Conservative investors and retirees tend to prefer fixed-income options with assured returns and a high degree of safety.

The deposits of Sundaram Home Finance are attractive for such categories of investors and rates, especially after their recent revision. These deposits of the Chennai-based lender carry the highest AAA rating with a stable outlook from CRISIL and ICRA and are therefore quite safe in terms of principal and interest servicing.

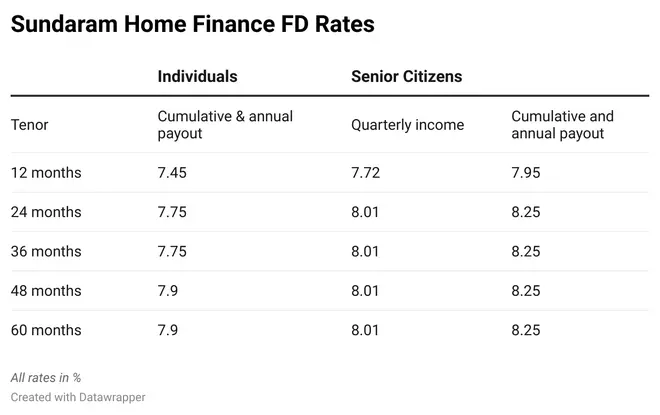

There are cumulative, quarterly and monthly payout options for depositors. While senior citizens get more than 8 per cent interest on deposits with tenors starting from 24 months and going up to 60 months, individuals get up to 7.9 per cent for certain tenors. These are quite attractive rates compared to the current options available for depositors, especially for senior citizens.

Here’s what you must understand about Sundaram Home Finance’s deposits before investing in them.

Also read: Sundaram Home Finance eyes disbursements of over ₹10 crore in small biz loans

Improving financial parameters

The company offers home, plot, and home improvement loans. It also gives loans against property. Housing and non-housing loans are given roughly in the ratio 65:35. This split enables the generation of optimal yields from advances. Key parameters are fairly strong for the company.

- The disbursements in FY23 were quite robust. Total disbursements in FY23 were 3901 crore, which was 68.8 per cent higher than figure in FY22.

- Loans under management for Sundaram Home Finance amounted to Rs 11,181 crore as of March 2023, which was 17.8 per cent higher than the figures for the fiscal 2021-22.

- Profit after tax was up 32.4 per cent YoY in FY23 over the number in FY22.

- The capital adequacy ratio as of March 2023 was 23.5 per cent, a bit lower than the 25.7 per cent it recorded in 2021-22. The capital adequacy is still healthy at this level.

- Stage 3 assets declined from 3 per cent in FY22 to 2.26 per cent in FY22. Stage 3 assets are those that are 90 days past due. Net stage 3 assets fell from 1.57 per cent in FY22 to 1.13 per cent in FY23.

- Return on average net worth increased from 10.44 per cent in FY22 to 12.45 per cent in FY23.

Also read: Housing demand stays intact despite multiple rate hikes: MD, Sundaram Home

Thus, the asset quality is improving significantly for the company. Housing finance focused on the retail segment is relatively safer than a firm that lends to many other avenues. Sundaram Home Finance’s key metrics are improving steadily.

What must investors do?

The deposits are attractive at higher tenors of 48 months and 60 months for both individuals and senior citizens. For individuals looking to invest in a relatively safe option over these tenors, it may be advisable to choose these tenors are rates elsewhere are better for lower tenors. The cumulative and annual interest options are suitable.

For senior citizens, rates in excess of 8 per cent interest rate are available on 24, 36, 48, and 60-month tenors – 8.25 per cent for the cumulative and annual payout options and 8.01 per cent for the quarterly interest payout mode.

For senior citizens looking for regular income, the quarterly and annual interest options are attractive enough. There is a monthly payment mode as well, though the rates are lower (7.95 per cent) and are available only for select tenors.

Investors who do not require regular income can lock into the cumulative option.

The minimum investment amount is ₹10,000. TDS would be applicable on interest payments beyond ₹5,000. You will require your PAN and Aadhaar for opening the deposit account with Sundaram Home Finance.

There are small finance banks and select NBFCs that are offering higher rates than these deposits at present. Even so, Sundaram Home Finance deposits with AAA rating and reasonably healthy interest rates can be considered.

Investors can consider parking a small portion of their debt portfolio in these deposits.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.