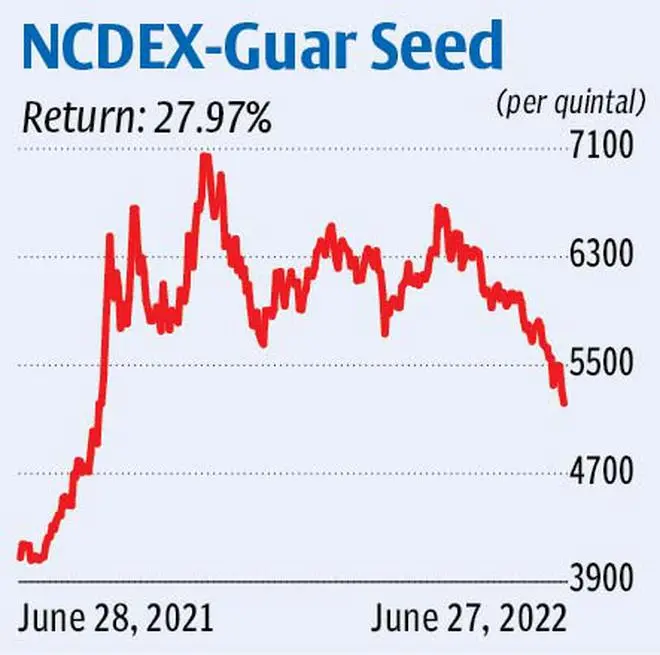

The price of guar seed has been on a decline since early April. Consequently, the continuous contract of guar seed futures on the National Commodities and Derivatives Exchange (NCDEX) started to decline from about ₹6,700.

As the downtrend extended, the contract breached a key support at ₹5,500 a week ago. It has been trading below this level since then. This has turned the near-term outlook bearish for the contract and as a result more decline is highly likely.

Although ₹5,000 can offer some support, given the current momentum, the contract is expected to decline to ₹4,700– nearest notable support– in two-three months. Subsequent support is at ₹4,570.

Nevertheless, the contract might retest the support-turned-resistance level of ₹5,500 before falling below ₹5,000. So, traders can plan the trades accordingly.

Based on our analysis, we recommend initiating fresh short positions at the current level of ₹5,230 and add more short positions when the futures move up to ₹5,400. Initial stop-loss can be placed at ₹5,600. Revise this down to ₹5,300 when the contract decisively falls below ₹5,000.

When price touches ₹4,700 liquidate 80 per cent of the total shorts and tighten the stop-loss to ₹4,900. Exit the leftover short positions at ₹4,570.

There are high chances for a corrective rally after the contract falls to ₹4,570. Such a rally can lift back the contract to ₹5,000.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.