Often the go-to category for many first-timers and the core component of many a retail investor portfolio who started investing in MFs years ago, the ugly truth about large-cap funds is that they are ageing rockstars. Performance of funds in this category has been getting steadily worse over the years. And, when it comes to beating a benchmark such as Nifty 100 Total Return Index (TRI), a large majority of large-cap funds are not able to sustainably deliver better returns and thus ain't fulfilling the primary mandate of actively-managed equity funds. Aditya Birla Sun Life (ABSL) Frontline Equity, which completed 20 years this August, is a good example of this trend. While for NFO investors the fund (rated 3 stars by BL Star Track rating system) has multiplied wealth by over 33 times since inception, the flagship offering has failed to live up to its reputation in the last few years.

Fund strategy

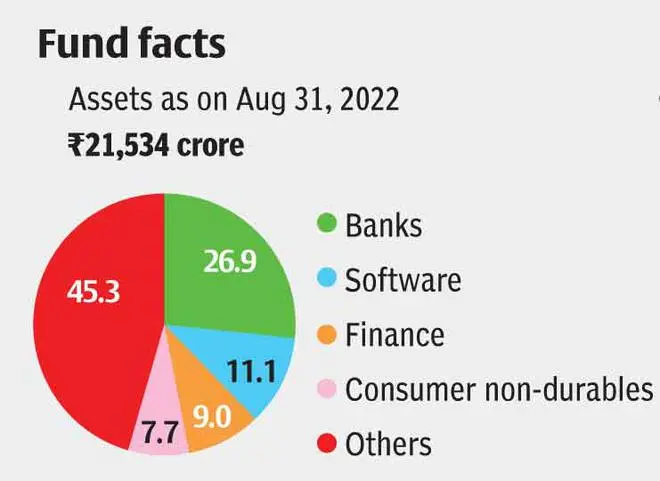

Aditya Birla Sun Life Frontline Equity saw its inception in 2002. While it has seen three different fund managers since launch, it has been managed for 17 years now by the incumbent Mahesh Patil, the chief investment officer of the fund house. In the last 10 years, the fund's assets have grown from ₹2,800 crore to ₹21,500 crore as many investors have chosen it and markets generally moved up.

The scheme endeavours to invest in 'frontline' stocks — stocks which, in the opinion of its fund manager, provide superior growth opportunities. The fund aims at being as diversified across various industries and/or sectors as its chosen benchmark index. It employs a blend of top-down and bottom-up approach for making investment decisions.

ABSL Frontline Equity targets the same sectoral weights within its equity portfolio as the benchmark index, thus being a benchmark-aware product. The scheme has the flexibility of selecting stocks within a particular sector from a wider investment universe. So, the equity component of the scheme's portfolio can track sectoral weights of the index, the stocks making up those sectoral weights in the scheme's portfolio could be different from those comprising the relevant sectoral weights in the index.

Performance

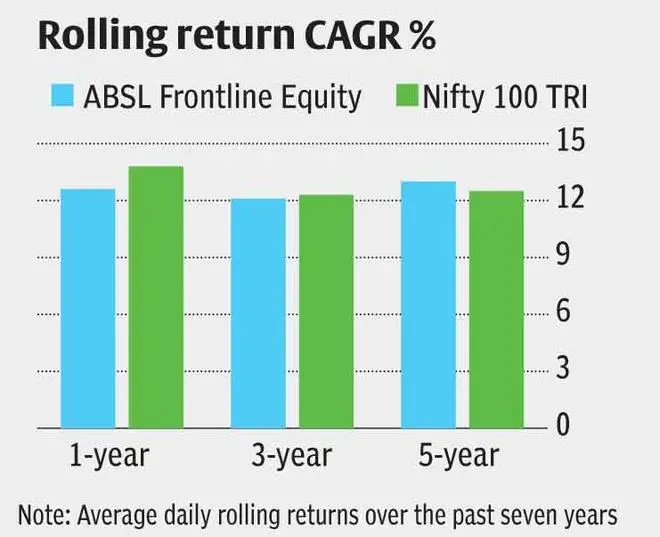

As mentioned earlier, the 30-odd actively-managed large-cap funds are having a tough time beating a benchmark such as Nifty 100 TRI. Over 1-, 3-, 5- and 10-year periods ended August 31, 2022, 87 per cent, 87 per cent, 92 per cent and 73 per cent of actively-managed largecap funds failed to beat Nifty 100 TRI. Post the SEBI recategorisation exercise in 2018, certain fund categories have been poor at delivering excess return over their benchmark given the narrow universe. While there is nothing novel about the index versus active debate, actively-managed funds should be able to beat their benchmark.

In terms of ABSL Frontline Equity fund performance, it ranks eighth in the one-year period, ninth in the three-year period, 20th in the five-year period and seventh in the 10-year period. Simply put, it is not a top performer and has been eclipsed by many who have been launched later. In terms of benchmark out performance, except in the 10-year period, the fund has consistently lagged Nifty 100 TRI across other periods.

A daily rolling return analysis of the five big funds (excluding HDFC Top 100 which saw a recent big fund manager change) over the last seven-year period also confirms ABSL Frontline Equity's uninspiring performance. The fund ranks behind Axis Bluechip, SBI Bluechip, ICICI Pru Bluechip and Mirae Asset Large Cap across one-, three- and five-year rolling returns in this seven-year period. In fact, the fund also failed to match Nifty 100 TRI in the one- and three-year rolling returns.

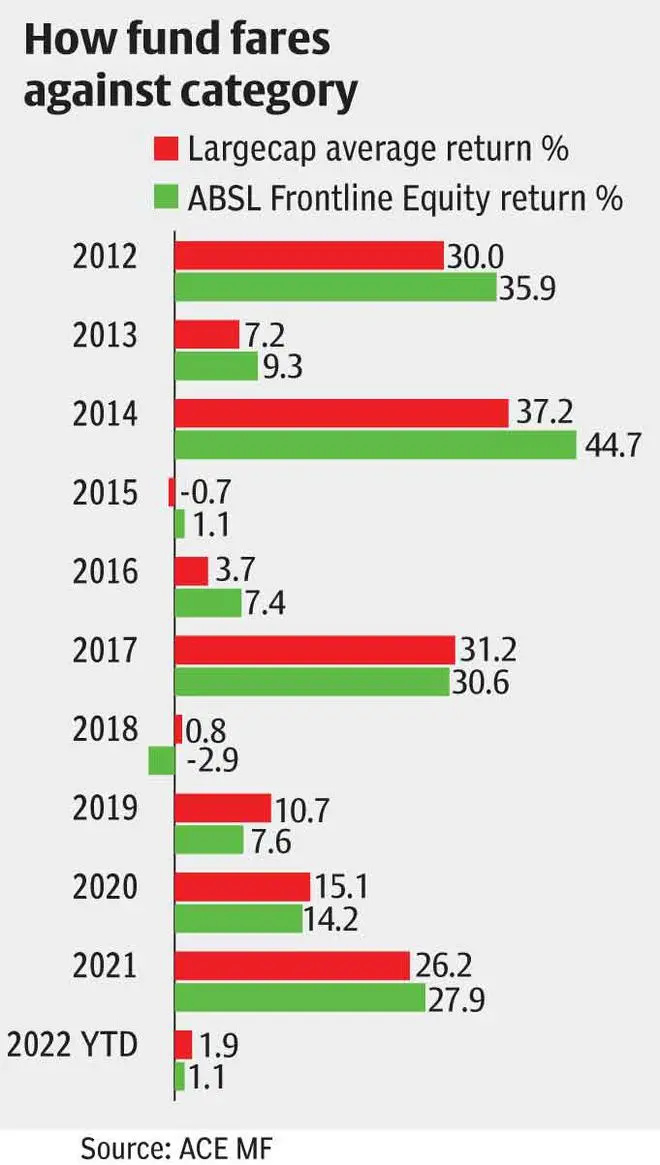

A calendar year wise point-to-point analysis over 2012 to 2021 shows that while ABSL Frontline Equity was able to beat category returns consistently till 2016, that record was broken between 2017 and 2020. In 2021, it was able to narrowly beat the category average, but that was a flash in the pan as 2022 year-to-date returns lag category again.

Large-cap funds are usually better at protectors during market corrections, but downside capture ratio for three-year monthly basis doesn't show the same for ABSL Frontline Equity (99 per cent). It does better than category at upside capture (98 per cent vs 93 per cent for category). The fund also fares well against category and some like-sized peers in terms of generating return (over and above the risk-free return) for every unit of risk undertaken.

Portfolio

Patil runs the fund as a benchmark-aware one and so the portfolio doesn't usually reflect significant over/underweight positions. Hence, the current stocks basket of ABSL Frontline Equity shows banks, software, finance, consumer non-durables and petroleum products as the five most preferred sectors. Compared to category, the fund appears more bullish on four out of five preferred sectors.

The fund has the largest number of stocks (71) in its portfolio, suggesting a rather long tail. This is compared to 46 stocks for the category. The fund has about 85 per cent exposure in large-caps, 9.25 per cent in mid-caps, 2 per cent in small-caps and the rest in cash. In terms of portfolio valuation, the fund's stock basket has a price to earnings (PE) of 32 times, which is lower than category average (35 times), as per ACEMF data. Except Mirae and HDFC large-cap offerings, most large funds have portfolio PE between 35 and 46 times.

Our view

Cutting the long story short, the 20-year period for ABSL Frontline Equity may have been good for early investors who have held on. But, it has failed to live up to its lofty reputation in the past few years. This isn't only true for this fund and could well be the fate of many others.

As an actively-managed large-cap fund, ABSL Frontline Equity hasn't done well against its benchmark or like-sized peers in recent times. Hence, existing investors can consider switching to a plain-vanilla passive large-cap index fund/ETF in a gradual manner.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.