India continued to be the world’s top rice exporter in 2023 despite banning shipments of white rice and imposing a 20 per cent duty on parboiled rice, according to the Thailand Rice Exporters Association (TREA). However, its share in the global market declined as shipments fell by 27 per cent.

TREA honorary president Chukiat Opaswong told media in Bangkok earlier this week that India exported 16.5 million tonnes (mt) of rice in 2023, continuing at the pole position. The shipments, including basmati, were against a record exports of 22.3 mt in 2022.

Opaswong said Thailand, Vietnam and Pakistan filled up the void caused by India’s curbs. Thailand emerged as the second-largest exporter, shipping out 8.8 mt, Vietnam third with a record 8.3 mt exports and Pakistan the fourth-biggest shipper.

Scaling down export estimates

However, India is expected to be back in the global rice market later this year and ship out more, the TREA official said, adding that Vietnam and Thailand will compete for the second spot exporting about 7.5 mt, while Pakistan could maintain its shipments at 5 mt.

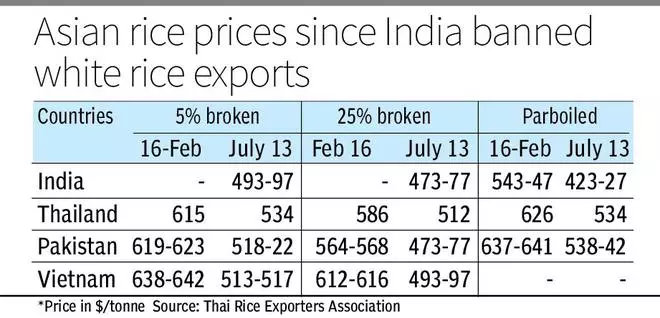

Thailand, Vietnam and Pakistan will continue to command over $600 a tonne for their rice as long as Indian curbs are in place, Opaswong said. Generally, barring Pakistan and Thailand’s 25% broken white, rice prices are ruling over $600 a tonne.

On the other hand, El Nino, which set in June last year, could affect production if drought and dry periods extend in Thailand. Not just Thailand, the El Nino weather pattern, expected to turn neutral by June this year could impact paddy in India, Pakistan and Vietnam too.

Prices moving up

India’s rice exports were curbed by the Centre banning shipments of white rice from July and imposing 20 per cent export duty on parboiled rice. It also fixed a minimum export price of $950 on basmati shipments.

India resorted to these measures as its kharif paddy was affected by a deficient south-west monsoon. The Ministry of Agriculture and Farmers Welfare has estimated kharif rice production 3.8 per cent lower at 106.31 mt against 110.51 mt in 2022. The decision was taken to curb rising food prices too.

Despite the supply curbs, Indian parboiled rice, the only variety available in the global market, is currently selling at $543-547 a tonne compared with Thailand’s $626 and Pakistan’s $637-641. The price includes the 20 per cent export duty.’

“The rice market is moving up and despite the Red Sea crisis, cargoes to West Asia, South-East Asia and Africa continue to go. Demand for parboiled rice is better than last year,” said VR Vidya Sagar, Director, Bulk Logix.

Brown rice gains

In the domestic market, parboiled is available at ₹33,000-34,000 a tonne including handling charges, he said. “There is no problem with parboiled availability,” he said.

M Madan Prakash, President of the Agricultural Commodities Exporters Association, said Indian exporters were indulging in “cut-throat” competition and he is not looking to ship rice now. “There are some enquiries for brown rice but I have not responded,” he said.

Sagar said Vietnam is buying brown rice, priced around the level of parboiled for human consumption. Brown rice too attracts 20 per cent export duty.

According to the Agricultural and Processed Food Products Export Development Authority (APEDA), non-basmati rice exports during April-December 2023 dropped by 28 per cent to 8.34 mt valued at $3.34 billion against 13.18 mt valued at $4.66 billion. Basmati exports during the same period were up 19 per cent at 3.97 mt valued at $3.97 billion against 3.20 mt valued at $3.34 billion.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.