‘Buy and hold good companies’ is an oft-emphasised investment strategy. But how good is it to buy and hold companies that just hold shares of other good companies? For example, investors of Tata Investment Corporation (TIC) found the last one month to be exceedingly rewarding, with 60 per cent returns . The stock has also returned over 90 per cent in the last year. Prior to this run-up, TIC, similar to many other holding companies in India, was trading at a significant holding company (holdco) discount for years. Holdco discount refers to the markdown in value of underlying assets owned, while valuing a holding company. This markdown can be attributed to reasons such as inefficiencies due to extra corporate layer, interests of promoters and minority shareholders not being aligned, lower liquidty of the stock, etc.

In the case of TIC, this discount was a little over 55 per cent a month back and around 60 per cent a year back. It has now reduced to 26 per cent post this run-up. Thus, it is primarily the expectation of value unlocking to reduce the discount at some point in time in future, that makes a case for owning holding company stocks.

Holdcos in India

Amongst the top 2000 companies by market cap in India, there are around 15 well-known holdcos (excluding bank holding companies such as Equitas, Ujjivan ). In this context, we are restricting our definition of holdcos to companies that don’t have significant standalone operations and derive almost their entire value from their underlying investee company. These holdcos are all part of business groups with investments primarily in group entities (except TIC, which has significant investments in non-Tata group companies as well)

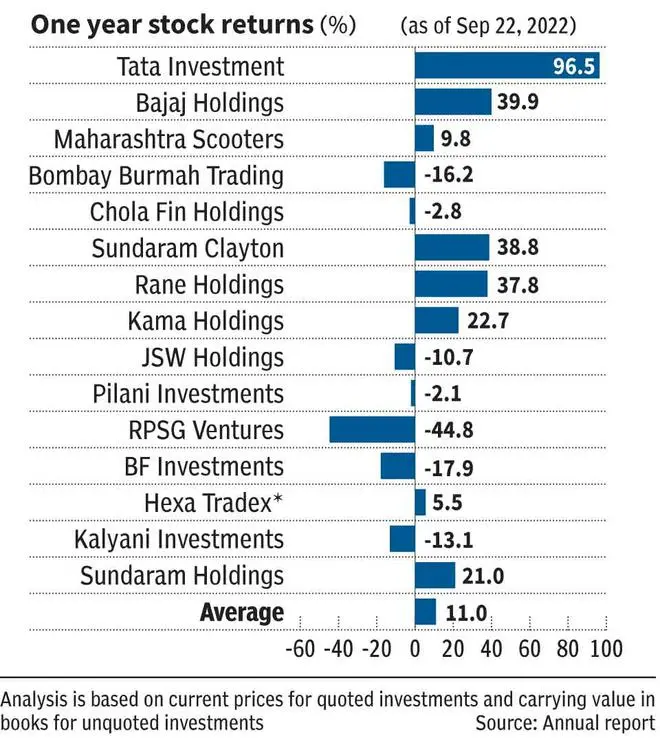

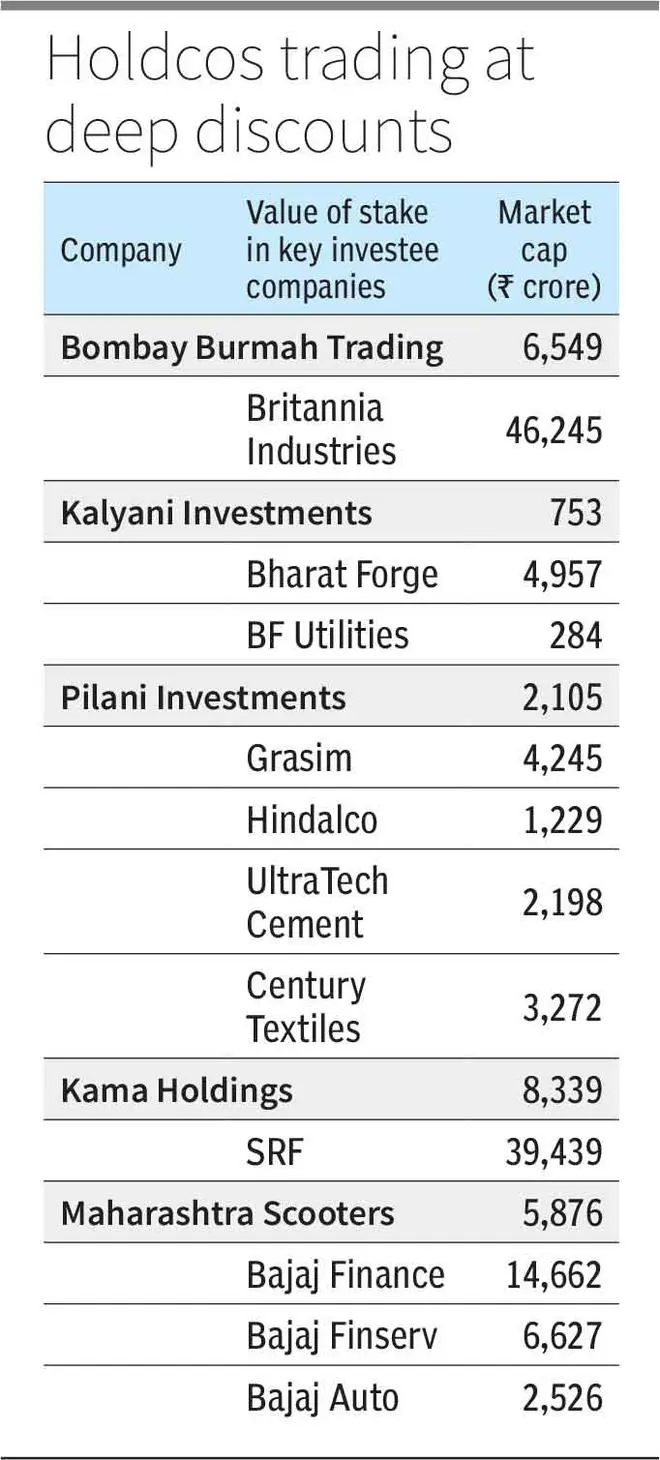

Out of these 15 companies, the holdco discount ranges from as high as 85 per cent (Bombay Burmah and Kalyani Investments) to a premium of 30 per cent (Rane Holdings) ( see infographics). A premium is a rare instance, though, and could either be due to market perception of the actual value of unquoted investments (usually carried at cost in books) or could be a case of mispricing by the market. Further, except in the case of Rane, TIC and Hexa Tradex, in all other companies, the holdco discount is above 50 per cent. Over the last one year, there has only been a marginal improvement in holdco discount at an aggregate level (see infographics). The simple average holdco discount for these 15 companies is at 57 per cent now, while it was at 60 per cent same time, last year.

Now coming to the important question – are discounts in excess of 50 per cent justified in valuing a holdco? Further, what justifies holdco discount as high as 85 per cent? In the developed markets, there is hardly an example of such high holdco discounts. In the Indian context, in most cases, holdcos are entities through which promoters can retain majority control of the underlying investee group company. In developed markets, promoters, rare as they are, use differential voting rights to exercise control and the case for a holdco to retain control is not common.

The reason for low appetite for holdcos in India could be investor perception that promoters may not be interested in value unlocking of holdcos as they may primarily want to wield control over group companies via holdcos.

Does that mean there is no opportunity for investors in holdcos? Far from it. There are two ways in which investors can benefit from buying holdcos bought at sufficient discounts. Even if holdco discount remains intact, if underlying investee company continues to perform well and its shares do well, then the holdco too can provide similar returns, tracking its performance. Add to it the prospects of holdco discount shrinking over a period of time; investors could then get to make compounded returns. For example, if the underlying asset moves up by 50 per cent in a specific period, and during the same time the holdco discount shrinks from 80 per cent to 50 per cent, the holdco investor gets to make 275 per cent returns. Thus, while there is no guarantee of returns, there may be merit in considering holdco companies trading at extreme discounts, provided other fundamental factors support the investment case.

Investors need to note that, in considering a holdco company, the primary way to value it is based on underlying value of its holdings. While holdco companies have income in the form of dividends and interest income from their investments (equity and preference share investments) these are not material in most cases as dividend yields in India are low by global standards. Thus, the income the holdco receives from subsidiary/associate companies may not be reflective of its value, although this appears to be the way markets are valuing companies where discounts are as high as 80 per cent. Ratios like PE or P/B may not be much helpful.

Other things being equal, tracking the holdco discount, comparing it with historical average and extremes is important. Over the last year, as mentioned above, the trends in holdco discount have been mixed, with discounts reducing for some and increasing for others. In some cases the discount rates have stayed in a narrow range through the year as well. Thus, it appears the volatility of the last year, shift of market mood in favour of value stocks, have not made much of a difference in this space for now, at an aggregate level.

Guidebook for investors

Keeping the above factors in mind, here are a few ways in which investors can approach holding cos :

One, have a long-term view. If success in investing is a game of patience, then success in investing in holdcos is a game of ultra-patience. TIC’s own long-term investors would have realised this as the shrinkage in company’s holdco discount happened after many years. Another example is Hexa Tradex (now in the process of getting delisted with promoters buying out minority shareholders), which has given 5x returns in the last 10 years, and a stunning 26x returns from Covid lows! Hexa Tradex is a holdco whose value is mainly derived from its investments in Jindal Steel and Power.

While these returns are assessed with full benefit of hindsight, the analysis highlights the opportunities in buying holdcos at extreme discounts as well as the need for patience. Since its listing in 2012 after being demerged from a Jindal group company, Hexa Tradex, only in recent short period (January 2021-August 2021), outperformed the investee company, resulting in shrinkage of holdco discount.

Two, assess the business and the valuation of the underlying investee company. There may not be any benefit in buying a holdco company at deep discount, if the underlying investee company is overvalued. The best time to buy would be if the investee company is undervalued, and the holdco discount is higher than historical average.

Three, analyse the corporate governance track record of the promoter group.Are their business activities and disclosures transparent? Do they have a good track record of addressing minority shareholder concerns? This needs to be an uncompromising factor in buying holdcos. While promoters with good corporate governance track record may want to continue to use holdcos to wield control over group companies, one can atleast be hopeful that they would be more receptive to minority shareholder suggestions for value unlocking.

For example, Sundaram-Clayton, which is the holding company of TVS Motors, announced an internal restructuring exercise early this year to unlock value and also return excess cash to shareholders. While the holdco discount remains high, such initiatives lend confidence that promoters will factor creating value for minority shareholders as well, over the long term. Consistency in such actions can result in compression of holdco discounts.

Four, keep an eye on the regulatory landscape. For example, according to a closed-end PMS fund that aims to tap opportunities from higher-than-warranted holdco discounts, opportunities may arise in this space as promoters feel the heat of the change in regulatory landscape. In their opinion, the thrust by MCA and SEBI on higher compliance requirements, time and again, could prompt promoters to consider delisting their holding companies, leading to value unlocking.

Five , something that has happened in promotor groups many times in the past is that, as ownership requires to get split across multiple family members, restructuring and value unlocking may become inevitable at some point in time. This has happened in groups like Bajaj (twice) and Reliance. Thus, for an ultra-long-term investor, this too is a factor that may work in favour.

Six, have an exit plan. If the holdco discount has shrunk significantly below historical norms in a short span of time or has gone into a premium, in the absence of any catalyst, then there may be some mean reversion in the discount. One must be alert to booking profits as well. For example, today, investors in TIC must assess whether it is worth holding to stock any more, when the holdco discount has reduced significantly.

Taking a leaf out of US markets

While we have many best practices of our own, adopting best practices from other markets can help address some of the distortions in our markets, like the way it exists in holdco valuations. The value in these companies remaining unrealised benefits no one, and rather may also cause distortions in the pricing of the underlying investee company, as many investors shun the indirect route of investing via holding company in favour of directly investing in the underlying company, even if it’s overvalued.

Tracking stock

The concept of tracking stock that exists in the US helps overcome this distortion there. A tracking stock is a form of equity that tracks specific segments or division in a company. These are traded in exchanges like any other equity instrument. For example, if regulations allow this, promoters can issue tracking stocks that reflect economic interest in the underlying investee company, to the minority shareholders. The tracking stock can be issued without voting rights or lower voting rights, and that way, promoters can continue to control the group companies, while minority shareholders can benefit from value unlocking. The instrument of tracking stock was extensively used by billionaire and media mogul John Malone. His business empire under the Liberty brand has a long successful track record of value creation through acquisitions/investments and consolidating his control while distributing economic ownership via tracking stock.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.