Rice prices in the global market have increased 7-8 per cent in the past month resulting in the rates soaring to a 15-year high on higher demand and low arrivals due to the season’s end, traders and exporters have said. “One reason for prices to rise is that it is the end of the season. Though the availability in India is good, prices are ruling firm,” said New Delhi-based exporter Rajesh Paharia Jain.

“Physical supply of rice is low in the global market, whereas demand is higher. In view of India’s ban on white and broken rice grades, there is a short-supply of at least 16 million tonnes (mt) in the global market which is nearly a third of the annual trade,” said S Chandrasekaran, a trade analyst.

According to the International Grains Council, Thailand rice prices have increased by 39 per cent and Vietnam’s 44 per cent in 2023. India’s parboiled rice has increased by 40 per cent during the same time, while exports of non-basmati white rice are banned.

Jain said parboiled rice was quoted at $525 a tonne free-on-board by India. The rice attracts an additional 20 per cent export duty. He said parboiled rice in India was available for exporters at ₹29,000 a tonne for 25 per cent broken and ₹31,000 for 5 per cent broken.

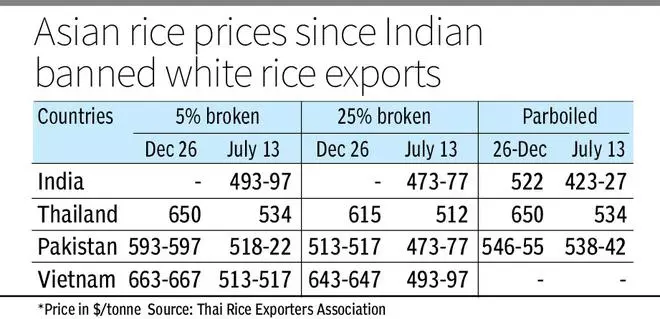

According to the Thai Rice Exporters Association, Thai parboiled 100 per cent sortexed is quoted at $650 a tonne. Thai white rice 5 per cent broken is quoted at $650, while Vietnam is offering at $663-667. Pakistan is the most competitive at $593-597.

Vietnam rates soar

The Food and Agriculture Organisation’s rice update said despite dearth in sales, Vietnam prices rose to their highest nominal level since 2008 as traders executed previously contracted deals in an overall tight supply context.

IGC has revised the global trade in 2023-24 season by 4 per cent to 50 mt due to “softer buying interest” from Asia and Africa.

However, the US Department of Agriculture said in its World Agricultural Supply and Demand Estimates (WASDE) December report that the 2023-24 global outlook for rice is for a slight increase in supplies, lower trade, less consumption, and higher ending stocks. “Supplies are raised just 0.2 mt to 692.8 mt, primarily on larger production in Thailand, which has greater water availability than previously expected,” it said.

“We expect demand for Ponni parboiled rice from Sri Lanka. The market is set to open. The rice is quoted at $625-650 a tonne,” said M Madan Prakash, President, Agricultural Commodities Exporters Association (ACEA). “We are not doing short grain in parboiled which is what Africa needs,” he said.

Abnormal rise

Chandrasekaran said parboiled exports have seen an abnormal rise over the past few weeks. “There is a sudden jump even in basmati rice exports,” he said.

Rice prices in the global market have gained this year on India’s curbs on exports with New Delhi banning shipments of white rice, imposing 20 per cent export duty on parboiled rice and stipulation $950 a tonne for registering basmati export consignments.

India came up with the curbs as its kharif rice production has been estimated 3.8 per cent lower at 106.31 mt against 110.51 mt last season. The production has been hit by the impact of El Nino, which resulted in August being the driest period in the past 120 years, while June witnessed deficient rainfall.

Indonesia and Thailand have also been affected by El Nino, which is caused by the warming up of the Pacific Ocean leading to drought and prolonged dry periods in Asia.

Chandrasekaran said rice prices will likely rule firm in the coming couple of months as the arrival of the new crop in Asia is expected only during February-March.

In addition, traders said countries such as Indonesia, which is scouting for 2 mt, are looking to buy more to meet domestic demand.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.