In May 2020, amidst a global pandemic which fundamentally altered the functioning of several companies, Bengaluru-based Wipro, India’s fourth largest IT services company, named Thierry Delaporte as its new CEO and MD. Unlike many of its peers such as TCS, Infosys, HCL Technologies, whose leadership was mostly Indian and based out of the country, Wipro, like it had done several times in the past, broke the industry mould to name a Frenchman as its new CEO. Also, the new CEO would be based in Paris even as the bulk of his workforce continues to be in India.

Delaporte took over Wipro at a time when the company was in a bit of flux. Less than a year earlier, Azim Premji had stepped down as Executive Chairman, to make way for son Rishad, after steering the once vegetable oil manufacturer to become one of the premier global IT firms in his 53 years at the helm. Over the last decade, Wipro had seen four CEOs before Delaporte’s ascension. As early as FY 2002, Infosys had overtaken it in terms of growth and revenue, and in FY 2019, HCL had taken away Wipro’s crown as the third largest India-headquartered IT service provider.

Cheers from Market

With Delaporte’s hiring, Wipro became the second India-HQ company to hire a senior Capgemini executive after Infosys had earlier hired Salil Parekh, another alumnus from the France-based company. The market immediately cheered Delaporte’s choice with Wipro’s shares rising around 6 per cent on the day he was named as the new CEO. With the relatively young Rishad lending ownership stability at the top, and Delaporte’s successful track record, much was expected.

In the first four quarters, much of the market expectations were largely met with Wipro getting back to double-digit growth after several years.

To be sure, this was boosted by industry tailwinds, provided by an enormous spurt in demand for digitalisation as large parts of the physical economy were shut during the pandemic. Wipro, like other IT services companies, benefited during this time. However, since then, things have started looking challenging for the company as its growth has slowed down relative to its peers. Analysts say, Wipro’s turnaround story is faltering as its consulting business and weakness in the Capco acquisition play spoilsport.

Immediately after taking over as CEO, Delaporte had outlined his game plan to get Wipro back to speed. This included simplifying the organisational structure, aiming at more acquisitions, focusing on large deal wins, and shifting the majority focus to the lucrative US and Europe markets.

As part of that strategy, he formed a large deal-focused team and oversaw Wipro’s largest-ever acquisition of Capco for $1.5 billion. Unlike its larger peers like TCS and Infosys, the BFSI segment had been a weak link in its offering. Capco was meant to address that apart from strengthening its consulting and business transformation offerings. But that bet has not yet fully paid off.

With the pandemic waning, deal sizes also have become smaller as enterprises hunker down into survival mode as the global economy slows down. Wipro’s struggle to reignite its profit and growth mojo can be seen in numbers.

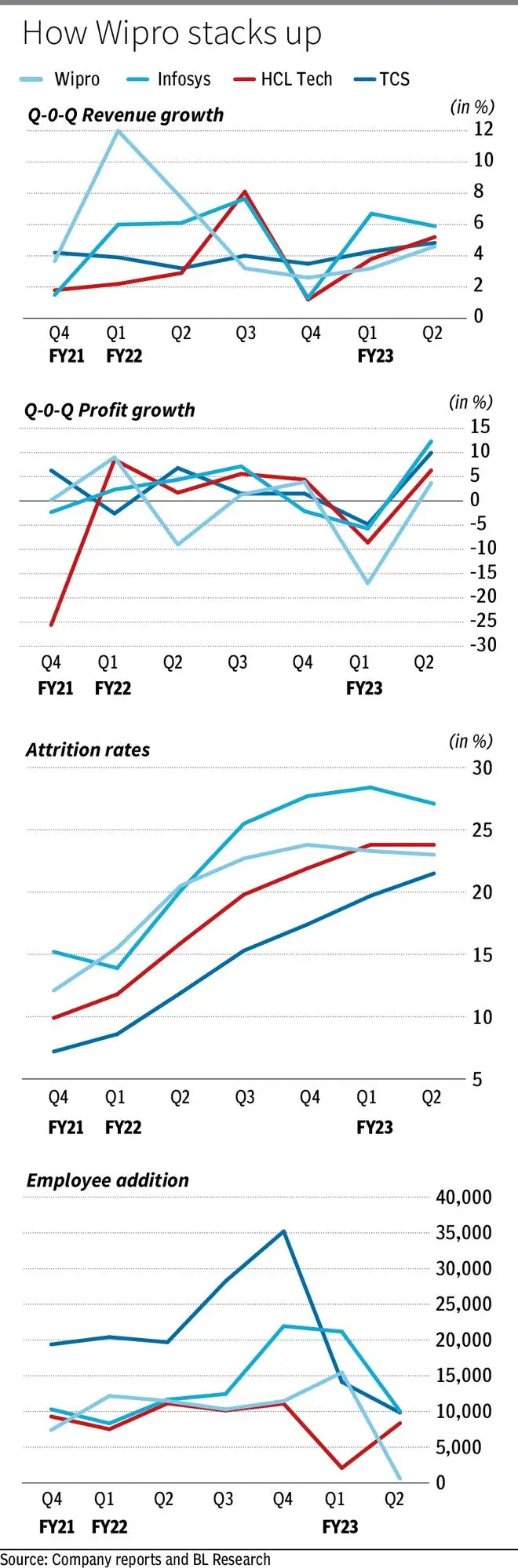

In comparison with its peers, Wipro underperformed for the quarter that ended September 30. While quarter-on-quarter (q-o-q) revenue growth for TCS was 4.83 per cent, Infosys – 5.9 per cent, HCL – 5.2 per cent, Wipro’s stood at 4.6 per cent, below the street expectations. In terms of profits, Wipro posted 3.7 per cent q-o-q growth while Infosys’ was 12.3 per cent, TCS – 9.93 per cent and HCL – 6.3 per cent.

Even on a y-o-y basis, Wipro’s numbers were lower than its peers. The same trend tracks back to the earlier two quarters as well. However, Wipro has managed to rein in attrition rates better than its peers as it has seen moderation for three quarters in a row. That being said, its employee addition for Q2 was the lowest at 605 while Infosys added 10,032, TCS – 9,840 and HCL – 8,359.

Sluggish growth

Analysts believe Wipro’s growth has become sluggish due to a slew of reasons. Brokerage firm Ambit Capital in a report said, “Wipro’s turnaround story is faltering because of various factors such as Wipro’s organic growth normalising to around 1-3 per cent on QoQ basis over the last four quarters and its large deal wins are sluggish.”

Omkar Tanksale, Research Analyst, Axis Securities, told businessline, “Wipro is not at par with its peers because it is lacking in converting the huge demand into their pipeline. Delaporte’s leadership is lagging in capitalising on the demand.” He also blames Wipro’s lack of execution, which he thinks its peer TCS has been better at even in a cautious environment given the probable slowdown in US and European markets.

Its consulting business and its biggest acquisition made under Delaporte are also to blame for the sluggish growth. Wealth management firm KR Choksey in a report said, “With the consulting business slowing down, the risk to profitability continues to rise due to a weakness in Capco and may force Wipro to choose between scaling up the vertical and margin. Europe margin has been volatile and declined materially, partly on account of acquisitions. Similar trends have been witnessed in APMEA margins too.”

Mitul Shah, Head of Research at Reliance Securities told businessline, “Wipro has fared lower than its peers in historic valuation as well. Reasons for the same are its management style, slightly different business profile and lower margin profile.” Of late, its acquisitions are also taking a toll on the growth momentum. Turning an acquisition successful is a challenge in the current market environment. However, the Capco acquisition is helping in terms of incremental revenue and profitability, he adds.

Going forward, the outlook for Q3 as well remains sluggish. Motilal Oswal in its report writes, “We were disappointed by Wipro’s weak 3QFY23 revenue growth guidance. While the management blamed this on macro uncertainty and geopolitical issues, it said that it has started to see a slowdown in the consulting business, although the same was partially compensated by cross-selling in services.” We remain concerned given the vulnerability of consulting due to its early cycle nature. Moreover, the low employee addition in 2QFY23 also adds to near-term growth concerns, it added.

KR Choksey in its report suggests Wipro address the gaps in its portfolio. “Wipro has several gaps in portfolio that require both organic and inorganic investments to deliver at par with its Tier I peers. M&A as a key part of growth strategy, and inorganic growth play as a margin dilutive tool in the near term,” it said.

Wipro’s scrip too has been on a declining trend. Trading at ₹412.35 on the NSE, it is down by 42.63 per cent year-to-date (y-t-d). In comparison, Infosys is down by 13.56 per cent y-t-d, TCS down by 9.97 per cent y-t-d and HCL down by 14.04 per cent y-t-d. The broader Nifty IT index is down by 14.12 per cent y-t-d.

The other point of concern about Wipro has been the recent multiple senior-level exits. Its Australia head Sarah Adam-George, Brazil head Douglas Silva, Japan head Tomoaki Takeuchi, and Middle East head Mohammed Areff have quit the company. Its general counsel and chief risk officer Deepak Acharya has also quit. Post the exits, Wipro has made multiple new appointments. In November it appointed Frederic Abecassis as BFSI head for Southeast Asia and Christopher Smith as MD of Australia and New Zealand.

Axis’ Tanksale says the organisational rejig would take time to show its effects on the company’s performance. “The new heads would require time to understand and streamline the company’s portfolio. Hence, it would take at least one to two quarters for them to deliver and there wouldn’t be an immediate impact in Q3 due to the change in leadership,” he said.

Troubled waters

A senior executive of a large IT firm, who did not want to be identified says, “He (Delaporte) has made some progress, but changing course of such a large ship is not an easy task. Also, there are some structural issues like their weakness in certain verticals which cannot be easily fixed.”

He also went on to add that, “Making large acquisitions work like that of Capco is a challenge. However, the problem Wipro faces is that, it will have to fix all this even as market sentiment for the sector, which was gung-ho even two quarters ago, has turned. As somebody said it is only when the tide recedes, you know who has been swimming naked. To come to an objective assessment, he needs more time.”

Wipro did not respond to a detailed questionnaire from businessline on the challenges facing the company.

To be sure, Delaporte has made some progress since he took over as the CEO but compared to peers and the broader industry, the turnaround story has run into a few issues. It will be interesting to see how the leadership addresses these challenges.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.