In the current landscape of the Indian stock market, the Sensex has experienced a 9 per cent surge this year and is currently hovering near its all-time high. Rather than trying to time the market, long-term investors should gradually strengthen their equity holdings through systematically planned investments aligned with their financial goals, such as Systematic Investment Plans (SIPs). This strategy involves a blend of stable large-cap investments and growth-focused mid-caps. Introducing the Bandhan Core Equity Fund, a three-star-rated option in our exclusive bl.portfolio Star Track Ratings. With a recommended holding period of five years or more, this fund presents a promising formula for potential returns. Over the past three years, it has orchestrated a notable turnaround and stands out as a performer with above-average return potential.

Strategy

Launched in 2005 in its initial form, Bandhan Core Equity (formerly IDFC Classic Equity/IDFC Core Equity) operates with a strategic focus, maintaining a controlled exposure (minimum 35 per cent individual exposure to large- and mid-cap stocks) to companies among the top-250 by market cap. The fund’s philosophy is structured around three key principles. Firstly, it engages in active portfolio management with a dynamic approach, adjusting the portfolio when businesses attain fair valuations. Secondly, it typically holds a higher number of stocks (87, the second-highest in its category), diversified across sectors (34). The fund places significant importance on macro factors to comprehend evolving trends, guiding its thematic and cyclical decision-making.

The portfolio construction can be segmented into three parts. The first part, high-growth/quality investing, focusses on sectors exhibiting higher-than-nominal GDP growth over the medium term, such as private sector banks, internet companies, auto ancillaries, and NBFCs. The second part encompasses thematic/cyclicals, currently focussing on power capex upcycle, real estate consolidation, commodities reflationary trends, and US generic investing. The third subset, optional and value investing, currently targets holding companies, emerging technologies (EV, biologics), and opportunities driven by corporate actions.

Given the reasonably fragmented nature of the benchmark (NIFTY Large Midcap 250 Total Return Index), Bandhan Core Equity’s active share is likely to exceed 50 percent most of the time. Additionally, due to the fund’s considerable exposure to mid-small cap stocks (48 percent in total), it may hold a reasonable amount of cash at times. Before SEBI introduced regulations on the categorization and rationalization of mutual fund schemes, Bandhan Core Equity, like many of its peers, was predominantly large-cap focused, with over 60 percent allocation in 2017.

Performance

The large and midcap fund category is over 5 years old. After being relegated to bottom quartile successively in 2019 and 2020, Bandhan Core Equity (direct plan) in the last 3 years has consistently improved its performance and scripted a solid turnaround viz. lower mid quartile (2021), upper mid quartile (2022) and top quartile (2023 YTD).

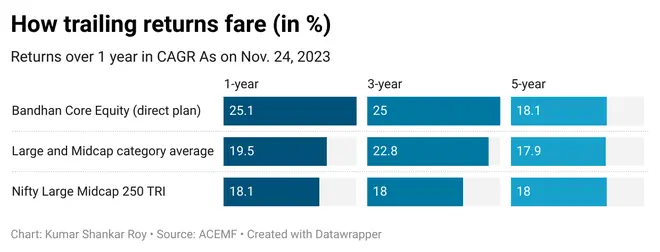

On a point-to-point trailing return basis (as on Nov. 24), the fund’s return of 25.09 per cent in one-year, 25 per cent in three-year and 20.72 per cent in five-year period beats the category average as well as the benchmark Nifty Large Midcap 250 TRI (see table).

While delivering above category-average results, the investment team appears to have been prudent as displayed by the Bandhan Core Equity’s top quartile ranking in volatility (measured by annualised standard deviation of monthly rolling returns). This is in fact better than category biggies such Mirae Asset Emerging Bluechip, Canara Robeco Emerging Equities and SBI Large & Midcap.

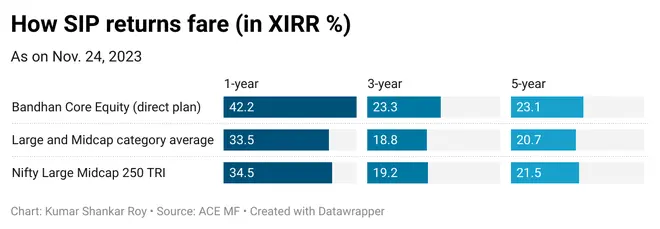

As a choice for SIPs, Bandhan Core Equity has delivered robust performance in the last 1-year (42.2 per cent), 3-year (23.3 per cent) and 5-year period (23.1 per cent), beating gains notched up by category-average and benchmark (see table).

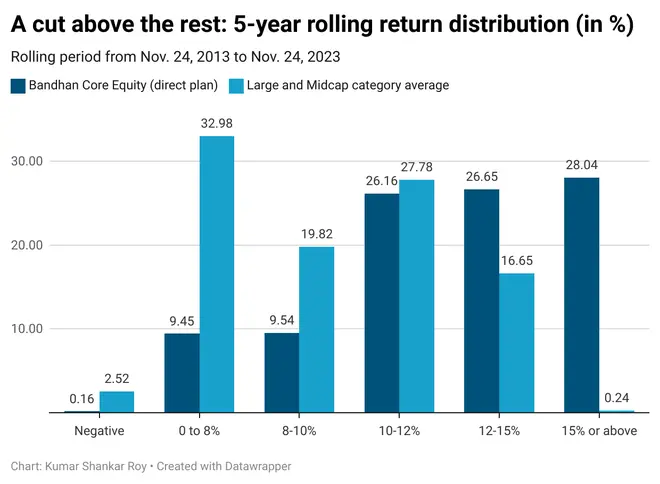

Rolling returns, a better measure of consistency, also confirm the fund’s track record being ahead of peers (see table).

Portfolio

The fund invests in a large portfolio of large, mid and small sized companies. There is a strong emphasis on risk management to mitigate the inherently greater volatility of a portfolio dominated by mid-caps and small-caps. This is also evident in the higher number of sectors in the fund versus its category.

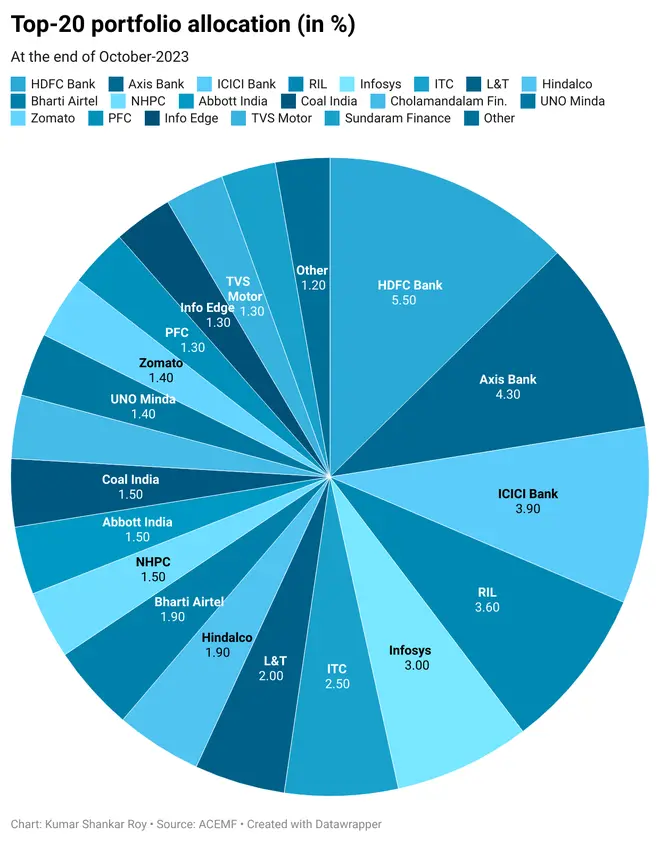

The fund’s top sectoral bets are Banks, Pharma, Finance, Auto Components, IT, Retailing, Petroleum Products and Electrical Equipments. Top portfolio picks (see chart) include HDFC Bank, Axis Bank, ICICI Bank, RIL, Infosys, ITC, L&T, Hindalco, Bharti Airtel, NHPC, Abbott India, and CIL.

The fund recently added positions in Info Edge, Sobha, HDFC AMC, One 97 Com., Shriram Finance and Titan, while paring holdings in Siemens, LIC Housing, Ajanta Pharma, United Breweries and Poonawala Fincorp.

While the fund demonstrates a somewhat more assertive investment approach, as evidenced by its higher allocation in small-cap stocks, its performance has been satisfactory in the recent period.

The portfolio’s earnings are estimated to grow higher than the benchmark. Portfolio valuation multiples are relatively attractive versus the benchmark based on FY25 estimates. This indicates the fund targets deeper value plays. Valuation multiple of Bandhan Core Equity portfolio is also better than the index on Price to Earnings Growth (PEG) parameter.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.