Investors looking for a low-risk fixed income options can consider bank deposits given the current high rates on offer. More so in the current circumstances as interest rates have reached attractive levels and are possibly close to their peak. The Reserve Bank’s stance of going easy with interest rates in its most recent policy has resulted in bond yields falling significantly over the last few weeks.

Small finance banks generally offer better rates than the regular large public and private sector banks, especially regarding special tenor deposits.

Equitas Small Finance Bank offers competitive rates on its 888-day deposit with senior citizens receiving an even better deal compared to most of its competitors. Here’s what you must know about the bank’s deposit offering before parking your money.

Upping the ante on rates

Among the various options , Equitas Small Finance Bank’s 888-day tenor tops the chart for investors.

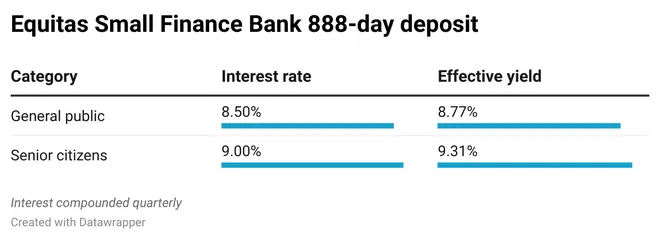

The regular public can avail an interest rate of 8.5 per cent on the 888-day deposit, while senior citizens will receive an additional 50 basis points, resulting in a rate of 9 per cent. These rates are better than what most large public and private sector banks offer for 2-3-year deposits or other special tenors.

For depositors, the interest will be compounded quarterly. Therefore, the effective annual yield for the general public works out to 8.77 per cent, while that for senior citizens it is 9.31 per cent.

As with most deposits, Equitas Small Finance Bank’s deposits come with cumulative (reinvestment), monthly and quarterly interest payout options. In case of monthly payout option, the interest will be discounted on a quarterly compounded basis. Depositors can choose the regular interest payout options in case they require regular cashflows.

Deposits of up to ₹5 lakh are covered by the Deposit Insurance and Credit Guarantee Corporation (DICGC), a division of the Reserve Bank of India (RBI).

Equitas Small Finance Bank allows you to open the fixed deposit online. Your PAN and Aadhaar must be kept handy to make the onboarding process smooth.

Investors can direct a portion of their surplus to these deposits, preferably to meet any specific financial goal. Given that the rates are attractive, conservative investors can lock into this deposit.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.