Many young folks put off investing because of the mind-boggling choices they are confronted with. This is especially true of mutual funds, where there are hundreds of schemes from 40-odd fund houses and 36 SEBI-approved categories. But if you are a new investor looking to start Systematic Investment Plans (SIPs), you need not worry about all the choices out there. There are simple equity products which can suit you perfectly well.

Large-cap funds score

In equities, fund houses offer large-, mid- and small-cap funds, as well as a combination of these. Beginners should ideally start with large-cap funds. They own the top 100 most-valued companies in the market.

Large-cap funds make for a good start because of three reasons. One, the biggest companies tend to be leaders in their sector. They tend to suffer less earnings volatility than smaller peers. Two, stock prices of large-cap firms tend to be less volatile than those further down the pecking order. When the market falls, it is in the large-cap space that smart investors first look for bargains. Three, today a lot of the foreign portfolio flows into Indian stocks are from global index funds. They simply buy up the basket of biggest stocks in the market to acquire a country exposure. It is the top 100 stocks by market capitalisation that corner these flows.

- Also Read: How to plan and invest in an SIP?

Passive shortcut

In large-cap funds, you can either choose actively-managed funds or passive ones. In active funds, you rely on a fund manager to cherry-pick stocks from the top 100 that will outperform the rest. So to choose the right active fund, you will need to know its track record, the manager’s performance, his style and so on. You will also need to keep tabs on the fund’s performance on an ongoing basis after buying it to know if it is beating the index.

Passive funds help you side-step such complications. They simply own the same basket of stocks as a bellwether index. As they don’t use a fund manager for stock selection, they come at a low cost that adds to your returns. Passive funds tracking large-cap indices are available at annual fees as low as 0.10 per cent, while actively-managed large-cap funds charge upto 2 per cent.

Within passive funds, you have the choice of buying exchange traded funds or index funds. Open-end index funds are preferable because you can buy them from the fund house at any time at the latest NAV (net asset value). This makes SIPs easier to execute. Exchange traded funds need to be bought on the stock exchange after double-checking market prices and trading volumes.

Which index?

The large-cap passive menu consists of index funds tracking the Sensex30, Nifty50 or Nifty100. A rolling return analysis (which studies the return on an asset over many start and end points over a long time frame) is useful to gauge how you should expect them to behave.

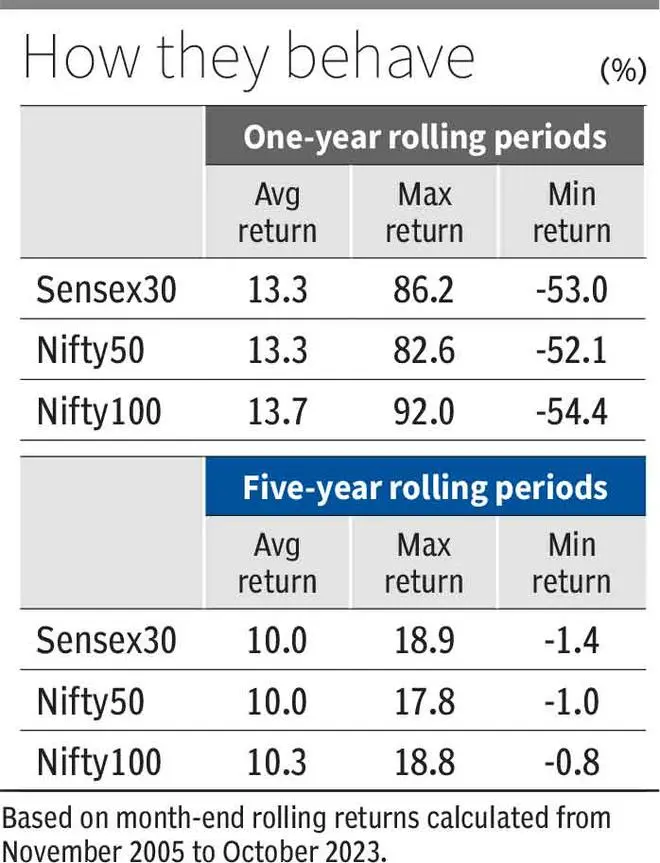

A rolling return analysis based on monthly data for the three indices, from November 2005 to October 2023 (18-year period), shows the following:

If held for a year at a time, the three indices delivered average returns of 13.3 per cent to 13.7 per cent. But the averages hide big year-to-year variations.

In their best year, the indices made 82.6 to 92 per cent. In their worst year, they fell 52.1 per cent to 54.4 per cent. You can take this as an indication of how much money you can make or lose in any given year, after investing in these funds.

If held for five years at a time, the indices delivered an average return of 10-10.3 per cent annually. As five years is the minimum recommended holding period for equity funds, this is an indication of the returns you can expect from these funds before fees.

In their best five-year periods, the funds made a 17.8-18.9 per cent compounded annual return. In their worst five-year periods, they lost between 0.8 per cent and 1.4 per cent a year. The losses clearly shrink as you stretch your holding period.

If you’re looking to choose between the three indices, the Nifty100 is slightly better. It has the highest average return and its maximum returns over both one- and five-year time frames are well above the Nifty50 and Sensex30. It has lost slightly more in the bad years, but the good years tend to compensate.

Bandhan Nifty50, Motilal Oswal Nifty50 and Axis Nifty100 index funds are among the low-cost options in this space, charging annual fees of 0.10-0.15 per cent. ICICI Pru BSE Sensex and Nifty50, Nippon Index S&P Sensex, SBI Nifty Index are funds with a 10-year plus track record charging 0.15-0.18 per cent.

If you would like to add a return kicker to your portfolio, you can add a fund tracking the Midcap 150 index, which is made up of the stocks immediately below the top 100. Motilal Oswal and ICICI Pru offer Midcap 150 Index funds at an annual cost of 0.20-0.21 per cent.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.