With geographical proximity, cultural affinity, and friendship dating back to the 1970s, India and the United Arab Emirates (UAE) have always had close ties. But the relations have significantly deepened in recent years.

While trade has strengthened following the Russia Ukraine war, a few recent developments across the commerce and cultural spheres have brought a new era in India-UAE relations.

Bi-lateral agreements

Recently, the central banks of the two countries gave permission to use local currencies (rupees and Dirhams) for cross-border transactions including trade, remittance, and investment flows. India’s payment system, UPI, was linked with UAE’s instant payment system Aani in a move likely to benefit over 3.5 million Indians living in the UAE, and travellers between the two countries. India’s Rupay cards can also be used in the UAE.

CEPA

The boost to trade also came from the landmark Comprehensive Economic Partnership Agreement (CEPA) signed between the two nations in February 2022. While UAE is India’s second top export destination after the US, India is UAE’s second largest trading partner after China.

Eyeing bilateral trade of $100 billion in the next five years, CEPA brings cuts in tariff, fast-tracked approvals for business, access to trade zones etc. As a result, trade between India and the UAE touched historic highs going from $72.9 billion in FY22 to $84.5 billion in FY23. During its implementation (May 2022 to Mar 2023), bilateral trade grew 14 per centy-o-y. 90 per cent of India’s exports to UAE now attract zero duty under the FTA with gems and jewellery, pharmaceuticals, food, energy, etc the key beneficiaries.

Ajay Sahai, director general & CEO, Federation of Indian Export Organisations (FIEO), says that the CEPA with UAE is India’s first such agreement with a complimentary economy compared to those in the past with South Korea or Japan. “FTA utilisation is going up and this is further helped by digitisation of issue of certificate of origins (COOs) for exports,” he said. While official data on FTA utilisation is not released, analysts estimate this at over 50 per cent based on the COOs issued.

Fourth largest foreign investor

In FY23, Emirates emerged as the fourth largest foreign investor into India from being in the seventh spot in FY22. $3.3 billion of FDI inflow came from the UAE into India in the said fiscal. Further, UAE’s sovereign fund has been an active participant in Indian stock market; Abu Dhabi Investment Authority (ADIA) holds 22 listed stocks with a net worth of over ₹3,447 crore, as per a December 2023 filing. This is across real estate, infrastructure, logistics, food, and other sectors. Reports also suggest that ADIA is setting up a $4-5 billion fund to invest in India through GIFT City, Gujarat.

Inspired by Saudi Arabia’s success with its Vision Fund, UAE funds ADIA, Mubadala and ADQ have also deployed money in India’s new-age firms. Reliance subsidiaries Jio Platforms and Reliance Retail, Byjus, Greenko, and Lenskart are a few private companies backed by the Emirati investors.

Neelesh Bhatnagar, founder of Dubai-based VC firm NB Ventures, said that the UAE’s innovation push has increased start-up opportunities for Indian entrepreneurs in e-commerce, logistics, EVs, and other areas. NB Ventures has invested in more than 50 start-ups and helps them tap UAE and larger West Asia region.

Cross-border business

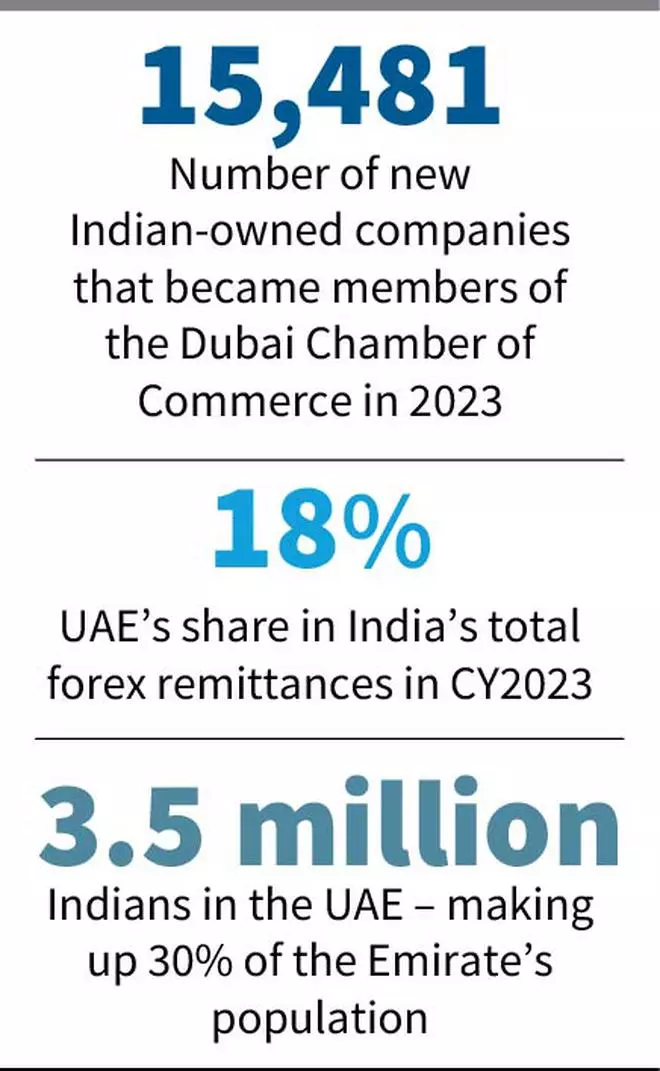

DP World, Sharaf, and Lulu Group are few top UAE companies with presence in India and similarly Indian enterprises like L&T, ONGC, Adani Group, and others also operate in the UAE. Recent data from the Dubai Chamber of Commerce shows that 15,481 new Indian-owned companies became members of the industry body in 2023, a growth of 38 per cent year-on-year.

“UAE’s ease of doing business makes it attractive for Indian companies, especially those looking to expand in Africa and GCC,” Rudra Kumar Pandey, partner, Shardul Amarchand Mangaldas, said.

Demographic affinity

Almost 30 per cent of the UAE’s population are Indians at around 3.5 million. Dubai and Sharjah, in particular, are preferred destinations and are popularly considered as “an India without the everyday hassle.” As the UAE builds a knowledge economy, it has also acknowledged the role of Indian professionals. Many of India’s investors, entrepreneurs, doctors, scientists, creatives and others are beneficiaries of the Golden Visa scheme.

As per a recent World Bank report, the UAE and other GCC nations are major contributors to India’s foreign remittance inflow and the use of local currencies in cross-border transactions will further increase this.

Demonstration of soft power

Leaders of both countries have increasingly demonstrated their new relations on the world stage. PM Modi alone made seven visits to the UAE during his 10-year tenure. In a milestone moment for cultural ties, PM Modi inaugurated a ₹700-crore BAPS temple in Abu Dhabi last month. Built in land gifted by UAE ruler Sheikh Mohamed bin Zayed Al Nahyan, this is the third temple in the UAE but the largest by far in the Middle East, placing UAE among India’s top allies.

Challenges remain

Trade analysts noted that while CEPA is increasing trade, it is yet to pick up in new categories. Moreover, the value add in India’s exports to the UAE is low as they are mostly import-dependent, they added.

“While exports from India to the UAE are on a rise, it’s important to note that imports are also rising,” Ajay Srivastava, founder, Global Trade Research Initiative, says. India’s imports from UAE rose 19% year-on-year in FY23 to end at $53,231 million. “Gems and jewellery, petroleum, and smartphones comprise 60% of India’s exports to the UAE; trade diversification is yet to happen,” he added.

FIEO’s Sahai says value-added jewellery exports are on a rise and the growth in the lab-grown diamonds market will help this increase in coming years. “It takes three to five years for any trade agreement to show results,” said Sahai.

Shardul Amarchand Mangaldas’ Pandey notes that while foreign portfolio investment from the UAE has picked up, FPIs are still constrained by the steep valuation of the Indian stock markets.