During the last week, bellwether indices Nifty 50 and Sensex rose 1.95 per cent and 1.84 per cent, respectively, driven by an improved inflation outlook in the US. The rally seen has been a broad-based one ex, except for Bankex, nearly all sectoral indices gained during the week, of which BSE IT (5 per cent), BSE Realty (4.8 per cent), and BSE Teck (4.2 per cent) have been major gainers.

In this column, we spotlight the three best-performing stocks every week. Last week, the three stocks that gained the most in the BSE 500 linked to some fundamental news were Tata Investment Corporation Ltd, Motilal Oswal Financial Services, and Varroc Engineering.

Tata Investment Corporation Ltd

The stock of Tata Investment Corporation Ltd gained around 22 per cent during last week, led by a 20 per cent single-day gain on Friday. While there was no significant news relating to the company, sentiment appears to have been buoyed by the upcoming IPO of Tata Technologies, in which the company has a small stake. The company holds stakes in other Tata Group companies as well.

The stock is trading at a P/B of 0.84 times.

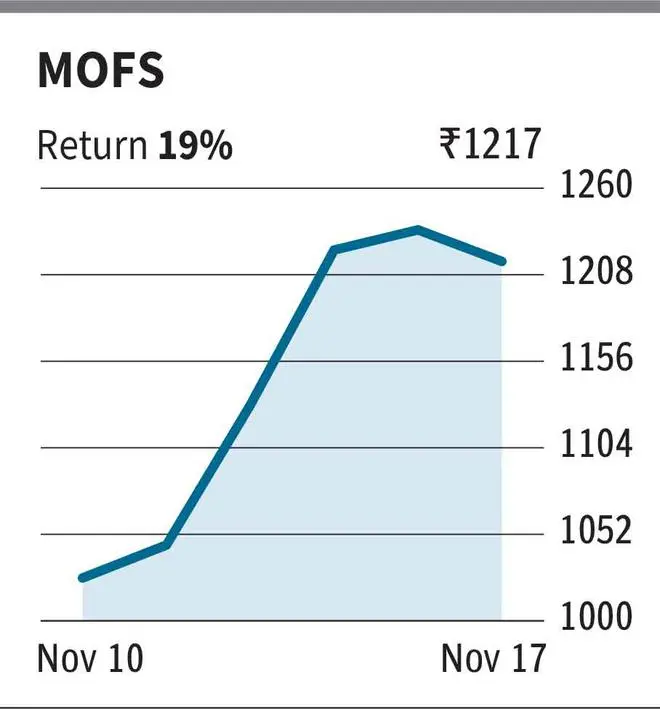

Motilal Oswal Financial Services Ltd (MOFSL)

The stock of MOFSL rose around 19 per cent last week on the back of strong Q2 FY24 results.

The company’s revenue jumped around 30 per cent on a YoY basis during Q2FY24. The company’s capital market business showed strong performance, reporting an all-time high quarterly profit and strengthening the retail market share position in the cash and F&O segments to 7.1 per cent and 7.5 per cent, respectively.

MOFSL stock is trading at a trailing P/E of 12.42 times.

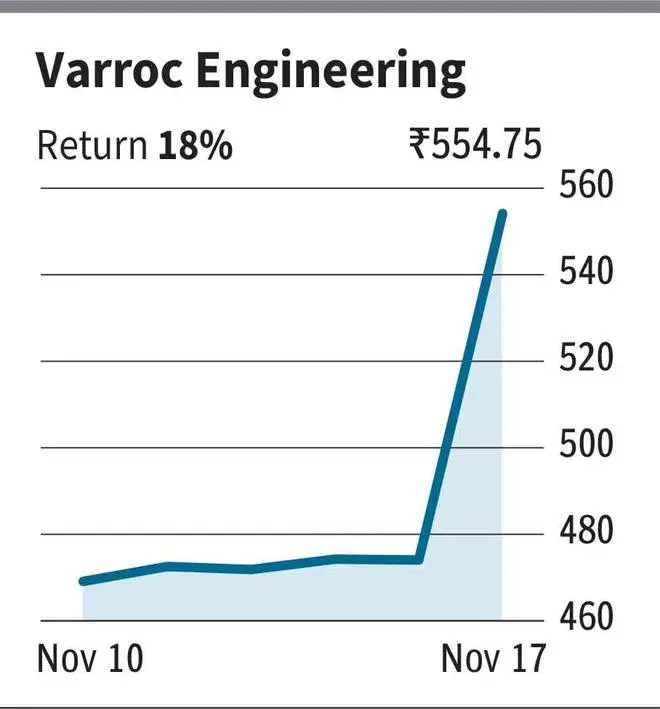

Varroc Engineering

Varroc Engineering’s stock shot up by around 18 per cent last week, driven by better-than-expected Q2 earnings.

The company grew its revenues by 3 per cent on a YoY basis despite sluggish growth in some of its overseas markets due to the holiday season in Europe. The financial and operational performance saw operational improvement in H1 FY2024. The balance sheet further strengthened as the company took debt reduction initiatives in Q2 and reduced its net debt significantly by over Rs 271 crore in H1 FY24, bringing its Net Debt/Equity ratio to below 1X.

The stock is trading at a trailing P/E of 57 times.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.