Stocks of Bajaj Finance, Bajaj Auto, TVS Motor, Britannia Industries, Bharat Forge, SRF, Tata Group and Aditya Birla Group companies have been investor darlings in recent years. But are you better off investing in these companies or holding companies (Holdcos) that derive their value from their stakes in these companies? Here is our analysis.

In our Big Story in bl.portfolio (September 25, 2022, Holding companies and their hidden value), we had highlighted how there was merit in considering investing in Holdcos trading at extreme discounts. Although many of these companies have controlling or significant minority stakes in family silver (flagship companies), investors often tend to treat them as brass or copper. What else explains the large discounts at which they trade in relation to the value of their stakes in investee companies? Globally, in developed markets, the discounts are much lower, in the range of 10-20 per cent.

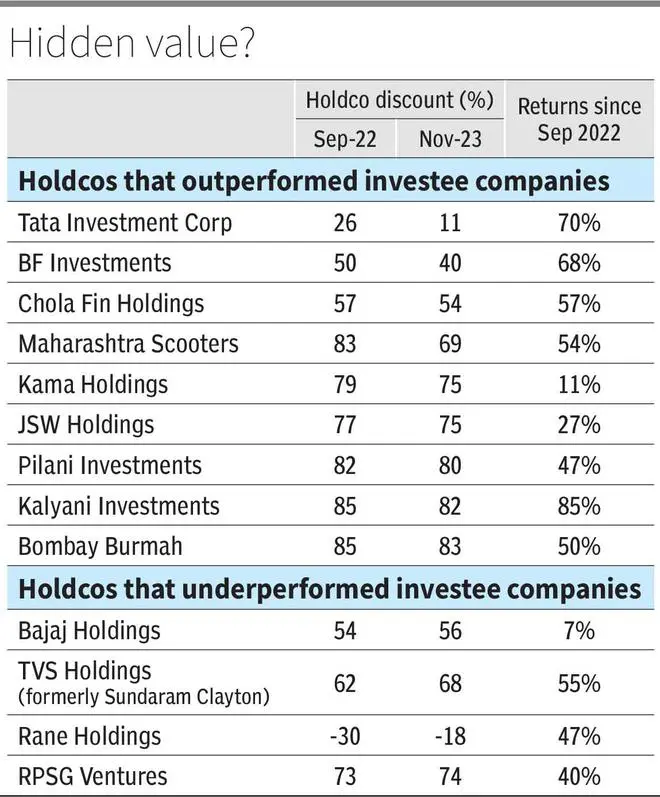

However, as investors seek value stocks, Holdcos garner attention. This has happened over the last 12-15 months as the value theme gained traction. In most cases, the Holdcos have delivered solid returns, aiding in their discounts shrinking.(see Table).

Since September last year (when we last analysed these companies), the returns of the Holdcos have been in the range of 7-85 per cent, and a significant 48 per cent on average (versus 10 per cent in the one year leading to September 2022). In nine out of 13 companies, the discount to underlying value has shrunk, although the discount per se remains very high in most cases. For this analysis, we have excluded holding companies with relatively significant standalone operations and considered only those that derive a substantial part of their value from underlying investee companies.

Best performers have been Holdcos like Kalyani Investments, BF Investments and Tata Investment Corporation. Kalyani Investments, which holds stakes in Bharat Forge and BF Utilities, was up 85 per cent in a little over a year, outperforming Bharat Forge, which returned around 54 per cent in the same period. In the process, the Holdco discount shrunk from 85 to 82 per cent. Although this shrinkage looks small, it is crucial to note that where Holdco discounts are high, even small narrowing of discounts can result in high outperformance over investee company, due to base effect. For instance, assuming the investee company’s value remains flat, a decrease in Holdco discount from 85 per cent to 80 per cent translates to a 33 per cent surge in Holdco’s share price.

Interestingly, BF Investments was another strong outperformer with 68 per cent returns and saw its Holdco discount shrink quite significantly from 50 to 40 per cent.

Opportunities remain in Holdcos. However, investors must study the fundamentals of underlying companies before investing. Upside to Holdcos can come from three aspects. If underlying investee companies deliver well, even if discounts don’t improve much, the Holdco shares will track the investee performance. Then, there is the case of discount shrinking as explained above. To tap this opportunity, it is best to buy stakes when discounts are at the higher end of historical range.

The third aspect, while speculative, is a case to consider for the ultra-long term. Upside may come from catalysts such as Holdco structure getting eliminated. To tap this opportunity, investors must be ready to play a long waiting game, with possibility that it may never materialise.

Bank holding companies, such as IDFC and Equitas, have experienced significant value creation in the past two years by moving away from the holding company structure. Although there are no immediate catalysts for the mentioned holdcos, in the long term, retaining majority control could become challenging as ownership is divided when the next generation takes over.

This may give rise to situations where the holding company could distribute its stake in the underlying companies directly to its shareholders, resulting in significant unlocking of value. Change in regulatory landscape encouraging elimination of these structures in broader investor interest may also be a catalyst.

Published on December 2, 2023

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.