Flexicap is among the most popular categories of mutual funds and has another entrant in the form of Sundaram Flexi Cap. Thanks to the highly flexible mandate that the category has with respect to investing in stocks across market capitalisation – large, mid and small – many funds in the erstwhile multi-cap segment opted to move to the same. Some started fresh schemes, as market regulator SEBI allows one scheme per category. The NFO closes on August 30.

The flexi cap category has no rigid rules on market capitalisation of stocks to be invested and is therefore convenient for most fund houses. But, most flexi cap funds have a large-cap bias and usually have 50 per cent or more invested in such stocks. Sundaram Flexi Cap has indicated that it would follow a valuation-based model for deciding allocation among large, mid and small-cap stocks.

Here’s what you must know about the NFO before considering any investments in the scheme.

Investing in cyclicals and consumer stories

Sundaram Flexi Cap is looking to approach sectors via a calibrated manner. The fund house’s CEO has indicated in media interactions that the fund will invest the mid and small-cap portion of the portfolio in sectors such as capital goods and discretionary consumption. So, building materials, cement, EPC players and steel companies would also figure in the mid and small-cap spaces. Exposure would also be taken to banks and financial services

Most analysts are bullish currently on automobiles, ancillaries, capital goods and infrastructure stocks. These segments have the right mix of government thrust, economic impetus and still reasonable interest rates – all of which could propel higher growth.

Overall, the fund looks to invest in a blend of investment, consumption and new-age companies.

The methodology

The fund will allocate to large, mid and small-cap stocks in a proportion that is decided based on the premium or discount of a composite one-year forward PE (price earnings multiple) – comprising Nifty 100 TRI, Nifty Midcap TRI and Nifty Small-cap 250 TRI.

For example, if the composite one-year forward PE is at a 20 per cent discount to the Nifty 100 TRI, the allocation would be 50 per cent in large-caps, 33 per cent in mid-caps and 17 per cent in small-caps. There is a progressive slab of 10 per cent and if the composite PE is at a premium of greater than 20 per cent, there would be 80 per cent large-cap allocation, 13 per cent mid-cap and 7 per cent small-cap allocation.

So, the ranges based on the composite one-year forward PE for large, mid and small-cap allocations are: 50-80 per cent, 33-13 per cent and 17-7 per cent.

This rule would generally be followed, though in extreme cases, it could be changed.

The flexi cap theme

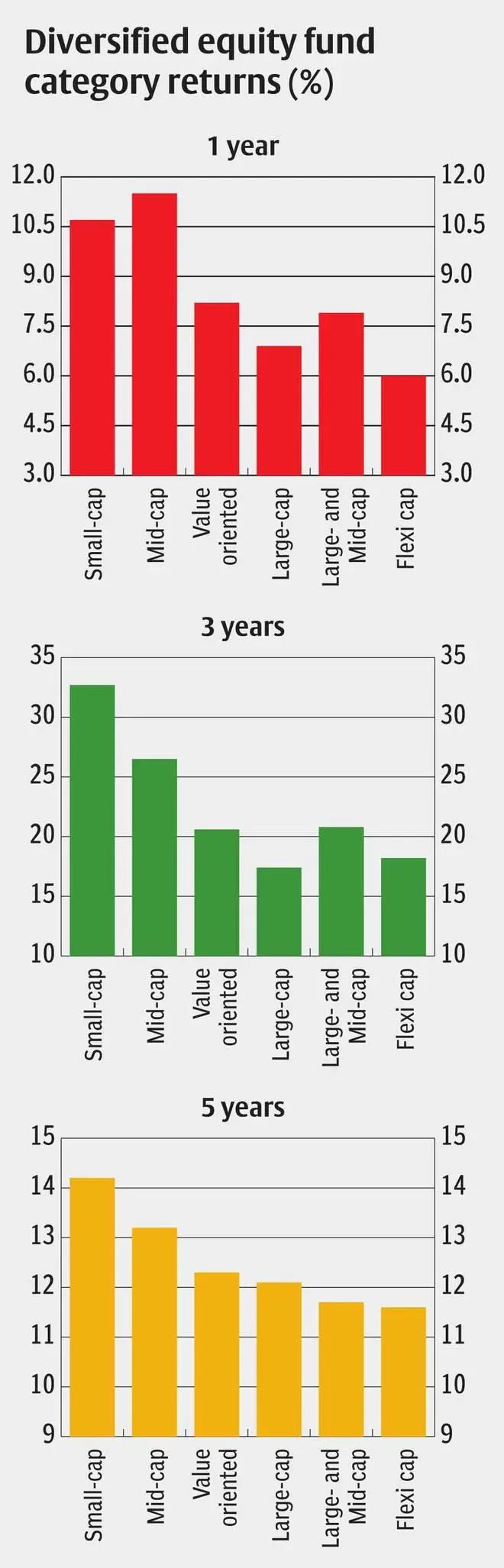

The flexi-cap theme hasn’t lagged many other diversified equity categories over the past few years, on a trailing basis. Given that mid and small-cap stocks had a great run since April 2020, large-caps have been relative underperformers, as most flexi cap funds are heavily invested in large-caps. Of course, some flexi caps have done spectacularly within the category over the years.

Most flexi cap funds have banks & financial services as their top sector holdings. Cement, consumer non-durables, auto and ancillaries, construction materials and industrial products are some other key holdings. Sundaram Flexi Cap, too, would be investing in most of these segments.

What should investors do?

A valuation-based approach to deciding on the appropriate market cap mix in its portfolio is interesting. But the category itself has many quality existing schemes that investors could choose from.

Despite the valuation approach, Sundaram Flexi Cap is still likely to be biased towards large-cap stocks, quite like most peers. Many of its intended target investment segments appear attractive currently, but those could be played via existing funds as well.

Investors can wait for the fund to develop a track record before considering any investments in the scheme.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.