The Indian stock market is trading near life-time highs, with the Sensex notching up a smart 21 per cent rise in the last one year alone. Those who were waiting for a correction may have missed yet another opportunity. Instead of timing the market, long-term investors should add positions in equity asset class via SIPs in a right mix of steady large-caps and growth-oriented mid-caps. In this context, SBI Large & Midcap Fund, rated 4 stars by our proprietary Star Track Ratings, can provide the ideal recipe for returns if your holding period is five years or more. A consistent performer with above-average returns potential, the fund is a low-risk option in volatile markets. Here’s a lowdown.

Competitive performance

Before SEBI came up with regulations on categorisation and rationalisation of mutual fund schemes, SBI Large & Midcap Fund was known as SBI Magnum Multiplier Fund (launched in 1993). This fund used to be predominantly large-cap oriented, with over 50 per cent allocation in 2017. SBI Large & Midcap, currently, holds 43 per cent in large-caps, 37 per cent in mid-caps, 12 per cent in small-caps and 8 per cent in cash-equivalents. Over the last one year, the fund has trimmed allocation to small-caps, maintained mid-caps and hiked exposure to large-caps. The fund uses different approaches for building large-, mid- and small-cap portions of the portfolio, but retains an eye on valuations.

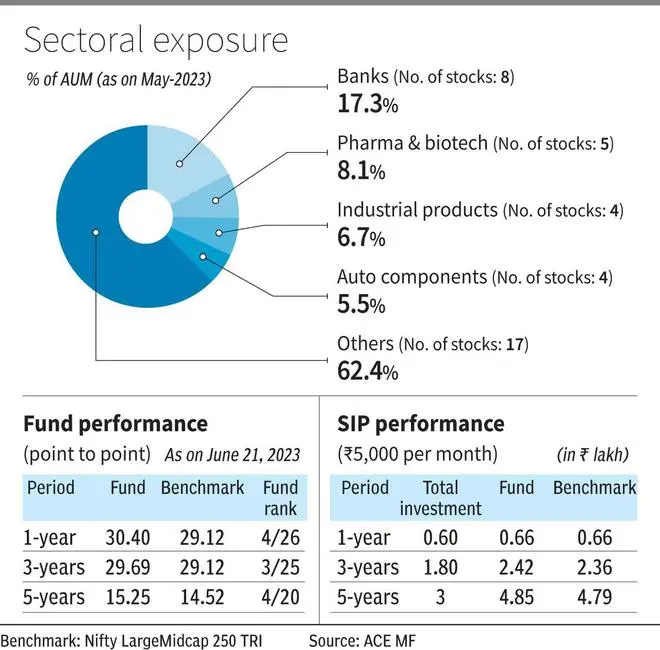

The fund has outdone its category average returns across one-, three- and five-year periods and has also outperformed benchmark Nifty Large Midcap 250 Total Return Index (TRI). Alpha (over benchmark) is 13-73 basis points in these periods and the extent of higher returns is around 300-900 basis points vis a vis large- and mid-cap fund category average.

In the last one, three and five years, the fund has consistently secured top quartile position (among third/fourth best) among category peers as well. This is an acknowledgment of the consistency and competitive results achieved by fund manager Saurabh Pant, who assumed control of this fund in the latter part of 2016. While delivering above-average results, the manager appears to have employed a degree of flexibility in terms of assessing value in order to capitalize on market phases driven by growth and momentum.

Over the long term such as 10- and 15-year periods, the fund features in the top-five club, but do note these returns are of an era when the fund wasn’t entirely a large- and mid-cap one.

In the last three years, which fall under the fund’s newest avatar, the scheme has managed downsides well, evident from downside capture ratio (DCR). With a DCR of 83 per cent, SBI Large & Midcap along with Kotak Equity Opportunities has lowest downside captures and have fallen less than the overall category (97 per cent). During upswings, the scheme has not struck any compromise and boasts of a three-year upside capture ratio of 96 per cent) compared to category average (94 per cent).

Related Stories

Why Canara Robeco Emerging Equities is a good fund to buy

The scheme offers the stability of large-caps and growth potential of mid-capsPortfolio and strategy

SBI Large & Mid Cap Fund allocates investments across various sectors, employing a mixture of growth and value investment styles, along with a comprehensive approach to stock selection that combines both top-down and bottom-up analysis.The portfolio valuation in terms of PE at 43.5 times is tilted towards growth, compared with category range of 23 times (UTI Core Equity) to 53 times (Axis Growth Opportunities.

The primary objective of the fund is to capitalise on the size advantages offered by large-cap companies while leveraging the growth potential of mid-cap companies. Typically, the fund maintains a well-diversified portfolio consisting of approximately 55-60 stocks to ensure sufficient diversification.

As a large and mid-cap fund, the scheme is mandated to invest 35 per cent each in large-caps and mid-caps (total 70 per cent). But in contrast to many peers, the fund has shown a tendency to use the balance 30 per cent more in mid- and small-caps, than seek refuge in large-caps, as some like-sized competitors such as such as Mirae Asset Emerging Bluechip and ICICI Pru Large & Mid Cap do.

Related Stories

Parag Parikh Flexi Cap fund multiplied your money five-fold in 10 years: Will the winning streak continue?

The fund’s investment and stock picking process has held it in good stead over the years, making it a top performerAlthough the fund exhibits a slightly more aggressive investment style, as indicated by its higher exposure to mid- and small-cap stocks, its execution has been decent thus far. The fund demonstrates a degree of risk management by maintaining lower concentrations in its top 5, 10, and 20 stocks compared with the average for its category.

The fund has a good mix of defensives and cyclicals. Banks have generally been the most-favoured segment. It is followed by Pharma & biotech

Industrial Products, Auto Components, Diversified FMCG, IT - Software, Hotels, Petroleum Products and Cement.

Over the last one year, the fund has trimmed exposure to IT, Textiles, Petroleum Products, Consumer Durables, Telecom, Ferrous Metals and Oil. Allocations have increased sharply in Pharma & Biotech. Do note the fund’s expense ratio is a tad higher relative to category.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.