The adoption of broadband internet delivered via optical fibre cables, which zoomed in after the Covid-19 pandemic, is continuing its rise. The number of wired broadband subscribers in India stood at 39.4 million as of February 29, 2024, as per Telecom Regulatory Authority of India (TRAI) data.

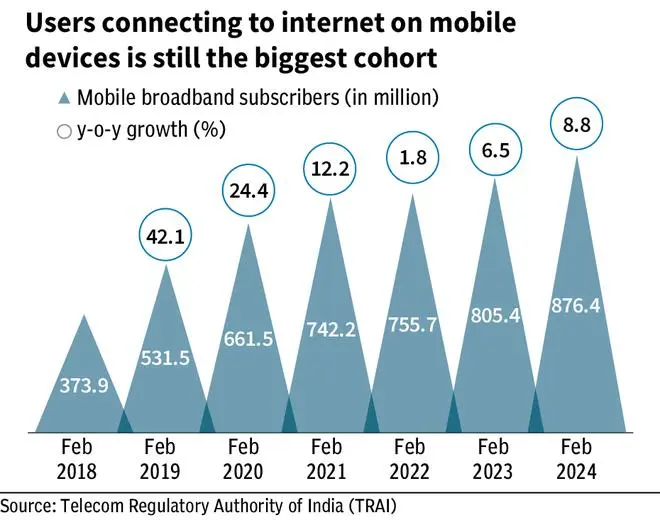

This number is 20 per cent higher than in February 2023. Overall, India’s broadband subscriber base has grown from 392 million in February 2018 to 916 million in February 2024.

Driven by the pandemic and the resulting digitisation boom, the subscriber base recorded year on year growth of 16 per cent in 2021, 19 per cent in 2022 and 23 per cent in 2023. The month-on-month (MoM) growth rates from February 2023 to February 2024 ranged from 1.3-1.7 per cent, slightly lower when compared to the growth range of 2.5-3 per cent MoM growth clocked from 2022 to 2023.

Currently, the internet is delivered via three modes- wired lines, through mobile devices and wireless radio spectrum. The Telecommunications Bill 2023 also allowed for spectrum allocation for satellite-based services without the need to participate in auctions, which could help Airtel’s OneWeb and Elon Musk’s Starlink to provide internet via satellite.

Despite this strong growth in the recent past, the wired broadband penetration in India just touches the 10% mark compared to 80-90% adoption levels in the US, China, and European markets. The proliferation of smartphones has led 95% of the Indian population to connect to the internet via mobile devices.

TRAI data

TRAI data shows that as of February 29, 2024, broadband subscribers via mobile devices (mobile data users) stood at 876 million compared to 39 million on wired lines. Indian users also consumed an average of 24 GB of data per month on mobile devices, as of 2023

.“There was hardly any focus on the fixed wired broadband segment before Covid hit, when internet connections for homes became important. Despite mobile data growth, there is an independent need for optical fibre-based internet for work-from-home, study and entertainment needs of a household,” Vivek Raina, CEO of Excitel Broadband, said. As per Raina, almost 70% of the costs in wired broadband are in the last mile connectivity to customer premises. “This has dissuaded large players from innovation and smaller players from entering the market,” he adds.

Reliance Jio, Bharti Airtel, BSNL and Atria Convergence Technologies (ACT) are the top players in the wired broadband space, as per TRAI data.

Industry think tank Broadband India Forum urged the government earlier this year to consider reduced statutory fees and GST exemption on service revenues for fibre connectivity and W-Fi broadband deployments to help the industry scale up to meet rising demands.

Telcos have been exploring Fixed wireless access (FWA) broadband as an alternative to wired broadband, but it has failed to find takers. FWA involves bringing the internet to homes and other premises using devices that transmit radio frequencies, without the need for optical fibre cables. In terms of adoption, FWA comprises less than 1% of the total broadband subscribers as of February 29, and this segment declined 22% between February 2023 and 2024.