Backed by a five-year high acreage, India’s cotton production in the coming season (October 2022-September 2023) will likely be around 375 lakh bales (of 170 kg each) but the weather Gods will have to be kind for that to happen.

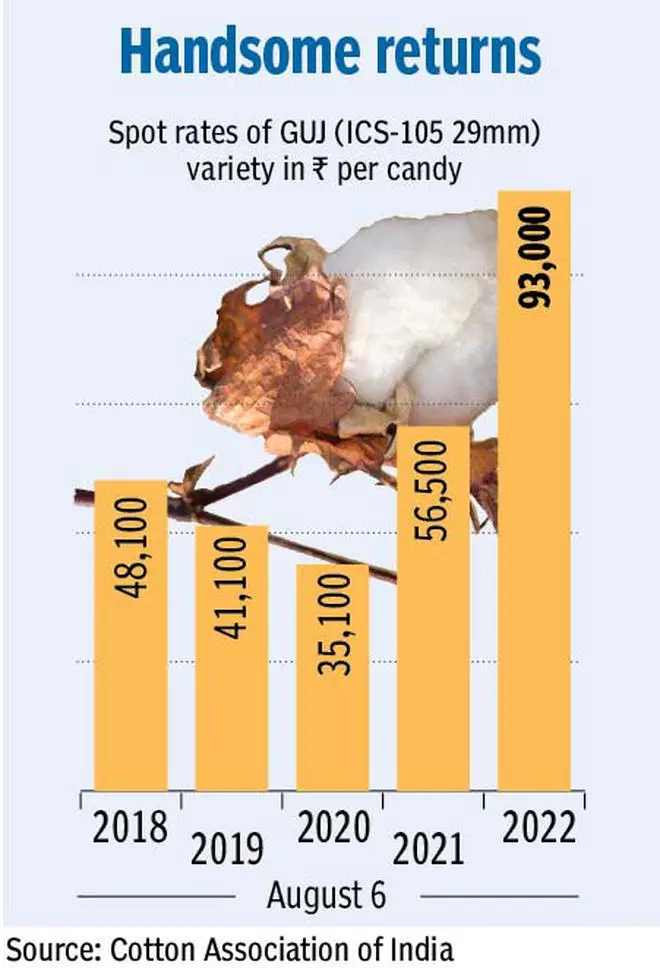

Record prices for kapas (raw cotton) right from the beginning of the current season have attracted more farmers to the natural fibre. Against the minimum support price (MSP) of ₹5,726 a quintal, farmers received as high as ₹12,500 at one time. However, for the most part of the season, prices have hovered around ₹9,000. For the next season, the MSP has been fixed at ₹6,080.

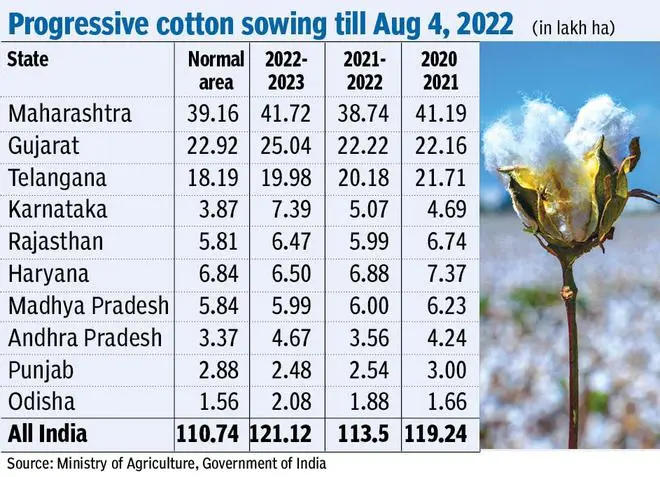

According to Ministry of Agriculture and Farmers’ Welfare data, the area under cotton as of August 5 was 121.13 lakh hectares (lh) compared with 113.51 lh during the same period a year ago.

Unseasonal rains impact

This sets the tone for cotton production to be higher but stakeholders are a little wary of rains during October-November. Last year, unseasonal rains during October-November resulted in the crop being affected and its quality deteriorating. There is a lurking fear of pest attacks, too.

Jagdish Magan, a farmer from Morbi district in Gujarat, has increased his cotton acreage by 1.5 times this year. “We got good returns last year. This year the climate has been supportive so far. And if it remains good throughout, we expect good returns,” he said, adding that he has cultivated cotton on 35 bigha (about 17 acres of land) this year against 20 bigha (about 10 acres) last year.

It is the record high prices of ₹12,500 per quintal that farmers fetched some time this season the reason for their preference for cotton over other crops. Though prices looked like dropping a couple of weeks ago, defaults in imports have resulted in domestic prices heading north again. Currently, prices of Shankar-6, the benchmark variety for exports, are quoted at ₹94,000 a candy (of 356 kg each).

100% higher than MSP

Atul Ganatra, President of the Cotton Association of India (CAI), said: “Cotton prices this season were about 100 per cent higher than the MSP. There is no such crop where farmers will get a price 100 per cent higher than MSP.

“Even though there was a setback to the output, the returns were very high. Farmers got attracted to the high returns,” Ganatra said, adding that the crop appears “fantastic at present,” with a likelihood of a crop size to be about 375-380 lakh bales (each of 170 kg).

“The crop will be higher this year, but there should not be any heavy rain in October like last year. If such a thing recurs, then it could damage production prospects,” said K Venkatachalam, Chief Advisor, Tamilnadu Spinning Mills Association (TASMA).

“The area under cotton should comfortably be above 128 lh. In Gujarat, it will top 25 lh,” said Anand Poppat, a Rajkot-based trade in cotton, yarn and cotton waste.

Damage in Maharashtra

Origo E-mandi said in its outlook that the area under cotton could increase by 4-6 per cent to 125-126 lh in view of the better realisation that farmers got over the last two years.

Initial reports say the crop condition in central, western and southern regions is robust. However, in Maharashtra and parts of the northern States of Punjab, Haryana and Rajasthan there are concerns over some damage following extended moist weather and the appearance of pink bollworm.

Origo E-mandi said about 8.5 lh had been affected due to rains in Maharashtra and the area includes soyabean. The actual report on the rainfall impact was awaited, it said.

Poppat said the damage due to excessive rainfall may be minimal and in some areas, farmers could go in for resowing. “If the farms have been affected by floods, farmers may need to resow. Otherwise, the planting is almost complete,” he said.

In Gujarat, the country’s largest producer, the area under cotton is 25.04 lh, up 13 per cent against 22.22 lh a year ago. The cotton acreage in Andhra Pradesh has jumped by 31 per cent to 4.67 lh, whereas in Karnataka the coverage has surged by 46 per cent to 7.39 lh. In States such as Gujarat, farmers have switched over from groundnut and sesame seeds to cotton in view of the fibre crop providing attractive returns.

Outlook positive

“In Tamil Nadu, too, the scenario is fast changing in favour of cotton,” said Venkatachalam.

“What we need now is favourable weather with good sunny days in the North and no rains during October-November,” said Ganatra.

In Karnataka, where there has been a sharp rise in acreage, sowing has increased for both long staple and medium staple varieties.

“Looking to the present scenario of the overall crop sowing pattern, the state-wise area covered under the cotton seems to be very positive and the present status of the crop prospects is very much encouraging. If everything goes well and climatic conditions favour, we feel this year we will get a record crop,” said Ramanuj Das Boob, of Bankatlal Boob Cottons Pvt Ltd in Raichur, Karnataka.

In Telangana, the third-largest grower, farmers are expected to take up cotton crop in about 24.30 lh — occupying half of the total Kharif acreage of 48.50 lh in the State.

Sowing has been completed on about 18.40 lh so far, even though it appears a tad lower than 20.23 lh a year ago. There is a likelihood of farmers going for more planting once the rains and floods abate.

Pink bollworm concerns

In Andhra Pradesh, the State Government has marginally increased the target for cotton acreage to 6.15 lh against 6.10 lh of the normal area.

“Farmers have crossed the normal sowing numbers as they planted the crop on 4.67 lh against the as-on-date acreage of 3.56 lh,” an official of the Andhra Pradesh Agriculture Department said.

In Maharashtra, the second largest in cultivating cotton, Marathwada and Vidarbha are the two major cotton-growing regions. The first round of sowing was affected by heavy monsoon rains. According to primary estimates, a majority of the over 8 lh area affected by the heavy rain has been under cotton.

The second round of cotton sowing is underway, but in some places, sowing has not been possible due to inundation. The State Agriculture Department officials say the government is providing all support to cotton farmers.

In North India, concerns over the cotton crop have been raised over extended moist weather and pink bollworm attack. Sushil Phutela, director, Indian Cotton Association Limited, said an extended rainfall in Punjab, Haryana and parts of Rajasthan was spoiling the cotton crop prospects.

“Punjab has big worry on pink bollworm. There is a widespread presence of the pest. Also, we don’t need rain now, but it is raining. So, we are fearing damage to the cotton crop,” said Phutela. He, however, added that fresh arrivals have started for a week now and the quality of the crop currently appears normal.

Poppat said the pink bollworm may have a minimum impact only as there is widespread awareness of its menace and the Centre has come up with solutions to tackle it.

Realisation could be lower

One of the advantages cotton growers is enjoying currently is that domestic prices are ruling well above global rates. This is hindering exports. International cotton prices hover around 90-95 cents per pound, whereas Indian cotton price works out to about 145-150 cents, which is costlier in comparison. “There are currently no export inquiries and we don’t see exports happening at this rate,” said Phutela.

Poppat said prices next season would be lower than this season, though some global firms have sold cotton at ₹65,000-70,000 a candy for the November-January period. “Imports this season will also have some impact, though only 17 lakh bales have been contracted so far,” he said.

Venkatachalam said if speculation in cotton takes place like this year, then prices could head north.

(This is the sixth in the series of kharif crop outlook. Tomorrow : Sugarcane outlook)

(With inputs from Vishwanath Kulkarni, Bengaluru; KV Kurmanath, Hyderabad; Radheshyam Jadhav, Pune; and Subramani Ra Mancombu, Chennai)

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.