After a full year of interest rate increases, the Reserve Bank of India (RBI) has hit the pause button in recent months. Inflation also seems to be slowly coming under control. The general perception therefore is that interest rates may be close to their peak. Interest rates on deposits and coupons on NCDs (non-convertible debentures) may almost be the best available for now.

In this regard, Edelweiss Financial Services has come out a new tranche of NCDs. The offer is open and closes on July 17.

Given that the group spans several businesses, investors may have to assess the key parameters associated with these firms before investing in the debenture offer.

The tenors on offer range from 24 months to 120 months, and the yields for some tenors run into double digits. But is the attractive yield enough to invest in the NCD? Read on to take a call on the offer.

Double-digit yields on certain tenors

The Edelweiss Financial Services NCD issue has been rated AA-/Negative by CRISIL and AA- by Acuite. A rating of AA- indicates high degree of safety in servicing principal and interest payments. This a few notches lower than the highest rating. These NCDs carry low credit risk.

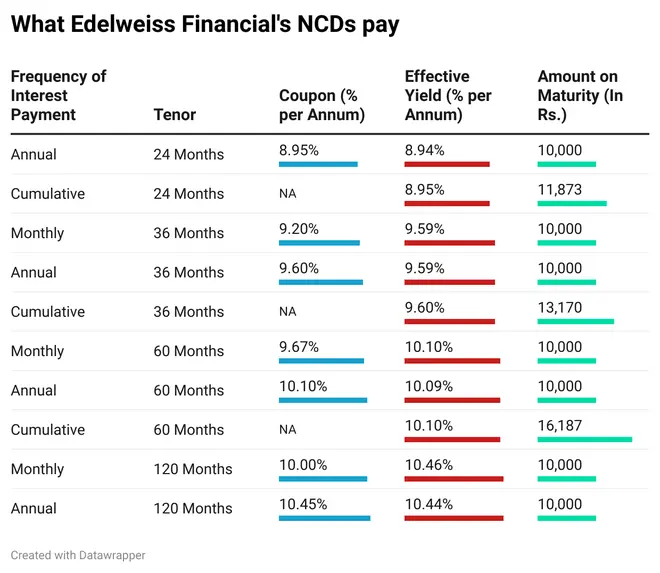

The minimum investment required is ₹10,000. Edelweiss Financial Services offers coupons of 8.95 per cent for the 24-month tenor to 10.45 per cent for the 120-month series.

There are monthly, annual and cumulative options for the 36 months and 60 months tenors. For the 24-month tenor, there are only the annual and cumulative options. In the 120-month option, there are only monthly and annual interest payout options.

The yields range from 8.95 per cent to 10.46 per cent based on the tenor and the payout option chosen.

For investors, the 36-month and 60-month tenors look attractive with annual and monthly payouts to ensure regular cash flows. Yields are 9.59 per cent and 10.1 per cent, respectively.

Also read: LIC Dhan Vriddhi review: A mix of low returns and coverage

Data from Kotak Mutual Fund indicates that indicates that yields on corporate bonds that are rated AA- are 105 basis points and 93 basis points more than g-secs of similar maturity. That would mean yields of 8-8.1 per cent. The yields on offer from the present NCD are therefore higher and attractive.

However, investors must restrict overall NCD exposures to around 10 per cent of their entire debt portfolios. Given the attractive interest rates on offer from small finance banks, AAA-rated NBFCs and small-saving schemes, those avenues can be explored first before getting into riskier options.

Only investors with a high-risk appetite must consider the firm’s NCDs.

Businesses on slow recovery mode

Edelweiss Financial Services has several businesses – NBFC (Non-banking Financial Company), Housing Finance, mutual fund, alternative asset management, asset reconstruction, insurance and wealth management.

Also read: LIC Housing Finance FD: Should you go for it?

Here are the key highlights of the key divisions.

In the asset reconstruction business, AUM has declined from ₹40,200 crore as of March 2022 to ₹37,100 crore as of March 2023. There were recoveries of ₹7,350 crore during FY23 and the segment continues to be profitable. Capital adequacy is robust at 47.1 per cent.

NBFC (ECL Ltd): The group continues to focus on reducing the wholesale loan book and would continue on this path for the next couple of years at least. It achieved a 40 per cent reduction in its wholesale book in FY23.

- Gross NPA (non-performing assets) ratio has fallen to 2.07 per cent in March 2023 from 2.76 per cent in March 2022. Net NPA is at 1.29 per cent, down from 1.96 per cent. The reduction in NPAs may also have been aided by the reduction in the loan book.

- The NBFC’s assets under management (AUM) have fallen by nearly 37.6 per cent y-o-y to ₹7,847 crore as of March 2023.

- Capital adequacy is healthy at 34.3 per cent.

Housing finance:Housing finance, too, has had a fairly anaemic trend as far as growth in assets is concerned.

- The AUM declined to ₹4,115 crore as of March 2023, from ₹4,400 crore in March 2022.

- Gross NPA has declined to 1.91 per cent from 1.99 per cent over the same period.

- Collection efficiency has been reasonably good at 97.79 per cent as of March 2023.

- Capital adequacy is healthy at 32 per cent

Mutual fund and alternative asset management:

- The AUM for the mutual fund segment grew by a healthy 24 per cent y-o-y to ₹1,05,000 crore as of March 2023. Retail folios grew 20 per cent y-o-y to 11.7 lakh as of March 2023

- The AUM for the alternative asset management business grew nearly 52.5 per cent y-o-y to ₹46,500 crore as of March 2023. Fee-paying AUM was almost half that amount.

The insurance business is not yet profitable, though premiums continue to grow. Its Wealth management business saw assets under advice increase 12 per cent y-o-y in FY23.

Barring the asset management (mutual funds and alternatives) business, which is doing well, the other divisions still appear to be on a slow recovery path.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.