Retail investors have taken to equities in a big way during the pandemic, entering the stock market through direct investment and mutual funds. While it was expected the number of new investor additions could reduce once the pandemic abates, and people get back to offices, this has not happened.

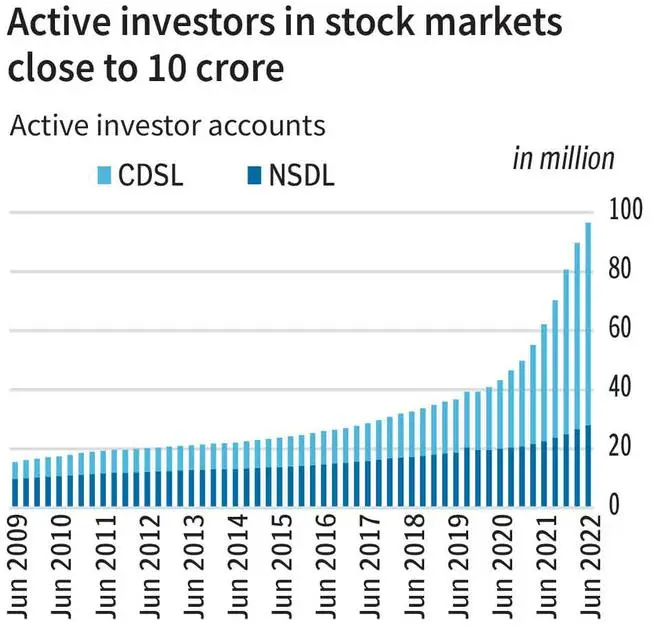

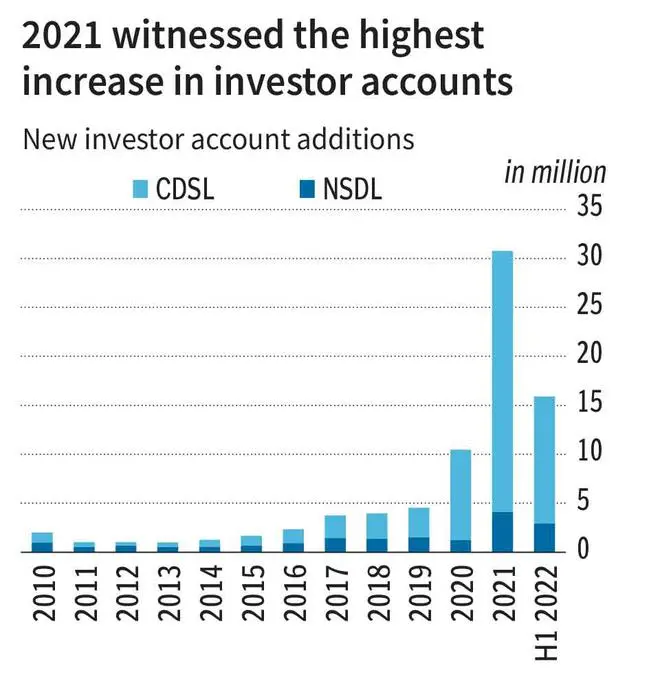

The number of active investors in the stock market has continued to rise and is at an all-time high nearing ten crores. While 2022 has added over 1.5 crore accounts, 2021 saw the highest increase in the last decade, adding over three crore new investor accounts.

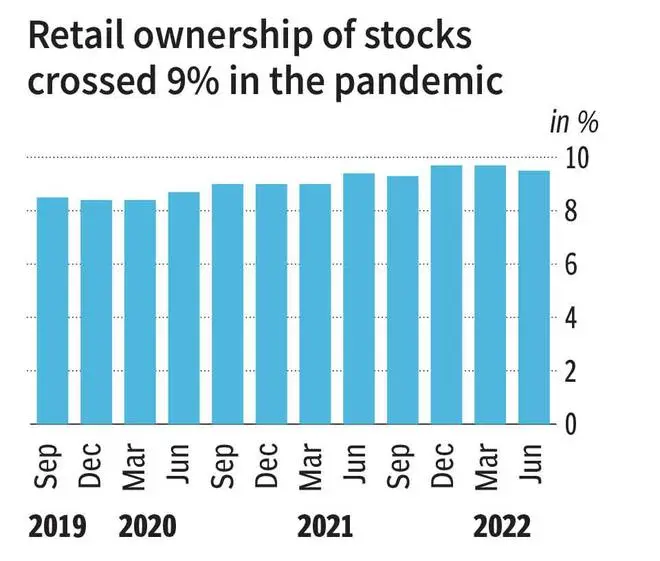

Retail ownership of stocks was below 9 per cent until June 2020 and above 9 per cent from September 2020 to June 2022.

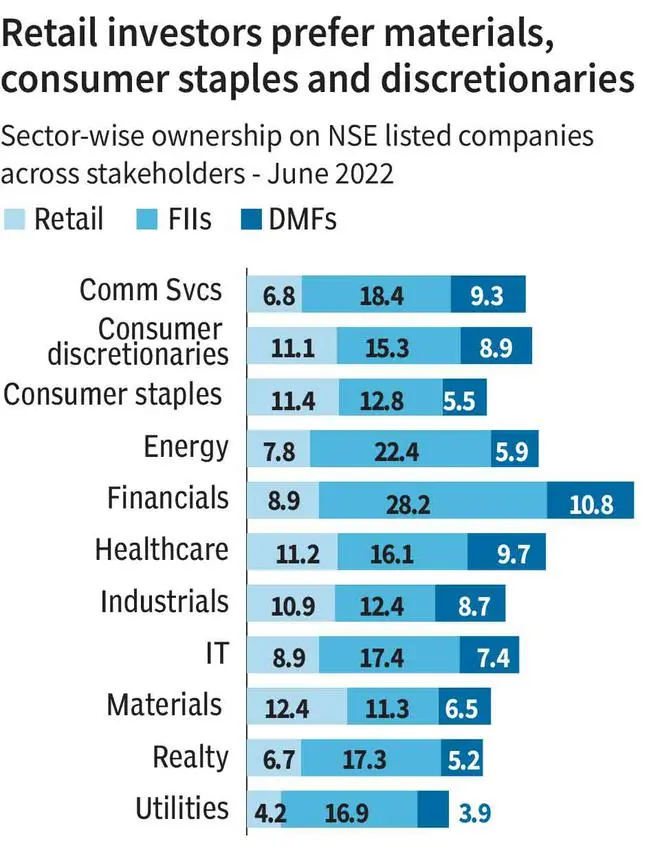

In the sector-wise ownership of NSE-listed companies, retail investors prefer sectors such as materials, where they hold over 12.4 per cent, followed by consumer staples with 11.4 per cent and consumer discretionaries with 11.1 per cent. The sectors with relatively lower retail holding are Utilities with 4.2 per cent, followed by realty with 6.7 per cent.

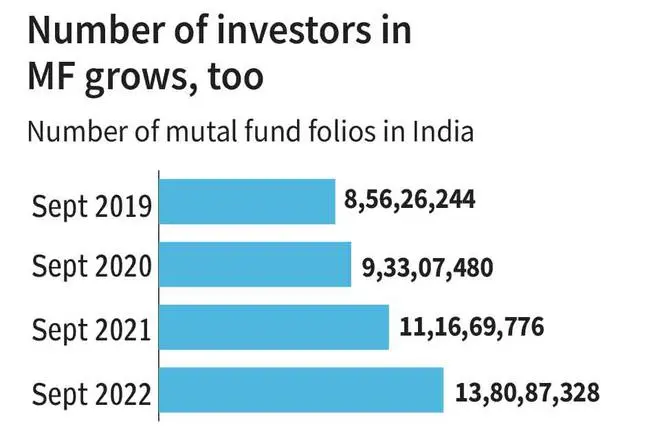

The number of mutual fund investors, too, is increasing. The total number of mutual fund folios in September 2022 has breached 13.8 crores, recording a 23.6 per cent jump since September 2021.

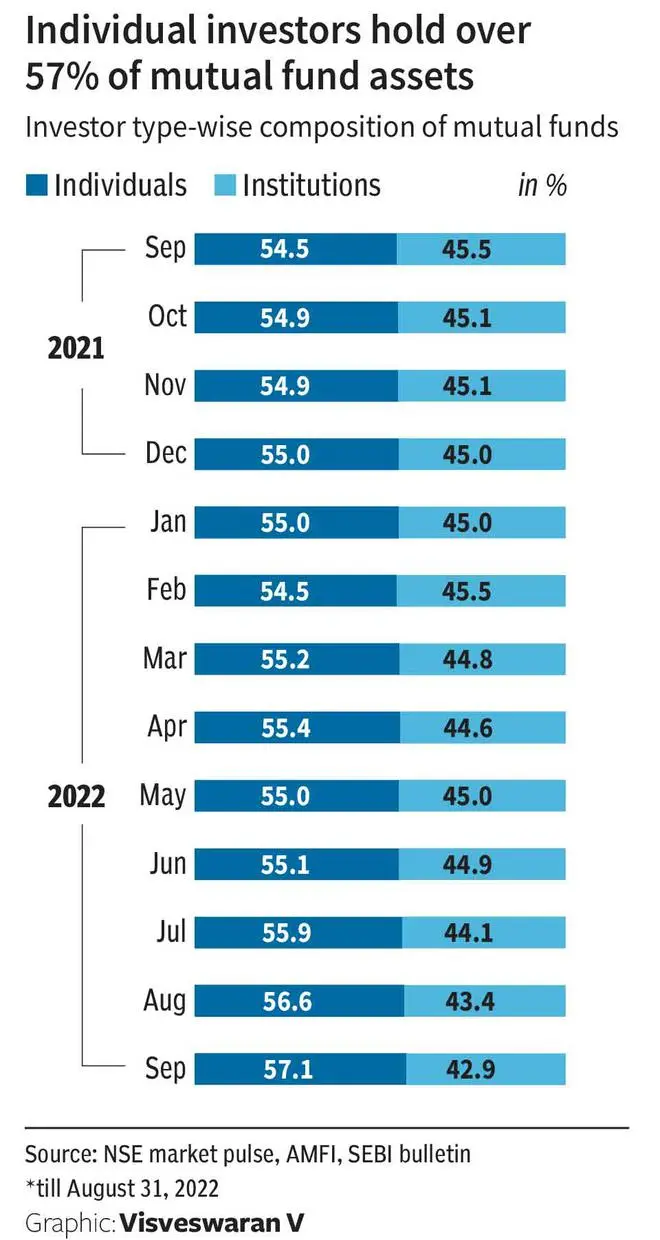

Individual investors’ holding in mutual fund assets has also grown to 57.1 per cent, while the institutions hold 42.9 per cent.

Among cities, Mumbai has the highest turnover in cash segments of BSE and NSE, with 68 per cent of BSE’s turnover and 36.4 per cent of NSE’s turnover. Mumbai is followed by Ahmedabad with 11.1 per cent and 21.3 per cent on BSE and NSE, respectively

Published on October 26, 2022

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.