Since last Diwali, markets have been stuck like a firecracker that didn’t go off, with the bellwether Nifty and Sensex at around the same levels now. But dig deeper, and there are plenty of reasons to smile. For more than 50 stocks, the festival of lights is truly heart-warming as they have zoomed anywhere between 100-1100 per cent in this period. More than 100 stocks gained between 50-100 per cent. In all, 500 counters, i.e. four of ten stocks in the 1130-odd BSE Allcap index moved up in this period.

Winners across market caps

While the equity market has been rather listless as Samvat 2078 witnessed the weakest show in seven years, beneath the surface was a flurry of activity. Investors in such counters such as Mirza International, Adani Power, Rajratan Global, Deepak Fertilizers, Cantabil Retail, D B Realty, Raymond, West Coast Paper and Elgi will be laughing their way to the bank given that they have been leading the pack of gainers in Samvat 2078.

Himadri Speciality Chemical, Andhra Paper, GMDC, TD Power Systems, Ingersoll-Rand, CPCL, Poonawalla Fincorp, L T Foods, TVS Motor, KSB, ITC and IHCL, gained between 50 to 100 per cent since last Diwali. An equal number of stocks have given investors a reason to smile with 25-50 per cent appreciation.

Overall, 44 large-cap stocks led by Adani group stocks, about 60 midcaps stocks led by Gujarat Fluorochem., Fine Organic and Schaeffler India, and close to 400 smallcaps led by Cressanda Solutions, Jyoti Resins, KPI Green Energy and Choice International, clocked gains since last Diwali.

Breaking down the winning stocks into sectors shows that many gainers since last Diwali come from IT, consumption, chemicals, utilities, auto, logistics, agri, apparel, realty, industrial and defence segments. On the flipside, some stocks that have lost substantially come from consumption, e-retail/digital, infrastructure, sugar, pharmaceuticals, insurance, stock broking, NBFC and ITes space.

Among the laggards are stocks from Future group, Dilip Buildcon, Venus Remedies, Indiabulls group, Nureca, Zomato, Zensar, GE Power, Dishman Carbogen, Godrej Properties, Take Solutions, Cartrade Tech, Manappuram, Welspun India, HEG, New India Assurance etc.

How the giants fared

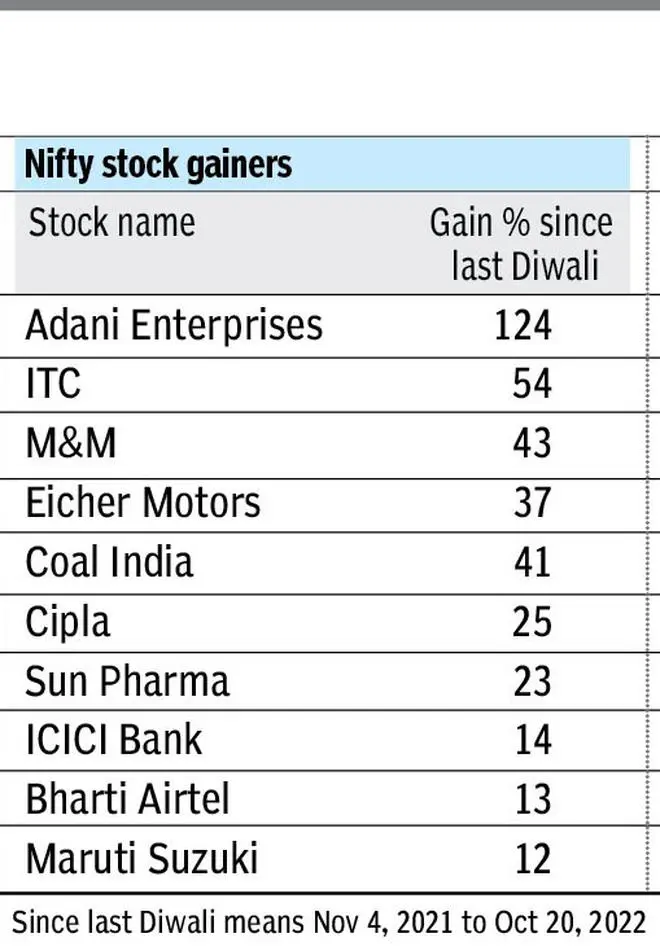

For investors who bet big on Sensex and Nifty stocks, it’s been a close call in terms of individual picks with about one in two stocks giving positive returns, led by Adani Enterprises, ITC, M&M, Eicher Motors, CIL and Cipla. The biggest laggards include Wipro, BPCL, Tech Mahindra, Divi’s, Tata Steel, HDFC Life and Tata Motors.

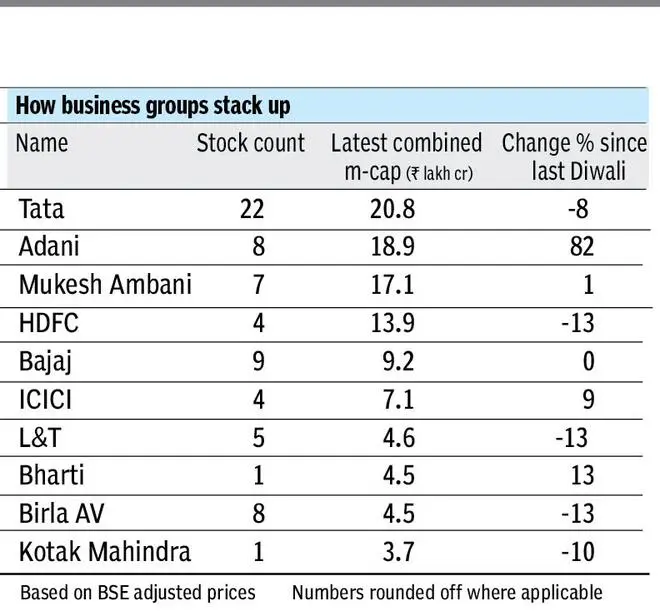

In terms of prominent business groups, Tatas are still the leader in terms of overall market cap (22 stocks), though their m-cap has dipped by over 7 per cent. But the Adani group (₹18.9 lakh crore m-cap) has moved to the number 2 position with a handsome 81 per cent jump. In the process, the Adanis have stolen a march over the houses of Mukesh Ambani (₹17.1 lakh crore) and HDFC (₹13.9 lakh crore), given their staid show. dip. At an absolute level, Adani group added ₹8.5 lakh crore m-cap, followed by around ₹50,000-60,000 crore each in Murugappa (8 stocks), ICICI (4 stocks), Bharti (1 stock) and Sun Pharma (2 stocks).

Pure-play Government of India companies, if they were a group (50 stocks) would be placed at the 5th slot with ₹12.1 lakh crore combined m-cap, up ten per cent since last Diwali. Some PSU stocks such as Mazagon, Bharat Dynamics, HAL, GRSE, BEL and Cochin Shipyard have registered stupendous gains.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.