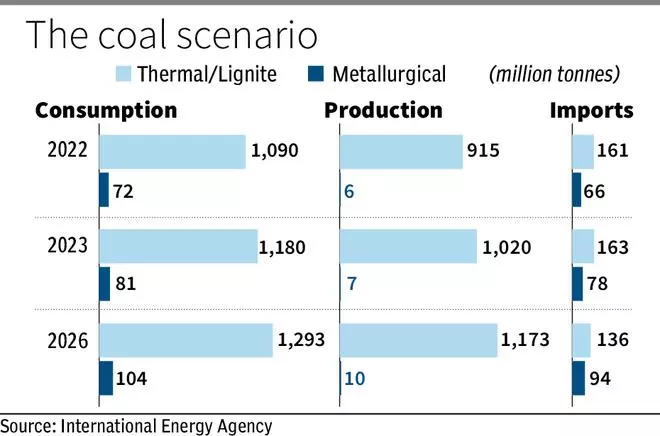

Growing industrialisation leading to higher steel consumption and limited availability of coking coal will aid in India becoming the world’s largest importer of metallurgical coal in 2026, surpassing China.

According to the International Energy Agency (IEA), metallurgical coal imports are expected to increase in 2026 with India accounting for the largest share aided by growing industrialisation.

Global metallurgical (Met) coal trade is expected to increase by almost 2 per cent to 353 million tonnes (MT) in 2026. A decrease of about 28 MT (or 28 per cent compared to 2023) in met coal imports into China is expected to be offset by increasing imports elsewhere, the IEA said.

“Imports into India are expected to increase by 2026, by 16 MT (or 21 per cent), driven by increasing steel production via the blast furnace-basic oxygen furnace route and limited availability of suitable domestic coking coal. Against this background, India will once more become the world’s largest met coal importer,” it added.

Imports in 2023

IEA expects the global metallurgical coal imports to have increased by about 11 per cent y-o-y, to 352 Mt in 2023.

“The increase has been driven by China and India, which are forecast to have significantly increased met coal imports, with China surpassing India to become the largest met coal importer again,” the agency said.

China’s imports are expected to have increased by 56 per cent y-o-y to 100 MT, an all-time high, while India’s imports are expected to have grown by 17 per cent to 78 MT, it added.

Russia’s gain is Australia’s loss

Benefiting from price discounts on Russian coal, India is increasingly replacing Australian met coal with Russian, the IEA pointed out.

“While in 2021 about 65 per cent of India’s met coal imports were of Australian origin, this share decreased to 53 per cent in 2022. During the same period, the share of imports from Russia increased from 5 per cent to 11 per cent. In the first nine months of 2023, Australia’s met coal share was down to 48 per cent, while Russia’s share grew to 18 per cent,” it explained.

IEA expects Russian met coal exports to have increased by 2.2 per cent y-o-y to 51 MT in 2023, although the buyer base for Russian coal has been shrinking.

“Russia exported about 22 per cent of its met coal exports to China and about 9 per cent to India in 2021. These shares more than doubled to 45 per cent and 18 per cent in 2022 and we estimate them to have increased further,” it added

With a respective share of 49 per cent and 26 per cent, China and India accounted for three-quarters of Russia’s overall met coal exports in the first nine months of 2023. Exports to China rose by 37 per cent y-o-y, while exports to India more than doubled, it said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.