Renting out a property is a service and it is hence under the purview of the Goods and Services Tax (GST). So far, units used for residential purposes were fully exempt from GST and taxes were only applicable for units used for commercial purpose. But, the recent GST council meeting (held on July 13, 2022) decided to withdraw the exemption for residential units and introduce a reverse charge mechanism. A GST registered tenant will now have to pay 18 per cent taxes, even for residential units.

Key change

The proposed change, which is effective from July 18, 2022, requires that when a residential unit is given on rent to a GST registered person, it is subject to GST at 18 percent rate. The new rule brings residential units rented out as residence to GST registered tenant on par with those leased for commercial purposes.

Also, unlike in the past, the rule applies regardless of the GST registration status of the owner and is only based on that of the tenant. The onus of paying the dues rests with the tenant. The tenant has to do self-invoicing for the rent that was paid and ensure GST payment and filing is completed by the due date. They can claim Input Tax Credit (ITC) on the payment made. The owner has no impact from the new rule.

The change affects anyone who is required to be registered for GST and has taken a residential unit on rent. This includes service providers whose annual turnover exceeds ₹20 lakh in a financial year and businesses that supply goods with annual turnover of over ₹40 lakh.

Different cases

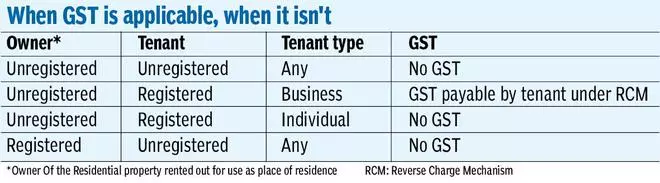

It is helpful to look at a few scenarios to better illustrate how the new rule works. First, consider the cases from the owners’ perspective. If the owner is a registered entity (individual or a company) who is renting out a residential property to an unregistered person, the rent will be exempt, even under the new rule. However, if it is let out to a registered entity (person or company), the new rule applies. The tenant is liable to pay the 18 per cent GST.

If the owner is an unregistered entity who has given the place on rent to a registered entity (say for use as a place of residence for one of its employees), there will be an impact from the new law. From being exempt earlier, the registered entity that has leased the place will pay 18 percent GST. But, instead of renting it to a company for use by employee, say it was taken on rent directly by the employee; in this case, the new law has no effect, as the tenant would be an unregistered entity.

Note that if the tenant is registered, it does not automatically mean GST is applicable. For instance, if the purpose of the rental is personal use rather than for business, there is no GST that is due, even if the tenant is registered.

Restating the same from the tenant’s perspective, there are two cases to consider. If the tenant is registered for GST and the lease is through the business (even if used as a place of residence), GST is applicable on the rent. If the tenant is registered for GST but renting for personal use or if the tenant is not registered, there is no GST applicable, clarifies Natasha Jhaver, Chartered Accountant, G N Law Associates.

What it means?

The change will impact companies that lease residential units for use as guest houses or employee accommodation. As they are now required to pay GST and claim input tax credit on the payment, some may rethink if offering this benefit is worth the hassle.

The net tax to the Government may be zero or minimal as tenants can claim ITC on the payment made. But, including residential units under the ambit of GST – albeit in a very limited sense with the change now – could be signaling an intent to cast the tax net even wider. For example, say the occupant uses the home as a place of work (work from home option), or a consultant with their home address as registered office. While the current change does not impact these cases, tenants may need to watch the moves of the GST council in the future.

For owners, while the change does not impact them directly, they are likely to face pushbacks from tenants. They may negotiate with the owner to bear part of the burden by reducing the rent, if they cannot claim ITC. They may also redo the lease in the name of an unregistered entity (or individual) or choose to vacate. For example, when the tenant is a proprietorship firm who has taken it as personal residence, the GST paid cannot be claimed under Input Tax Credit as it is not a business expense. A better choice would be to transfer the lease in the name of the individual to avoid GST liability.

The author is an independent financial consultant

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.