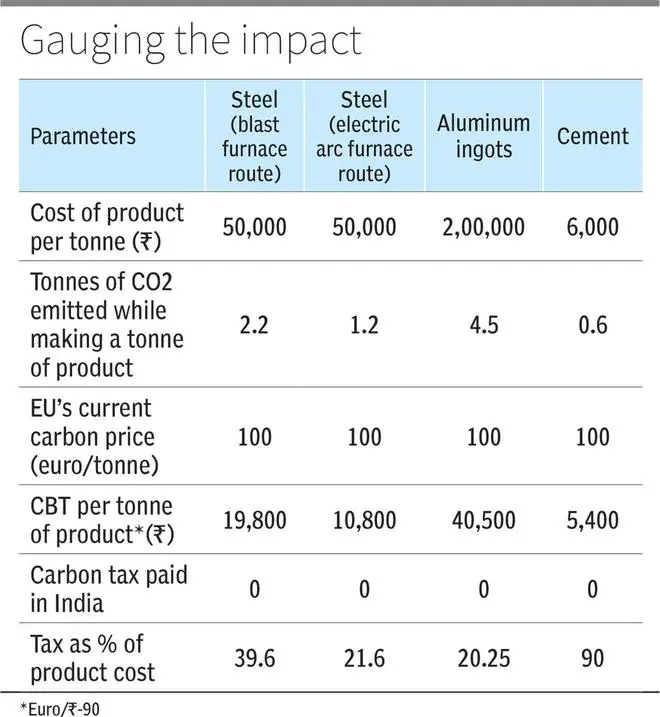

Calculate monetary impact: The rate of CBT depends on how much carbon has been emitted during production to make the export product. Steel made from a blast furnace route emits more carbon dioxide and may attract higher tax than steel made through an electric arc furnace, or steel made using green hydrogen. The table gives an idea of CBT as a share (percentage) of the product cost in most affected sectors.

Check if CBT will enhance your competitiveness: Compare your product’s manufacturing process with that of competitors within the country and globally. Your tax liability will be lower if you make the same product with a cleaner approach. For example, consider two types of steel-making processes. Blast furnaces and basic oxygen furnaces emit about 2.2 tonnes of CO2 per tonne of steel produced. But electric arc furnaces emit 1.2 tonnes of CO2 for the same quantity of steel produced. So, a firm using an electric arc furnace to make steel will have lower CBT liability than those using the blast furnace route.

Hire an auditor to prepare documents: Starting October 1, 2023, Indian exporters of steel, aluminium, cement, fertiliser, hydrogen, and electricity will need to share precise emission data with the counterpart EU importers, who will share the data with the CBT authorities. The CBT requires EU importers to purchase emission certificates to pay the differential between the country of production’s carbon price (or lack thereof) and the cost of carbon emissions in the EU ETS (emission trading system).

The producers’ data would include installation-wise production details like the quantity of products, verified emissions reports, and data regarding the embedded emissions of each type of goods. Scientifically capturing this data will need the help of energy auditors.

If the data submitted is not okay and the carbon intensity of a product cannot be estimated, the EU will charge the highest default tax rate. This will assume product emissions to be the worst 10 per cent of European companies.

Use power generated from renewable energy. This will immediately lower the carbon load — fossil fuels like coal, oil, or natural gas cause 75 per cent of global carbon dioxide emissions. Wind, solar and green hydrogen are current options. However, switching to new technology is expensive and may only be feasible in some cases. A case-by-case study is a must.

Explore greener production options: For making steel, cement and chemicals here are some greener options.

Steel: The low carbon way to produce steel is switching from the blast furnace route (using coal) to the electric-arc furnace route (using natural gas).

They holy grail for steel-making is replacing natural gas with green hydrogen in the electric-arc furnace. The product is known as green steel. Sounds good, but it is doubly expensive. Why? For this, one needs to understand the making of green hydrogen.

Electrolysis of water using wind and hydro-power produces hydrogen in an electrolysis plant. Hydrogen is then pumped into a reactor containing iron ore, where it snaps oxygen from iron ore, producing just water and sponge iron. Sponge iron, so called because its surface is full of holes, is refined into steel using an electric-arc furnace.

However, producing hydrogen requires 70 per cent more wind and solar energy than replacing natural gas power plants with wind and solar installations. This almost doubles the cost of steel made using green hydrogen. Technology is still being perfected, with many start-ups trying it.

Cement: Heating limestone generates about 60 per cent of the cement sector’s carbon emissions. Firms are trying to make cement that uses less clinker, thus limiting carbon emissions. But there is a limit to reducing emissions by such means, and the way out is capturing the carbon dioxide produced. This CO2 is then compressed, transported and injected into deep underground wells for permanent storage.

Chemicals: A sure way towards less carbon emission goal is using electricity from wind or solar sources, not coal or natural gas. But as fossil fuel is the raw material and not just an energy input for over 30,000 regularly used products, complete decarbonisation looks difficult.

Carbon Tax is unjust. It may not help in reducing pollution as there is no focus on lowering wasteful consumption. But the industry must prepare adequately to survive and thrive. The above guidelines will ensure the avoidance of any shocks.

The writer is founder, Global Trade Research Initiative

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.