Of late, there has been a lot of discussion around the revival in capital expenditure of private sector. The Chief Economic Advisor recently stated that private capex in the first half of this fiscal year has crossed ₹3 lakh crore and we could see the number surpassing ₹6 lakh crore by the end of this year.

Revival in the cycle was imminent, as noted in this column, ‘Private capex on the cusp of a revival’ ( businessline, April 15, 2022). Companies had reduced their borrowings significantly and a cleaner balance sheet, coupled with demand revival as shown by higher credit growth and improved capacity utilisations, were the right levers for kick-starting the capex cycle this fiscal year.

The government has been trying to nudge companies towards higher capex spending in many ways — from Performance Linked Incentive schemes to the Finance Minister cajoling India Inc. to expand their manufacturing capacities by calling them ‘Hanuman’, the Indian God who was so humble that he needed others to tell him about his own strengths.

But the first half of this fiscal year has been rather difficult for companies with reducing profit margins and more challenging external demand environment. That’s probably why capital expenditure of Indian companies has not picked up steam in the first half of FY23. A handful of companies account for bulk of the spending. For the cycle to gain momentum, both fiscal and monetary policies need to be more supportive.

What the numbers show

An analysis of the reported results of all listed manufacturing companies for the first half of FY23 shows that addition to fixed assets amounted to ₹3.66 lakh crore. It is therefore quite possible that the CEA’s target of ₹6 lakh crore of private capex will be easily achieved by the end of this year.

But before we exult at this number, it needs to be stated that achieving the ₹6 lakh crore private capex is quite easy for India inc. Private capex expenditure as captured by additions to fixed assets was ₹6.55 lakh crore in FY22, ₹8.19 lakh crore in FY20 and ₹7.05 lakh crore in FY19. It was only in the first year of the pandemic, in FY21, that the private capex expenditure had dropped to ₹4.74 lakh crore.

Annual growth in private capital expenditure was 14 per cent in the pre-pandemic years of FY19 and FY20. While it slid to 6 per cent in FY21, it moved higher to around 9 per cent in FY22. What the numbers show is that though companies may not be announcing large capital outlays every year, large manufacturing companies have to keep spending on maintenance, which amounts to many trillion rupees, when added together.

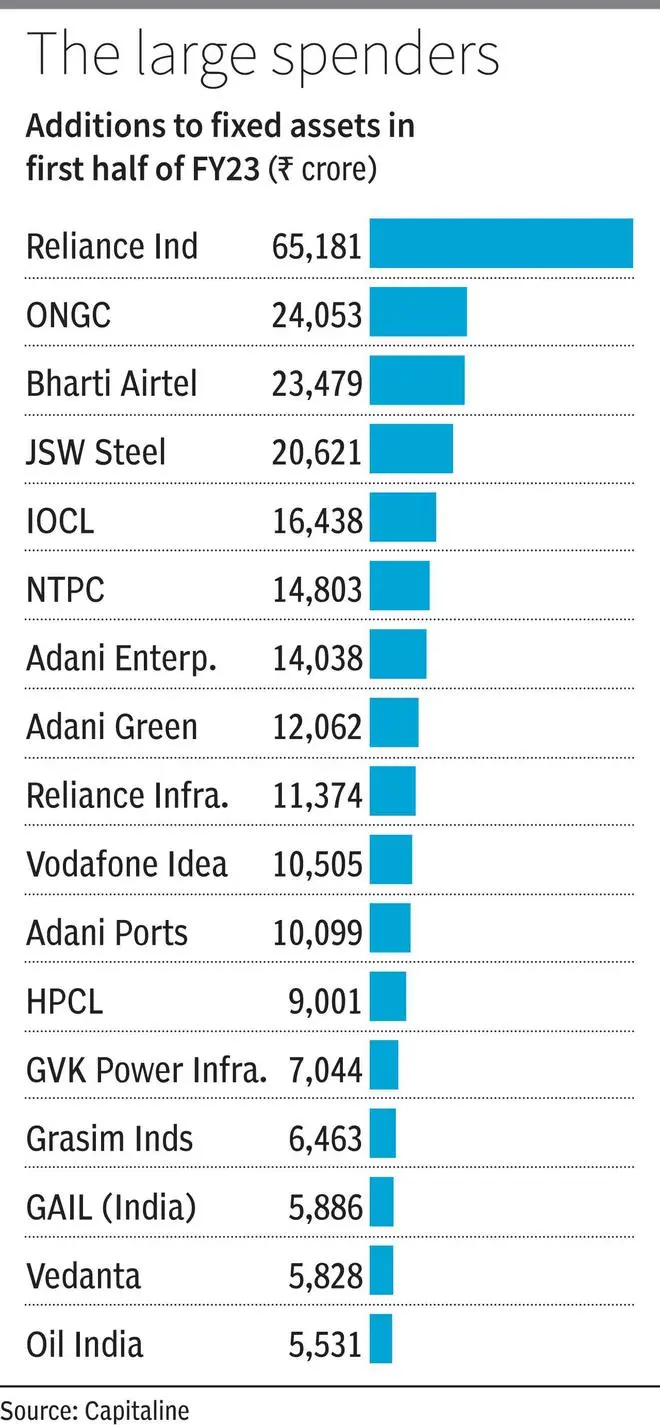

The large spenders

If we look at the disaggregated numbers on companies spending the most on capex, the charge is being led by a select few. The top 20 companies accounted for 71 per cent of the capital expenditure of ₹3.66 lakh crore between April and September 2022.

Reliance Industries has been the largest spender over the last five years. With its massive investment of around ₹2 lakh crore over the next couple of years in the 5G roll out and outlay of around ₹75,000 crore in oil to chemical businesses, besides investments in the new green energy vertical, the company is likely to drive India inc’s capex over the coming years as well.

All telecom companies have been investing heavily for 5G implementation. According to Bank of America Securities, Bharti Airtel proposes to invest $7.7 billion and Reliance Jio $9.1 billion between FY23-25 on 5G.

Steel companies, especially JSW Steel, have also been at the forefront of announcing large capital outlays as steel demand witnessed a surge in FY22. The Adani group, with its interests ranging from airports to green energy, has also been investing heavily in recent past. Oil refiners, power producers and cement manufacturers also feature in the top spender list, largely due to ongoing maintenance expenditure.

But of the 3,477 listed manufacturing companies analysed, almost 47 per cent, or 1,659 companies, witnessed a decline in their fixed assets compared with the same period in FY22. This shows that almost half the companies are selling assets, probably to tide over near-term difficulties.

Challenges to capex spends

In other words, it would not be right to get sanguine about the revival in private capex cycle. While Indian listed companies, especially the heavily indebted ones, have deleveraged, not all companies are willing to invest in expanding capacities yet. The reasons could be many.

One, while oil marketing and metal companies witnessed a sharp expansion in earnings in FY21 and FY22 due to increase in global prices, the picture is different this year, with many of these companies reporting fall in profitability. Pressure on margins due to higher input and interest cost has eroded operating margins, leaving lesser surplus to deploy in capex for commodity companies.

Two, weak export growth is also making many companies re-think their expansion projects. Companies such as JSW Steel are now scaling back their capex spends due to this reason.

The sharp policy rate hikes by the RBI, coupled with tightening liquidity, has increased the financing cost for companies which again impedes investment.

The Centre can not afford to derail a nascent private capex recovery through its policies. It is good that some of the export duties on crude and metals, imposed earlier this year to combat inflation, are being rolled back. Similarly, slashing of windfall tax is also a good step. These levies were reducing the surplus available with oil producers and metal companies which could be used for investing in capex. Further, regulatory uncertainty too makes companies think twice about additional investments.

Finally, the central bank should also be mindful about not derailing this recovery in private capital expenditure with its future rate hikes.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.