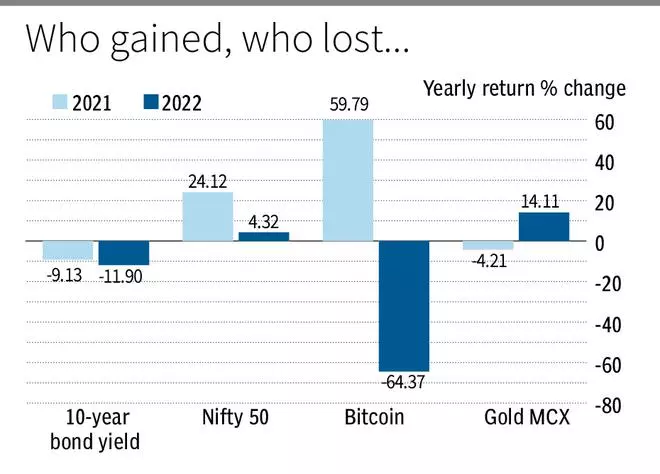

Investors have faced a challenging time in 2022. Since the beginning of the year, India was hit with a third wave of Covid followed by the Russia-Ukraine conflict. Stocks and crypto assets which delivered stellar returns in 2020 and 2021 did a volte face and bond yields continued to rise. Investors who bet on real assets such as gold and real estate would have seen some gains.

Here’s a lowdown on the winners and losers among asset classes in 2022.

Best performer

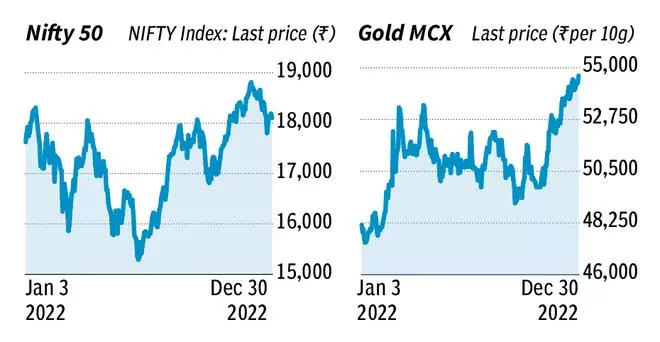

The best performing asset class in 2022 was gold which increased by over 14 per cent on the multi-commodity exchange. Gold prices increased from ₹48,157 for 10 gram towards the beginning of 2022 to ₹54,656 in December 2022. This safe haven is the most sort after asset class during economic or geo-political tensions and is most often used to hedge against inflation and fluctuations in currency.

It, however, needs to be noted that the return on gold in rupee terms gets a leg-up due to rupee depreciation against the dollar. Gold has gained only 0.5-1 per cent in dollar terms as rising global interest rates reduced the allure for global investors.

Given that inflation is likely to remain elevated through a large part of 2023 and with risk of recession in many advanced economies next year, gold is likely to find takers, as a good diversifier next year.

Worst Performer

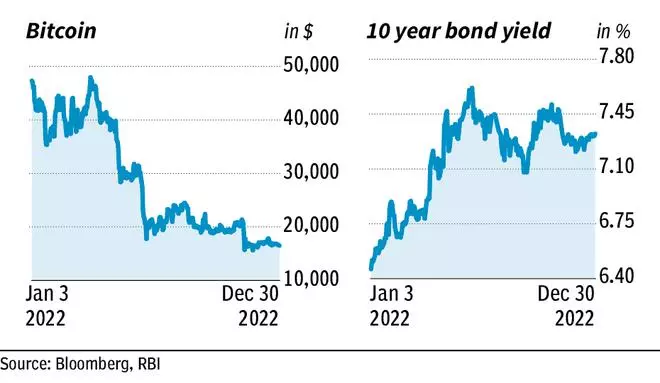

Crypto currencies by far have been the worst performing asset class of 2022. Digital assets have had a rough 2022 with Bitcoin bleeding more than 64 per cent in just a year. Bitcoin, after a stellar performance last year, hitting an all-time high of $64,400 in November 2021, fell to a 2 year low of $16,509 in December 2022. It lost over half a trillion dollars in market cap in 2022.

Increased regulatory clampdown in countries including India and China, reduced global liquidity due to central bank tightening and increased global uncertainties are some reasons for the downfall.

Given that the rally in 2020 and 2021 was driven purely due to speculative fervour and had no fundamental basis, it is unlikely that crypto assets will regain their lofty peaks just yet.

Mellow stock market

There were multiple global headwinds for global markets in 2022, resulting in most global benchmark indices recording steep losses of over 10 per cent. Nifty 50 performed much better than its global peers, managing to gain around 4.33 per cent this year.

It was a volatile year for the Indian benchmark with several ups and downs. Nifty 50 crossed the 18,000 mark several times and was above this level in November 2022. The fear of recession, higher lending rates and the Russia- Ukraine war has kept the market mellow. Nifty 50 performed much better last year, delivering 24 per cent gains in CY21.

With correction in stock prices having begun in December, 2023 is going to be challenging for Indian stocks given mounting global uncertainties. A sideways market is the best-case scenario, against this background.

Bond yields soar

Indian fixed income investors would have gained due to increase in bank deposit and corporate and government bond rates as RBI went on a rate hiking spree to tame inflation. Those holding government bonds would have seen their returns bleed as a large fiscal deficit and rising inflation pushed bond yields upward.

The 10-year Indian government bond yield closed at 7.3 per cent in December 2022, from 6.3 per cent in the beginning of 2022. With the fiscal situation likely to be worrisome and policy rates unlikely to move lower any time soon, not much of a return can be expected from G-secs in 2023 either.

Real estate

Robust demand in residential and commercial real estate in 2022 indicates revival of real estate market in India after two years of lacklustre demand due to the pandemic.

“Global economic sentiments and market volatility haven’t affected the Indian real estate market that much as yet. The pandemic and geopolitical tension in a way had a positive impact on the Indian residential sector. Many analysts believe that the self-sustaining nature of the sector coupled with the growth potential of the Indian economy, optimistic expectations, and upward momentum will persist in the future year. The value of the real estate sector is expected to reach $1 trillion by 2030 (up from $200 billion in 2021), and at that point, it would have contributed 13% of India’s GDP, ” said Mr Sanjay Dutt, MD and CEO, Tata Realty and Infrastructure.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.