Galaxy Surfactants is poised on an even keel at the current moment. On one side, the profitability per tonne has dropped sharply, which led to earnings decline in the last three quarters. On the other hand, the demand situation has reported a marked turnaround in Q2FY24. The stock, currently trading at 26 times FY25 earnings, is in line with its historical average. However, it is still on the higher side when compared to broader markets.

Given that the demand is looking up, we recommend that investors accumulate the stock on dips, which will provide a better entry point. A turnaround in global consumption and later a movement towards premiumisation will be rewarding for shareholders. After a period of consolidation in the last two years, Galaxy will look for volume-driven growth with higher mix of premium segment.

Daily-use business

Galaxy has a long supply relationship with most of FMCG leaders across India, AMET (Africa, Middle East and Turkey), US and Europe. This provides access to essential demand of daily-use products through established and emerging FMCG players.

Surfactants are chemicals that alter surface tension and act as foaming agents, rinsing, cleaning, detergents or other applications. FMCG industry and more specifically, home and personal care (HPC) segment, is the primary focus of Galaxy. Across oral, skin, hair, cosmetic, home care and toiletries, Galaxy’s portfolio of 210 surfactants perform essential action or other features advertised by the FMCG. For instance, 15-20 per cent of body washes, shower gels and shampoos are composed of surfactants with water accounting for remaining 75 per cent.

The company also has a speciality division (40 per cent of FY23 revenues) that caters to niche and premium products within HPC and which provides a higher margin profile for the company. Performance surfactants division (60 per cent) also has a mix of volume or value-based which allows for higher or lower realisations based on the internal mix.

Bottomed out metrics

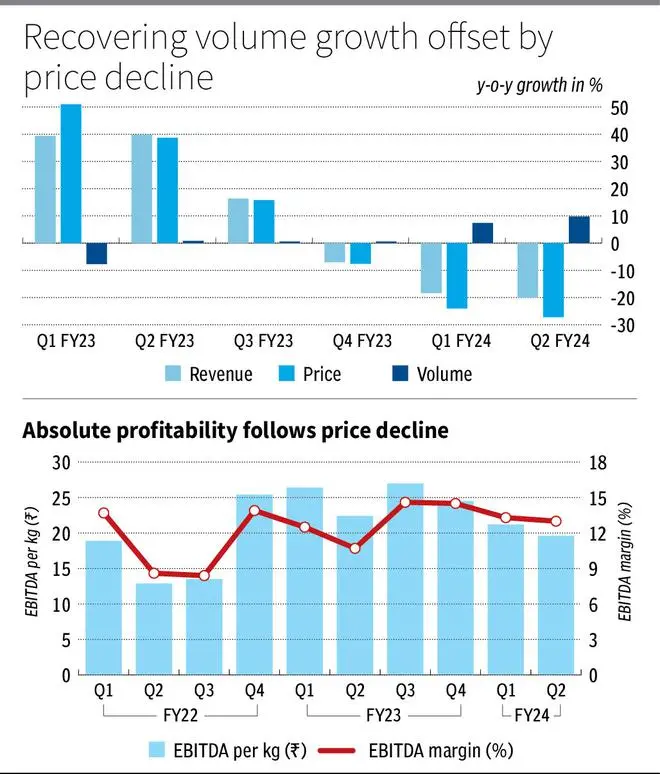

Starting with Covid in 2020, later hyper-inflation in AMET regions, demand slowdown in Europe and now channel destocking in the US, Galaxy faced flat volume growth in the last three years. In Q2FY24, for the first time, all the three segments, India, AMET and RoW markets reported positive growth for a total volume growth of 9.8 per cent YoY.

The company aims to generate 6-8 per cent growth for FY24, which is still low considering the flat volume base of last three years. Europe, facing higher inflation and cost of living, is recovering from an eroded volume base. The US faced channel destocking last year and is also on path of volume recovery. Similarly, Egypt and Turkey, which are major markets for Galaxy in AMET, are normalising the hyper-inflationary environment and demand is expected to return to customary levels soon.

On the pricing front, the company passes on the cost and safeguards its margins, to an extent. The primary raw material is fatty alcohol — an edible oil derivative. The raw material costs inflated to $2,600 per MT in March 2022 and have since retreated to $1,300 levels now. While input prices cooled off, the realisations and hence profitability per tonne for Galaxy at a consolidated level have been coming down in the last 2-3 quarters as the company passed on the benefits. Despite the sharp rise and fall, the company has been relatively better off on the margin front by maintaining the 11-14 per cent range since FY23.

On an absolute basis, EBITDA per tonne has declined 16 per cent YoY to ₹20 per kg in H1FY24. But owing to an improved product mix within speciality and performance segments, this is still above the ₹18 per kg reported in FY22.

India opportunity

Through the volatility in volume growth for other regions, India has steadfastly delivered strong growth for Galaxy, accounting for almost 45 per cent of FY23 revenues. This is aided by Galaxy’s supplies to MNC and domestic leaders in FMCG and tier-2 players who operate at a smaller level. With domestic consumption growth not being affected by inflation or geopolitics, as with other regions, Galaxy’s strong presence in the regions can support its growth. The company will also gain from longer-term trend of premiumisation in Indian FMCG consumption driving its higher margin speciality division.

Financials and valuations

The company reported revenue and earnings growth of -20 per cent/-17 per cent YoY in H1FY24. Volume has returned to positive territory across regions after two-and-a-half years. Price decline, which is tracking RM cost, is expected to stabilise from H2FY24. Galaxy should expect normalised volume growth on a flat pricing. A higher contribution from specialty with the return of premium demand from Europe/US and even India can elevate margin growth over the volume growth in the medium term if economic outlook stays on a recovery path. On a structural footing, with earnings outlook tied to basic consumption growth with a higher focus on India, Galaxy should deliver strong growth.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.