The pervasiveness of technology and digital systems has gained tremendous momentum over the past decade, especially in recent years after the Covid-19 pandemic.

Apart from just IT services, many sectors are now primarily technology-driven.

These include media (OTT: Over The Top;), digital payments, e-commerce, telemedicine, telecom (mobile service providers, infrastructure players, hardware makers etc.), new generation banks and aggregators (food delivery, cabs and the like).

A handful of technology funds have been around for a couple of decades now, and many have widened the scope over the years from just investing in software service companies. Most have robust track records.

In this light, Quant Teck and HDFC Technology are fresh new fund offerings (NFOs) that are available for subscription and close on September 5.

Should you invest in these NFOs? Here’s what you must consider before opting for these funds.

Technology to drive growth

The size of Indian IT, e-commerce, media and broad technology segments becomes apparent with key pointers from various industry reports and fund presentations.

Indian technology sector comprising domestic ($49 billion) and exports ($178 billion) segments was at $227 billion FY22. This is set to grow to $350 by FY25. The country has a 59 per cent share of the global sourcing market and remains at the number one position in this aspect.

The domestic e-commerce market is expected to become $188 billion by 2025 and $350 billion by 2030.

India’s OTT revenues are set to grow by 14.3 per cent annually over 2022-27 to $3.5 billion by 2027. Internet advertising is set to surge at 12.3 per cent over 2022-27 to $7.94 billion.

Media and entertainment as an industry is set to see revenues grow at 9.7 per cent annually to $73.6 billion by 2027.

The short point is that the size of the TMT (technology, media and telecom) is enormous in India and multiple players are set to drive this growth and benefit from it.

What the tech funds entail

The NFOs are benchmarked against the BSE Teck index, which has information technology firms (79 per cent weightage), telecommunication companies (18 per cent) and media & consumer services players. Although both funds will be actively managed and will vary their sector weightages, the benchmark index’s composition indicates that IT companies are still likely to dominate the holdings.

Interestingly, in 11 of the 16 financial years from FY 2008, the BSE Teck index has outperformed the BSE 500 TRI. Both funds will likely take a flexi cap approach to choosing stocks, given that there is an investment universe of over 120 stocks, with mid and small caps forming the majority.

Frontline IT stocks have been underperforming for the past 18 months, and there are still headwinds in terms of slowing client spending due to a downturn in the US and Europe. Valuations, though not very expensive, are still above comfort zones. For the foreseeable future, IT is likely to be more of a contrarian play. Other segments, such as telecom players, new-age internet companies and select media firms that are focused on the domestic market, may still do well.

What must investors do?

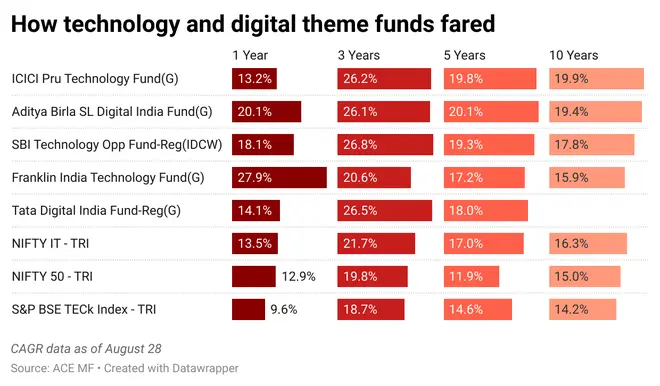

As mentioned earlier, a few funds are under the technology and digital themes. ICICI Prudential Technology, Aditya Birla Sun Life Digital India, SBI Technology Opportunities and Franklin India Technology have been around for a very long time – 20-25 years. Across several information technology-related disruptions and cycles, these funds have delivered strong returns across time horizons. In addition to IT services companies as the mainstay, many of these funds have added telecom, media and new-age companies, apart from a few overseas technology stocks, to their portfolios. ICICI Prudential Technology and Aditya Birla Sun Life Digital India have particularly strong track records and have been consistent performers.

Investors seeking to ride the technology/digital theme can have these two funds as their main choices for the long term as part of their satellite portfolio.

Tata Digital Fund is a relatively recent vintage, with a little over seven years of track record.

Quant as a fund house has done exceptionally well across categories over the past 4-5 years and HDFC has a great pedigree as an AMC with sound track record over decades. However, investors can give some time for these schemes to develop a track record before taking the plunge, especially as there are existing choices available.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.