As the Southern State of Telangana goes to poll towards the end of this month, the electorate will be taking stock of the performance of the K Chandrasekhar Rao-led government’s performance over the last five years.

- Also read: Rajasthan Election. Trump card or liability?

The government has been focusing more on welfarism and agri-led growth in the last five years, which has been pegging back growth. With revenue not sufficient to meet the welfare expenses, the debt of the State has been piling high.

GSDP trots along

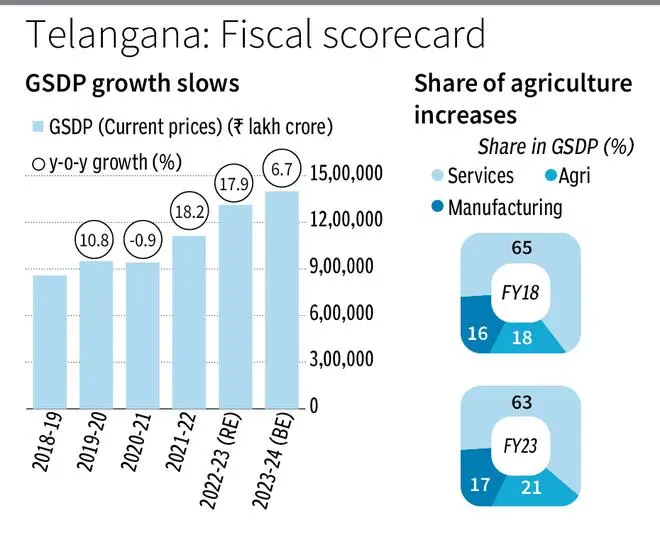

The State’s GSDP is led by the thriving IT and other services sector in the Hyderabad area, which contributes over 60 per cent to the economy. Growing digitisation has helped the State recover well from the Covid-19 pandemic, recording around 18 per cent growth in GSDP in nominal terms in FY22 and FY23. However, growth would be be pulled back to 6.7 per cent in FY24 on overall slowdown in IT sector and drop in inflation.

In the last five years, the government has focused more on agri and allied sectors with its pro-farmer schemes, resulting in agriculture’s contribution to GSDP increasing from 18 per cent in FY18 to 21 per cent in FY23.

Services sector, on the other hand, has seen its share decline from 65 per cent to 63 per cent in the same period.

- Also read: In a first, EC deploys an app to monitor cash, jewellery seizures in election-bound Telangana

A greater focus on services could have helped higher growth.

The residents of the State are, however, fairly wealthy with GSDP per capita clocking annual growth of 9.4 per cent in the last five years.

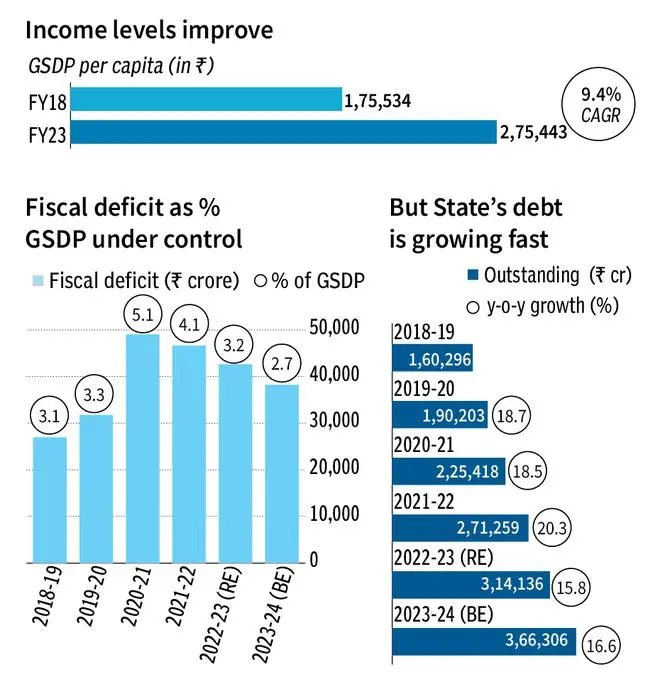

Fiscal burden is masked

The State budget numbers are showing that the fiscal deficit has been brought under control at 2.7 per cent of GSDP in FY24, below the FRBM mandate. The deficit had widened sharply to 5.06 per cent of GSDP in FY21.

But the States’ revenue is insufficient to cover the various welfare schemes unrolled by the government. This is leading to high off-Budget borrowing. Two of its flagship welfare schemes are Rythu Bandhu, which provides farmers ₹5,000 per acre per season to help farm investment and is paid directly to over 55 lakh farmers, and Dalit Bandhu scheme, which provides one-time grant of ₹10 lakh each to Dalit families. The State is hard-pressed to sustain these schemes.

The CAG in its State finance report pointed out that if the off-Budget borrowing of the State were considered, it would lead to debt to GSDP ratio of 38.1 per cent in FY22, which is far higher that the 30 per cent limit mandated by the 15th finance commission. Outstanding State guarantees stood at R₹1.35-lakh crore in FY23, while outstanding debt was ₹3.66-lakh crore.

Other freebies announced in the election year such as loan waiver and interest-free loans to farmers could stress the fisc further.

Numbers too rosy

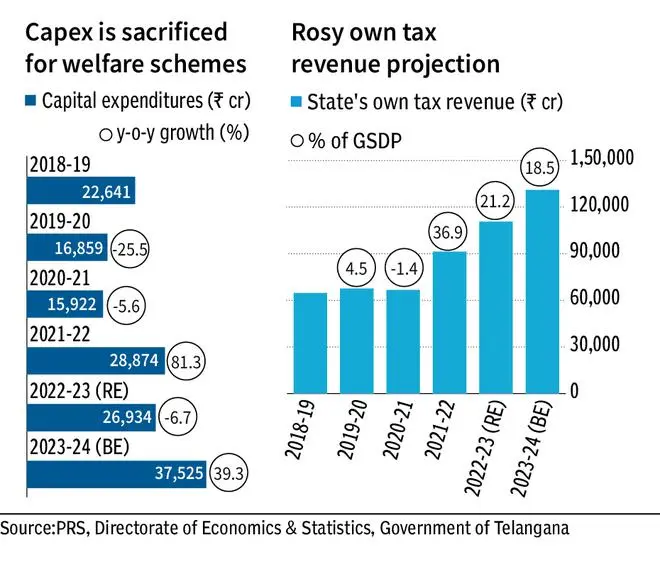

The State has projected capital expenditure of ₹37,525 crore for FY24, though the revised capital investments in FY23 was 7 per cent lower compared with FY21. The higher revenue expenditure on welfarism is leading to reduction in capital investments.

The 2023-24 Budget has also projected an extremely high own tax revenue growth of 18.48 per cent, which appears unattainable given the GSDP growth projected for this fiscal.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.