A 700-basis points expansion in operating margins to 17 per cent and a doubling of profits ( to ₹96.35 crore) year-on-year in the quarter ended June 2023 has seen the Jyothy Labs stock move up sharply since end-July, when the results were announced. Until then, the stock was trailing both the Nifty FMCG Index as well the Nifty since the beginning of the year. Uptick in volumes and lower input costs have stood the company in good stead in Q1.

Prospects remain sanguine too, with focus on premiumisation on one end and strategy to improve penetration/volumes through LUPs (low unit price packs) and wider distribution network on the other. While most FMCG stocks are per se not cheap, Jyothy being a smaller player is at a good discount to the behemoths. It currently trades at around 40 times its trailing 12-month earnings, vs the 55-62 times of peers such as Marico, Dabur, Godrej Consumer and Hindustan Unilever. Investors can accumulate the Jyothy Labs stock on dips due to broader market volatility.

Strong recovery

Compared to a 3 per cent volume growth for the whole of FY23, Jyothy’s volumes grew by 9 per cent in the June 2023 quarter. Lower input costs and improved demand across its segments helped.

After growing revenues at 15 per cent in Q1 to ₹686 crore, the company expects to continue the double-digit momentum for the rest of FY24. This will be predominantly driven by an improvement in direct reach as well as volumes and supported by branding/advertising initiatives, according to the company. It currently has a direct reach of 1.1 million outlets. Jyothy added about 1 lakh outlets in the last year and expects to continue to do so at least for the next two years. 80 per cent of its business comes from general trade and the rest from modern trade, e- commerce, CSD and others. Jyothy derives about 40 per cent of volumes from rural areas.

The recovery seen in Jyothy’s performance is reflected in the data from NIQ (formerly NielsenIQ) on the Indian FMCG market released recently. In value terms, the market grew 12.2 per cent year-on-year in April -June 2023, with a 7.5 per cent underlying volume growth. This is the highest value as well as volume growth in the last 5 quarters. Rural volumes grew 4 per cent in Q1, as against the 2.4 per cent fall in Q1FY23. The monsoon trajectory and a comeback in inflation remain risks to demand.

However, the company has enough elbow room to increase ad spends to push volumes. Advertising expenses as a percentage of sales now constitute 7-8 per cent for the company. Besides, its presence in various price points in its key categories such as fabric care and dishwash can provide some cushion if customers downtrade. If input prices remain benign, this may help too. FMCG players are already wooing customers with price cuts and higher grammage, thanks to the current cooling off.

Growth strategy

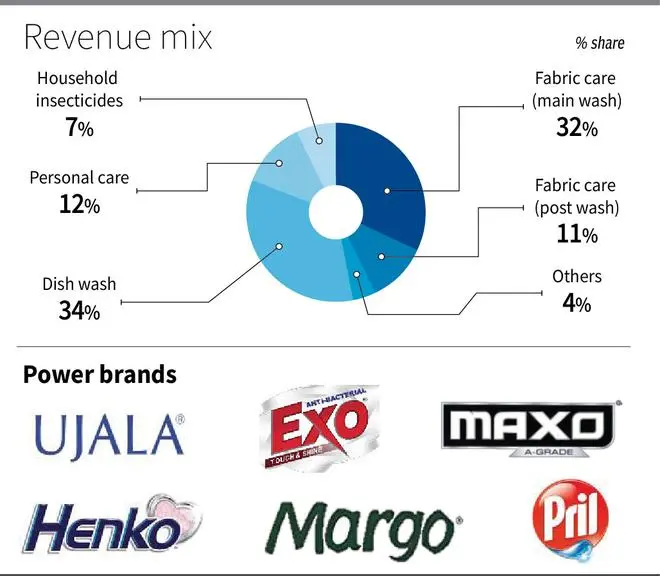

Jyothy operates mainly in the fabric care (Ujala, Henko), dishwash (Exo, Pril), personal care (Fa, Margo) and household insecticides (Maxo) segments. Fabric care and dishwash are the major ones, together bringing 77 per cent of the revenues. The company is adopting a three-pronged strategy for growth focused on pemiumisation, LUPs as well as underpenetrated segments.

Accordingly, with categories such as fabric care being crowded spaces, it is looking at post wash care as well as liquid detergent under the Ujala brand, for the next leg of growth. Ujala Crisp and Shine (post wash), first introduced in Kerala and Tamil Nadu, is now available in Andhra and Telangana as well. Ujala liquid detergent is available in 4 States. Similarly, liquid detergent under its premium Henko brand was launched last year. Pril Tamarind is another example of a premium variant introduced in recent times. Company launched LUPs of Henko, Exo and Pril to improve penetration especially in rural segments and help conversion from mass and mid segment brands. LUPs of ₹5, ₹10 and ₹20 (bridge pack) constitute 25-30 per cent of volumes for the company. In the household insecticides segment, often impacted due to either seasonality or the rampant availability of illegal incense sticks , the company is focusing on liquid vapourisers to drive growth rather than coils. The ratio of coils to liquids stand at 60:40 currently.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.