As the Reserve Bank of India (RBI) tightened interest rates, there has been an increase in the yields of bonds across the board. The cascading effect has been felt in the case of tax-free bonds as well. These tax-free bonds deliver better returns compared to fixed deposits on a post-tax basis. And there is very little risk in these bonds as these are issued mostly by AAA-rated public sector companies.

Now, such bonds are ideally suited for those investors in the higher tax brackets – 30 per cent and higher – given that the interest received is tax free.

Read on to know how these tax-free bonds are traded, the available yields and specific options to pick from.

Companies that issued tax-free bonds

Select public sector companies and firms focused on funding power, housing and road infrastructure projects among other key activities were allowed to roll out tax-free bonds from 2014-2015 onwards. Since these were developmental projects, the government gave the incentive to these companies for raising funds via bonds where the interest received wouldn’t be taxed. These bonds were issued for time frames ranging from 10 to 20 years.

Prominently, REC (Rural Electrification Corporation), NHAI (National Highways Authority of India), NABARD (National Bank for Agriculture and Rural Development) and IREDA (India Renewable Energy Development Agency), IRFC (Indian Railway Finance Corporation), HUDCO (Housing and Urban Development Corporation), among a few others, were allowed to issue tax-free bonds.

But over the past several years, tax free bonds have not been issued. The available bonds in the category are traded on the exchanges.

Bonds traded in the exchanges

Tax-free bonds issued in the past are traded in the exchanges, BSE and NSE. The volumes aren’t very high — a few lakh rupees worth of bonds are traded usually. But most of the tax-free bonds that we have mentioned are traded daily, with volumes spurting once in a while.

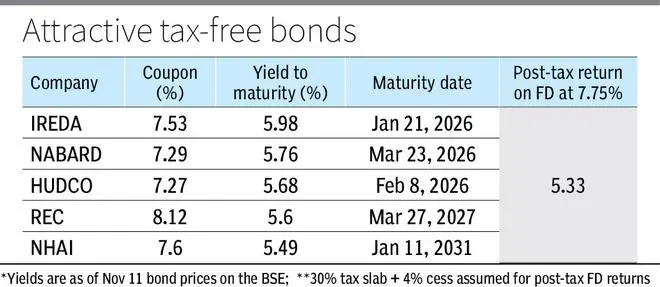

But yields have become highly attractive. There are tax-free bonds available with yields of 5.5-6 per cent. These are 15-65 basis points higher than what investors in the 30 per cent slab would get from fixed deposits on a post-tax basis.

One critical point to understand here is that the coupon rates (see table) and yields are different. Coupon rate is the interest paid on the face value of the bond, usually on ₹1,000. The yield is the return you would get if you bought the bond now and held it till its maturity. Buying it at a different price or selling it before maturity will alter the yield significantly.

Also, higher yields hold for investments of up to ₹10 lakh. If you invest more than ₹10 lakh, the coupon rate is reduced by 10-25 basis points in certain cases. You can restrict your investment to less than ₹10 lakh to make the most of it.

Is it safe to invest in these bonds?

These bonds are issued by government companies that are ‘Miniratnas’ involved in funding developmental projects. All of them are rated AAA by at least one of the three prominent credit rating agencies – CRISIL, ICRA and CARE.

There is also the government’s implicit backing in place. Therefore, these bonds carry very low credit risk. None of these firms has ever defaulted on interest or principal payments to bond investors.

The net non-performing assets (NPAs) of these companies are at 1-3 per cent. This appears to be largely under control. The risk of default on these bonds is very low.

Bonds that investors can consider

We have taken a set of bonds that are usually traded daily and can give yields of 5.5 per cent or higher when held till maturity from the current levels.

The tax-free bonds of HUDCO, NHAI, HUDCO, REC and IREDA are among the attractive options to consider. The residual maturity or the time left for these bonds to mature ranged from 3 to 8 years.

The yields are better than the post-tax returns investors would get from taxable bonds and deposits.

Investors not wishing to lock in their amounts for very long periods can consider bonds maturing over the next 3-4 years. The same company has issued multiple series of bonds. We have taken a few bonds that offer 5 per cent or higher yields.

Currently from banks and non-banking financial companies a 7.75 per cent interest is among the highest. What investors in the 31.4 per cent or 42.7 per cent tax slab would get post-tax would be 5.33 per cent and 4.44 per cent, respectively. That is much lower than the 5.5-6 per cent yields in tax-free bonds.

Investors can consider parking a portion of their debt portfolio in such bonds and restrict exposure to less than ₹10 lakh so that they don’t end up with lower coupons.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.